BRAC Bank to raise Tk130cr from capital market

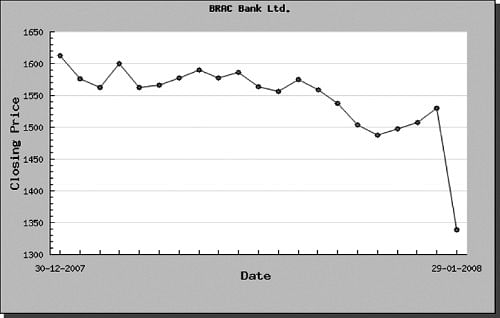

Brac bank's closing share price on the DSE in one month.

BRAC Bank said yesterday it will raise over Tk 130 crore from the stock market through a rights share issue in order to strengthen its capital base to meet regulator requirements and to fund further growth.

“We want to meet the requirement on capital adequacy and total capital as set by the Bangladesh Bank. We also need the money to meet our future growth projection,” said a senior official of the bank, who preferred to remain unnamed.

The news, which came as the bank announced a 10 percent stock dividend for 2007, was met with little enthusiasm by investors on the Dhaka Stock Exchange where shares in the bank fell more than 12 per cent.

Under the terms of the rights issue the bank will offer one rights share for every five shares at Tk 500, with a premium of Tk 400. The book value of BRAC Bank's share is Tk 100.

At present, BRAC Bank's paid up capital stands at Tk 1.2 billion with the total number of shares standing at 12 million

“We do not have a capital shortfall right now. But the funds will be needed in coming days to meet our expansion plan,” he said.

BRAC Bank, which started its journey in 2001, has been making profits since 2003.

“We have an average growth of over 60 percent a year since 2003,” said the official of the bank which now has 36 branches, 55 ATMs (Automated Teller Machines) and over 390 small and medium sized enterprise unit offices.

According to Dhaka Stock Exchange, BRAC Bank's earning against each share rose to Tk 63.31 in 2006, up from Tk 38.54 a year ago.

The official said the bank lagged behind the present regulator requirement on total capital of Tk 2 billion instead of the previous requirement of Tk 1billion.

The Bangladesh Bank last year raised the requirement on total capital for banks to Tk 2 billion from Tk 1billion. The BB however allowed banks to raise the funds in phases.

The need to maintain a capital adequacy ratio at 10 percent of the risk-weighted assets also led BRAC Bank to raise the fund, he said.

In terms of market capitalisation BRAC Bank is one of the largest companies on the DSE and the market had expected a more generous dividend.

“I expected a much larger amount from the BRAC Bank authorities,” said one investor.

Investors said the dividend had been determined at par, meaning at the share's face value, which resulted in a much lower dividend than expected. BRAC Bank shares closed down 12.48 percent on the day at Tk1338.50 on the DSE.

The DSE online source said the Board of Directors of the bank also decided to increase authorised capital to Tk 500 crore from the existing Tk 200 crore subject to approval of EGM & the regulatory authorities.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments