Pharma sector to grow at 15pc a year: study

Bangladesh's pharmaceutical sector can grow at 15 percent for the next five years riding on the expanded domestic market as well as new export frontiers, according to a new research.

“It would be unsurprising if it takes a similar route to Indian pharmaceutical industry,” said LR Global, an asset management firm, in its report on Bangladesh's pharmaceutical sector.

In 20 years, the neighbouring country's pharmaceutical sector grew 30 times, according to the report.

Presently, the pharma industry of Bangladesh meets 98 percent of the local demand and exports to more than 125 countries.

Greater affluence among the poorest socio-economic group and a shift in disease profile are expected to drive the growth of healthcare expenditure in Bangladesh, it said.

Bangladesh's disease profile is expected to change in two major ways: the rise of non-communicable diseases and a gradual move from acute to chronic diseases.

The country's ageing population is increasing: by 2036 about 25 percent of the population will be over 50 years of age.

Besides, drug purchasing power is likely to rise with sustained growth in income as Bangladesh advances into the league of middle income countries, according to the analysis.

The industry also has growth opportunities in the international domain -- enough to emerge as the next thrust sector after garment.

“With backward integration, quality research and skilled human resources, Bangladesh's pharmaceutical industry can emerge as a world leader in producing off-patented generics medicine.”

Globally, healthcare providers are increasingly endorsing generic drugs and Bangladesh can capitalise on the trend to penetrate the markets in the US, Germany, France, the UK and Japan.

Global generics were valued at $168 billion in 2013, and are expected to reach $380 billion by 2021.

Emerging markets also hold promise for Bangladesh's exports: their spending for pharmaceutical products stood at $249 billion in 2015 and is expected to reach $345-$375 billion by 2020. “While most of the emerging markets in the low and middle income countries are dominated by multinational pharmaceutical companies, Bangladeshi companies have the capacity to penetrate these markets.”

Since the beginning of the decade, the pharmaceutical industry in Bangladesh has experienced double-digit growth driven by large consumer base, improved health consciousness and a supportive regulatory framework.

Two effective policies have accelerated the growth of the sector. One was the Drug Control Ordinance 1982, which banned foreign companies from selling imported pharmaceutical products in the country.

The other was the relaxation of the World Trade Organisation's agreement on Trade-Related Aspects of Intellectual Property Rights (TRIPS), which permitted Bangladesh to reverse engineer patented generic drugs. The relaxation of TRIPS for least-developed countries has been extended to 2032.

In fiscal 2015-16, the annual sales of pharmaceutical products stood at Tk 15,600 crore. “This is a huge jump for the sector as the industry size was only Tk 170 crore in 1982.”

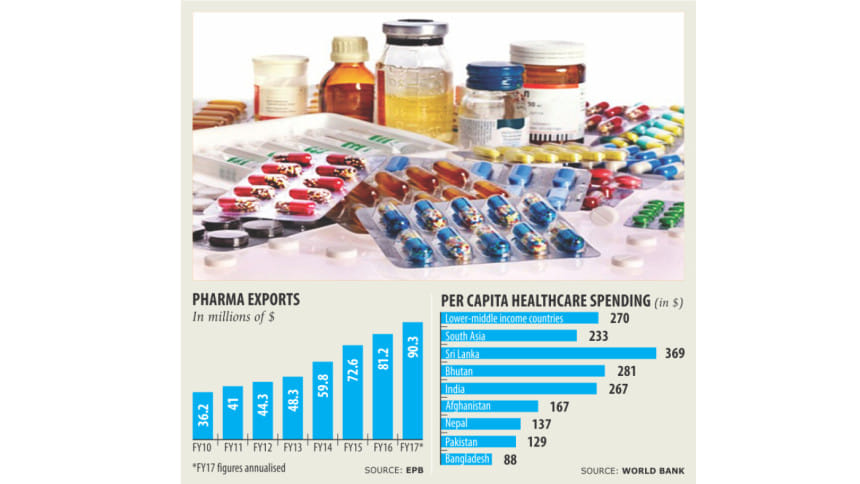

Exports of pharmaceutical products registered 14.6 percent growth in 2011-2016, while the industry is expected to log in receipts of $90.3 million for fiscal 2016-17.

“In one sentence, the pharmaceutical sector is the most successful sector in Bangladesh,” said Rizvi Ul Kabir, director for marketing of Beximco Pharmaceuticals, adding that it did not compromise on quality to get to its current position.

In line with the growth of the market, everybody has invested in quality, lab equipment and human resources to raise the standard to international level, which enabled local firms to enter developed and highly regulated markets, he said.

For instance, Beximco Pharma-ceuticals has already started exporting to the US, one of the most regulated drug markets in the world, from last year. It shipped Carvedilol, a prescription drug for hypertension.

Bangladesh's pharmaceutical industry is dominated by local players. Square Pharmaceuticals leads the charge, commanding an 18.8 percent market share, followed by Incepta at 10.2 percent, Beximco 8.5 percent, Opsonin 5.6 percent, Renata 5.1 percent and Eskayef 4.5 percent, according to the study.

Multinational companies such as Radiant, Sanofi and Novo Nordisk enjoy a 10.5 percent market share and are focused on some specialised products. At present, oncology drugs are imported but some of the local players like Renata and Acme have heavily invested in the segment, according to the analysis.

“Given the fact that local companies can manufacture quality products at affordable price, oncology segment will emerge as an attractive growth segment in future.”

Bangladesh, however, relies on imports for raw materials.

More than 90 percent of Tk 4,700 crore worth of raw materials are imported every year. As a result, the industry is vulnerable to external shocks, according to the report.

To address the issue, the government has started the process of constructing an active pharmaceutical ingredient industrial park in Munshiganj. At least half of the companies that got plots in the API park are expected to go into operation by 2018.

Once the API park is completed, Bangladeshi companies would be able to source at least half of their raw materials from the complex, reducing reliance on imports, said a senior executive of a pharmaceutical company.

The report said the park can open up the international API market to Bangladesh.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments