Banks cash in on SME loan definition

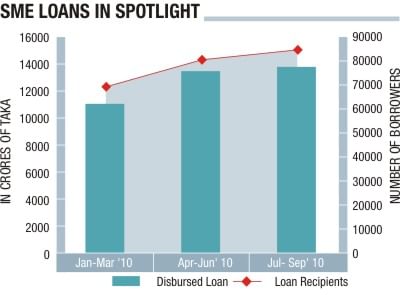

In the first nine months of this year, the banking sector exceeded the whole year's target for giving loans to small and medium enterprises (SME) -- but only thanks to a new definition of SME loan, according to some bankers.

The bankers said the definition included existing non-SME portfolios as SME loans, helping raise disbursed funds to Tk 38,283 crore against a target of Tk 23,995 crore.

“If a trader borrows Tk 10 crore, it can be mentioned as medium enterprise loan because of the definition,” said an official with the SME credit department of a private bank.

He said many banks have shown their loans up to Tk 15 crore as SME credit, which exaggerated the disbursed figure.

Bangladesh Bank data shows less than Tk 15,000 crore was lent to the SMEs in 2009.

The central bank redefined SMEs and loan limits last year, and directed the banks to give priority to small enterprises and women entrepreneurs. The loan limit for small entrepreneurs was set at Tk 50,000 to Tk 50 lakh.

For the medium enterprises no limit has been mentioned. The banks decide the amount for such entrepreneurs on the basis of need.

“Disbursing Tk 38,283 crore to the SMEs in nine months is absurd. If this amount of money was lent to the SMEs, there would be a huge impact on the economy and employment,” said a senior official of a private bank.

"How can there be such a demand without any new gas and electricity connection this year?" he asked.

The banks have a financial incentive to exaggerate the SME loan figure.

“Provisioning and capital adequacy demand is less for the SME loans than for others,” said Shahjahan Bhuiyan, managing director of United Commercial Bank.

According to the bankers, if a bank keeps 125 percent provisions against loan to an unrated borrower, it would be 60 percent for the SMEs.

The central bank governor, Atiur Rahman, said the Bangladesh Bank (BB) has set the SME definition in line with the country's industrial policy.

“We will strengthen monitoring to check whether other sectors' loans are included as SME credit to get advantage,” he told The Daily Star.

Although there are no exact figures, sector people said the estimated number of SMEs in the country at 4 to 5 lakh.

According to Bangladesh Economic Review 2009, the SMEs are the largest sector in terms of employment generation, even though they are about 6 percent of the country's $100-billion economy.

Aftab ul Islam, chairman of SME Foundation, said the SME sector now contributes up to 25 percent of the country's GDP, about 40 percent of manufacturing output, 80 percent of industrial jobs, and nearly 25 percent of the total labour force.

Currently, the banks charge the SMEs interest rates between 14 percent and 20 percent. The central bank wants the rates to come down to a single digit.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments