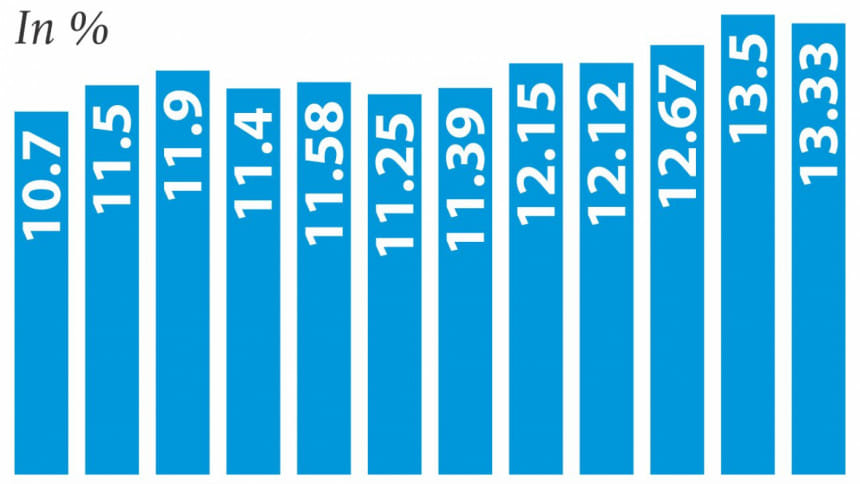

Private credit growth slows

After rising for two months, private sector credit growth came down again in January due to the seemingly never-ending political unrest.

Private sector credit grew by 13.33 percent year-on-year in January, in contrast to the 13.5 percent growth recorded the previous month, according to Bangladesh Bank.

Even the sliding lending rates -- now 12-13 percent against 14-15 percent a year ago -- cannot boost demand for funds from the private sector, bankers said.

“We have disbursed hardly any fresh loans in the last two months as the demand for money has simply plummeted,” said Shafiqul Alam, managing director of Jamuna Bank.

Businesses cannot even utilise their already-approved loans for the prevailing anti-business climate from the start of the year, let alone taking out new loans.

For example, if a borrower has a Tk 20 crore loan limit, he cannot even use Tk 5 crore now as he cannot bring in raw materials into the factory or sell the finished goods, Alam said.

The latest bout of political upheaval comes just as the private sector was recovering from the disruptive politics in the second half of 2013, the hangover of which lasted until the first half of 2014.

If the present situation continues, credit growth will decline, so will the utilisation of loan limits, said Touhidul Alam Khan, deputy managing director of Prime Bank.

“No businessmen will put in their efforts and hard-earned money for the picketers to vandalise.”

Helal Ahmed Chowdhury, former managing director of Pubali Bank, said normal business activities cannot be pursued under a situation like the present one.

Bankers said manufacturing and productive activities have been hampered seriously but trade, commerce and services sectors have kept the economy running.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments