Stocks break losing trend

Stocks broke a four-day losing streak as the finance minister clarified in parliament that there would not be any tax on capital gains and the government did not make it mandatory for investors to have tax identification numbers .

The benchmark general index of Dhaka Stock Exchange (DGEN) gained 67 points, or 1.26 percent, to close at 5,444.

The selective categories index of Chittagong Stock Exchange (CSCX) increased 111 points, or 1.19 percent, to 9,786 points.

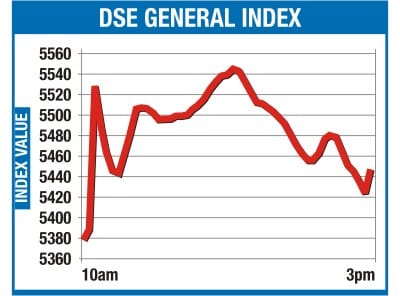

After falling for the fourth straight day, the index gained heavily in the morning session buoyed by optimism that there will be a midterm reversal.

“The finance minister's remarks in parliament reassured the investors of making a qualitative improvement in the market,” LankaBangla Securities said in its daily market analysis.

In the morning session, DGEN gained 173 points, breaking the 5,500 resistance level established a day before.

But the index started to falter from the beginning of the afternoon session due to lack of volume support.

An accelerated fall during the closing hours worried the investors about sustainability of the index at the current level next day.

On the whole, the market turnover was Tk 349 crore, or 1.7 percent higher than Monday's Tk 344 crore.

Around 3.86 crore shares changed hands on the DSE. On the DSE floor, 216 shares gained while 39 shares declined. A total of six shares remained unchanged.

Money market instability and heavy import payment using dollars before the budget are causing a liquidity crunch in the market, said LankaBangla.

Most of the major sectors gained on the day: banks lost 0.74 percent, non-bank financial institutions 1.60 percent, telecoms 1.21 percent, pharmaceuticals 0.80 percent, and fuel and power 0.70 percent.

MI Cement Factory Ltd topped the turnover leaders with 8.49 lakh shares worth Tk 11.50 crore changing hands.

Meghna Cement was the biggest gainer of the day, posting a 9.99 percent rise in its share prices, while Southeast Bank First Mutual Fund was the worst loser, slumping by 20.58 percent.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments