Go slow on new remittance offices: BB

The central bank will let a few more commercial banks open exchange houses abroad, said a senior official of Bangladesh Bank (BB).

Currently, local banks, both private and state-owned, have 35 exchange houses abroad, according to official data. BB is considering applications for another 13 exchange houses.

The BB plans to go slow to avoid saturation and due to its concerns over additional expenditures the banks incur when opening exchange houses abroad, which help foreign workers send money home.

“We are planning to be selective in this regard,” said a top official concerned with the BB. “Some markets (countries) have already become saturated.”

Remittances have become very important sources of funds for the commercial banks. Now banks are rushing to handle remittance transfers both to gain foreign exchange and increase profits.

Bangladesh receives a majority of its inward remittances from the Middle East, but Europe, Canada and the US are increasing sources of remittances.

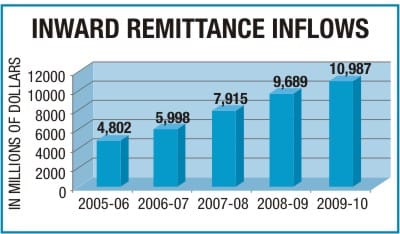

Inward remittance grew by 13.4 percent to nearly $11 billion in fiscal 2009-10 from $9.7 billion a year ago, despite the global recession.

Experts believe a huge amount of remittance also flows through an informal but faster and cost-effective network known as hundi.

“Exchange houses will help rout more remittances through the banking channel,” said Yusuf Khan, senior executive vice president and head of international and NRB division of Mercantile Bank.

But the BB official worries that private sector bank executives may have more latitude to make wasteful or even corrupt expenditures during personal visits foreign exchange houses.

The central banker also warned banks not avoid saturated markets. “Monetary Authority of Singapore has already stopped giving permission to any Bangladeshi exchange house,” he said. “London is also becoming saturated.”

The official suggested that the banks should open exchange houses in Korea, Japan, Australia and some East European countries where there are no exchange houses.

"Bangladesh Bank should take into account the interest of the private banks and inflow of foreign currency. Banks should be allowed to open more exchange houses," said the managing director of a private bank, asking not to be named.

The central bank last year decided to break the state-owned banks' monopoly on opening exchange houses.

Private commercial banks had to rely on drawing arrangements (DAs) with exchange houses abroad.

Currently, 40 banks have nearly 1,000 DAs with around 300 exchange houses abroad.

[email protected]

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments