Telecom on fast track

Nobody thought about 100 percent mobile coverage when Bangladesh enacted its first telecom policy in 1999, as only a handful of the country's 64 districts was under wireless network coverage at that time.

But the ever-explosive sector has dwarfed all expectations and doubts to help Bangladesh become one of the fastest growing telecom markets in the world.

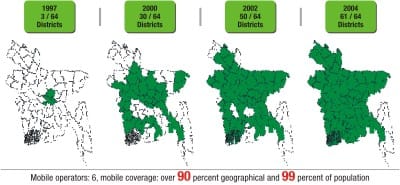

In 1997, only three out of the country's 64 districts were under mobile network coverage, which reached 30 in 2000, 61 in 2004 and now all districts are under the wireless network.

As of January this year, the total number of mobile phone active subscribers has reached 7.03 crore, according to Bangladesh Telecommunication Regulatory Commission (BTRC).

Grameenphone leads the market with 3.04 crore customers, followed by Banglalink 2 crore subscribers, Robi 1.26 crore, Airtel 41.84 lakh, Citycell 18.58 lakh and state-run Teletalk 12.04 lakh clients.

The telecom sector has seen mobile penetration growth, now over 42 percent, that has exceeded all expectations, said Syeed Khan of Asian Tiger Capital Partners. "Bangladesh subscriber growth remains one of the fastest in Asia," he told journalists at a workshop in the city last week.

He said the government should enact more telecom-friendly regulatory or fiscal reforms such as cuts in the SIM tax to encourage faster mobile phone penetration to catalyse access to information and hence the Digital Bangladesh push.

The sector is also a major contributor to the country's tax revenues, contributing 10 percent of the country's total revenues generated in 2010, according to Association of Mobile Telecom Operators in Bangladesh.

Between 1997 and 2009, the sector saw an investment of Tk 30,000 crore in Bangladesh. Six mobile operators, who cover more than 90 percent territory and 99 percent population, accounted for over 60 percent of the total foreign direct investment flown to Bangladesh last year.

Thanks to increasing competition among operators, the customers now enjoy one of the lowest tariffs in the world.

Experts say despite 100 percent mobile coverage, penetration stands at below 45 percent, a figure buoys the operators to grow further.

Operators say the rural areas will dominate the growth next phase of subscriber growth, with over 60 percent of all new connections currently being sold in the remotest regions.

The massive expansion into rural areas however will affect average revenue per user, but the decline could be recouped by growth of value-added services and data services.

Operators say the government should support the sector through reducing Tk 800 SIM tax to accelerate mobile penetration rates and also clarifying regulatory uncertainty about licence renewal as rapidly as possible.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments