Recent FDI trend

Foreign Direct Investment (FDI) has been playing a great role in modernising the economy of Bangladesh for the last fifteen years. For developing countries like Bangladesh, moving from an agrarian economy to an industrial economy seems to be an imperative pre-requisite for economic development. The move towards an industrial economy needs an intensive saving and investment.

There are some determinants that attract FDI, such as geographical location, cheap labour cost, government attitude towards liberalisation of the existing laws of the host country, skilled manpower, incentives for investors, exemption of taxes etc. Considering these determinants, among the emerging economies, India and China have become the desired place for investment. However, the Board of Investment (BOI) of Bangladesh claims that Bangladesh also offers an attractive and unparallel investment climate in comparison with other South Asian countries.

We know Bangladesh liberalised its economy in early 1990s and introduced investment incentives to create a favourable climate for FDI. Before this, FDI inflow was not significant due to the absence of a favourable policy framework. According to BOI (2007), FDI has been contributing to revamping the economy since trade liberalisation. Except nuclear energy, defense equipment, reserved forest area, security printing, and mining and railways, all other sectors have been made open for FDI.

Generally FDI is of three categories, (1) Equity capital: direct investor's purchase of shares of an enterprise in another country, (2) Intra company loans: debt transactions between parent enterprises and affiliates, (3) Reinvested earnings: direct investor's share of profits not distributed as dividend or remitted to it, which is reinvested.

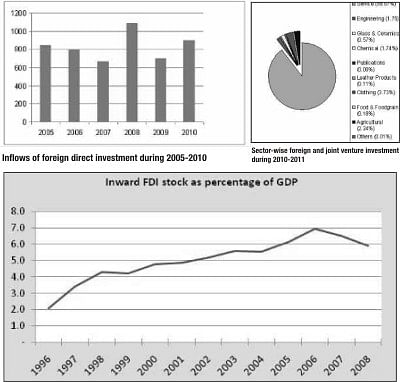

FDI inflow was not at an appreciable level until 2004. In 2002, the total FDI inflow was $ 328.3 million, in 2003 it was $ 350.2 million, and in 2004 it was $ 460.4 million. But in 2005, FDI inflow doubled ($ 854.3 million) compared to 2004. Bangladesh Investment Handbook (2007) stated that this was the second highest volume among South Asian economies. Then the economy experienced a slight downfall in FDI inflow in 2006 and 2007 -- $ 772.9 million and $ 666 million respectivelydue to political instability.

Inflows of foreign direct investment during 2005-2010 Sector-wise foreign and joint venture investment during 2010-2011

However, in 2008 the economy witnessed the highest ever inflow of $ 1,086 million, an 80% increase in comparison with 2007. In 2009, the economy experienced 35% inflow ($ 700 million) in comparison with 2008. In 2010, there was an increase of nearly $ 200 million, with a total of nearly $ 900 million in comparison with 2009 due mainly to significant increase in equity capital inflow. Besides we see that the inward FDI stock as percentage of Gross Domestic Product (GDP) has also been rising since trade liberalisation, though we see a slight downfall in 2007 and 2008.

Although the cheap labur cost and geographical location attract foreign investors here, corruption, political instability, bureaucratic hassles and infrastructural insufficiencies are posing great barriers to FDI inflow.

The government should take steps to remove these problems. Political institutions and actors should be more compromising and consolidate democracy for the economic development of the country. The administrative structure should be more accountable and transparent to achieve a good governance system that restrains corruption. The government should enforce monitoring and evaluation procedures in establishing the infrastructures that can attract FDI. It should also emphasise human resource development through practical education and training programmes.

FDI inflow is most important for a developing economy like Bangladesh, not only from the perspective of capital inflow and foreign currency but also from the perspective of new technologies and know-how, skills, and management practices of foreign investors. The value of the Bangladeshi taka has been declining against the US dollar. One of the reasons for this is less FDI. So, FDI is an important indicator for increasing the purchasing power of Bangladeshi taka. Besides, after the global financial downturn, the world is turning to the Asian economies since these economies have faced and handled the recession well, thus it is easier for Bangladesh to attract the world's foreign investors now than before.

It is high time for us to compete with other developing countries in attracting FDI since Vietnam, a comparable economy with ours in terms of size and macroeconomic indicators, had a growth rate of 5.5% in 2009, which is below ours, but has FDI inflow of $ 4,500 million. Moreover Pakistan, that is assumed to be more vulnerable to political unrest, had a growth rate of only 3.7% in 2009 but has FDI inflow of $ 2,387 million.

FDI is a necessary indicator for our economic growth but is not sufficient. We have to keep in mind that we should be competitive to attract the investors, but in a way that does not affect our economy. The policy makers should be more vigilant in assessing how much investment we need to achieve the aspired GDP growth, how much investment we can make domestically and how much FDI is needed to fill the gap. Then, on the basis of our need, we should go for arranging the competitive investment climate in our country and promoting the country's comparative advantage.

Since the information on Bangladesh, its economic environment and its investment climate, is not available to many prospective foreign investors it should be presented to them so that they can match their demands and priorities with what Bangladesh offers. In that case, the Trade Commission and other actors in international relations should come forward to bridge the information and communication gap.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments