IMF report on loan defaults alarming

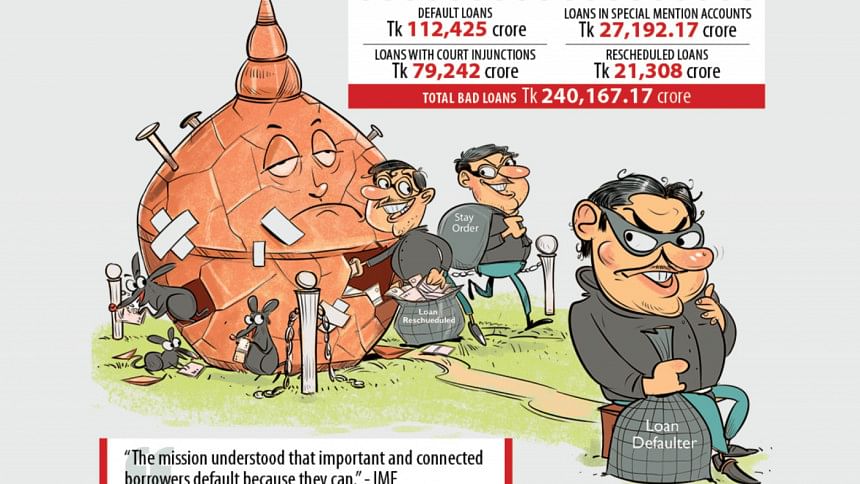

The revelations of the International Monetary Fund (IMF) regarding the state of defaulted loans in our banking sector is disturbing, if not entirely surprising. According to a report published by the international money-lender, the amount of bad loans is actually double the figure presented by the Bangladesh government. This is in part the result of policies and practices that not only enable banks to mask their default loans as rescheduled loans and "special mention" loans, but also allow big loan defaulters to go about their business unfettered. The large borrowers have exploited the stay order by the court which has caused a large amount of this money disappear from the CIB database, and the banks can also report them as non-classified. This has resulted in the stunted amount of default loans as reported by the authorities. According to the IMF, these loans, along with those in special-mention accounts, should be counted as problem assets. As of June 2019, the total amount of problem assets stands at a staggering Tk 240,167.17.

The number is shocking, but what is even more alarming is the fact that most of these defaulters are well-connected and influential businessmen, who have realised that "there is no palette to enforce repayment of their loans," thanks to the constant rescheduling and restructuring of their loans with the help of the central bank. Bangladesh Bank has issued NOCs to banks on a case-by-case basis to reschedule defaulted loans. This has sent a very wrong message to the defaulters. Moreover, the central bank's backtracking on the principle of imposing strict discipline on distressed borrowers is sending out the wrong signal to these unscrupulous businessmen—that the banks are rewarding financial malpractice, or at the very least, bad credit decisions are being encouraged.

The finance minister is expected to meet with the IMF on the sidelines of its annual meeting to be held between October 14 and 20, to work on the next plan of action. We hope he will take cognizance of the recommendations of the international money-lender and work out a feasible plan to not only discourage such financial malpractices and bring the culprits to book, but also to make sure that the country's resources are made available to the financial sector to facilitate further growth and enforce stricter credit discipline. The government should also take measures to increase interest rates of defaulted loans in order to put additional pressure on the defaulters. The country's robust economic growth should not be allowed to stall due to the malpractices of the habitual defaulters.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments