Galloping garment sector goes downhill

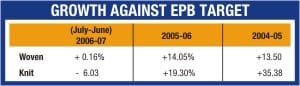

Growth in the readymade garment industry, the powerhouse of the country's export economy, has slowed with the sector for the first time failing to reach export targets and facing a sharp decline in new orders. The RMG sector, which accounts for more than 75 percent of Bangladesh's export earnings, fell behind the export target of the EPB (Export Promotion Bureau) for the first time in history, notching a negative growth of 6.03 percent in knitwear products and barely edging past with 0.16 percent rise in woven items during the last fiscal year. "Yes, we passed a rare disappointing year," Bangladesh Garment Manufacturers and Exporters Association (BGMEA) President Anwar-Ul-Alam Chowdhury told The Daily Star, adding that garment manufacturers missed out on about $1.5 billion more exports due to orders being moved to other countries. The grim export statistics followed growths of over 19 percent in knitwears and 14 percent in wovenwears beyond the EPB projection in 2005-06. Bangladesh even showed promise to stake a bigger claim on the $500 billion apparel market when its knitwear manufacturers made light work of quota-free concern in the post-MFA era, posting a record 35 percent export growth in 2004-05 fiscal year. The manufacturing sector has grown rapidly in recent years but in the 12 months to June 30 exports rose by a modest 16.5 percent, compared to 23.12 percent in 2005-06. Anwar-Ul-Alam Chowdhury blamed the slowdown on a weakened US economy and the unprecedented rioting at garment industries in and around Dhaka for 8 weeks when nearly 400 factories, most of which are socially compliant, were damaged and the DEPZ (Dhaka Export Processing Zone) was shut down twice. The BGMEA boss said buyers placed 22-25 percent less orders last year and moved to new destinations in South East Asia. Representatives of several local and foreign buying offices also confirmed shifting of significant orders, mainly to Vietnam and Cambodia, the two countries that emerged as potential competitors in the world clothing market with yearly growth of over 34 percent in knitwear items. Country representative of a prominent German importer Obermeyer, AK Kamrul Alam, said that his buyers placed about 20 percent less orders last year mainly due to labour unrest and poor sales. Interestingly though, his buyers increased orders significantly in Vietnam, Cambodia and China. Leading Italian chain store Gruppo Coin SPA has reduced its orders in Bangladesh to half, while at the same time piling up orders in India. Meanwhile, almost all the top buyers including American giant Wal-Mart cut down orders significantly due to the weakened US market and changing weather patterns in Europe that dictate season-based product sales. The BGMEA president hopes for a turnaround in October, the period for the placement of bulk winter orders. "We might not have achieved the EPB target this time, but still the export volume from readymade garments grew from $7.9 billion to $9.2 billion in last fiscal year," he said. But that 16.59 percent export growth has not calmed the frayed nerves of garment manufacturers, a majority of whom have hardly any orders till October and fear how they will cope with fixed overhead costs and salaries. "It's a very unusual situation we are in here," former BGMEA president Annisul Huq told The Daily Star. "Orders are very low up to October. Woven garments are in particularly bad shape. Even a big industry will now find it hard to squeeze out 10,000 pieces surplus order." The leading garment exporter sees the sale loss to major retailers in the US and the Bangladeshi government's failure to protect garment industries and investment as two main reasons for the slump in business. In some cases, going gets so tough that owners are considering a temporary shutdown and retrenchment of workers. Mohammad Faruque, chairman of a composite knit factory in Mirpur, has partially shut down his factory one month back and does not know when the factory could be run fully. "In my 12 years in this business, I have never had to close the factory except for holidays and hartal days. We had order shortfall in some months but never in the past have we run out of orders like this," he said. General manager of another composite unit, Mehedi Hasan, can partially run his unit in Savar at present, although operational losses are piling up. "If things continue to go on like this, we will have to say sorry to our workers." Alarmingly, there are plenty of Faruques and Mehedis now in the RMG sector, which directly employs nearly 2 million people and generates over $20 million export in related industries. Market watchers meanwhile predict that worse is to come next year when the EU's 7.5 percent export growth restriction on China goes by December-end. However, this concern is played down by experienced exporter Annisul Huq. "I'm concerned but not afraid," he said, adding that Bangladesh garment would grow more strongly if the business climate was improved and the fears of RMG buyers dispelled. "The buyers appreciate the anti-corruption drive, stable political situation and improvement in areas like the port, electricity and customs. But they are also concerned about where does the country go? Where does it end?"

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments