Private credit growth finally hits the brakes

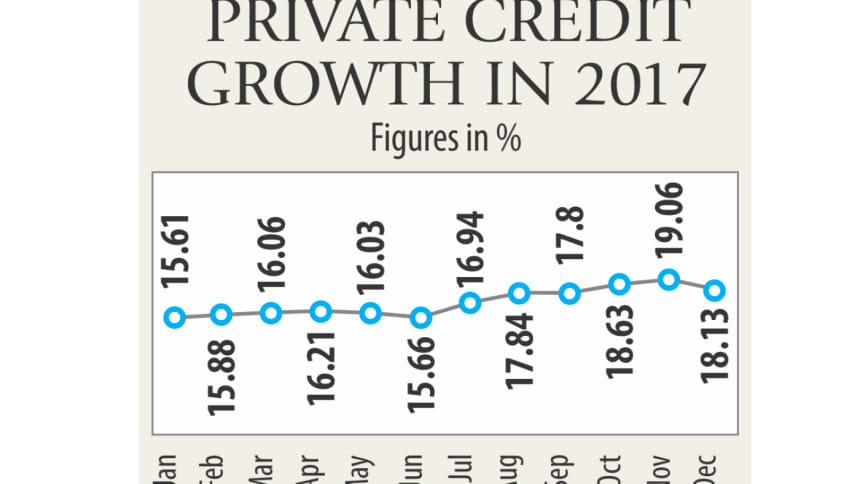

After being on an ascent for the best part of 2017, private sector credit growth slowed down in December thanks to an increase in interest rate for lending and high deposit collection.

At the end of last month, private sector credit growth stood at 18.13 percent, down from 19.06 percent the previous month, which was the highest in 2017.

The Bangladesh Bank had targeted to keep the private sector credit growth within 16.2 percent in the first half of fiscal 2017-18.

Subsequently, in the monetary policy for the second half of the fiscal year that will be unveiled on January 29, the private sector credit ceiling will be increased slightly, said a senior BB official.

“There is little room for improving private sector credit growth as public credit growth has remained negative,” he said.

Public sector credit growth in December was 4.72 percent in the negative against the monetary target of 3.80 percent, according to data from the central bank.

Though the private sector credit growth seemed to have declined, it has not actually, said MA Halim Chowdhury, managing director of Pubali Bank.

“It was a mathematical trick.”

It is common practice that banks bump up their deposit collection efforts towards the end of the year to flatter their balance sheet.

“As a result, the percentage of private sector credit growth seemed less.”

Besides, the upward trend of lending rate also hindered the credit flow slightly, he added.

The credit growth of most of the banks was well past 20 percent in October last year due to aggressive lending, said the BB official.

The mismatch between deposit and credit growth prompted the regulatory authority to go for tough action by blocking funds, he said.

As a result, banks became cautious in lending, causing a slowdown in credit growth towards the end of the year, he added.

Deposit growth declined to 10.95 percent in October last year from 13.13 percent in December 2016, according to data from the central bank.

The total deposits in the banking industry stood at Tk 9.76 lakh crore as of October last year.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments