Investor confidence dips amid absence of meaningful talks

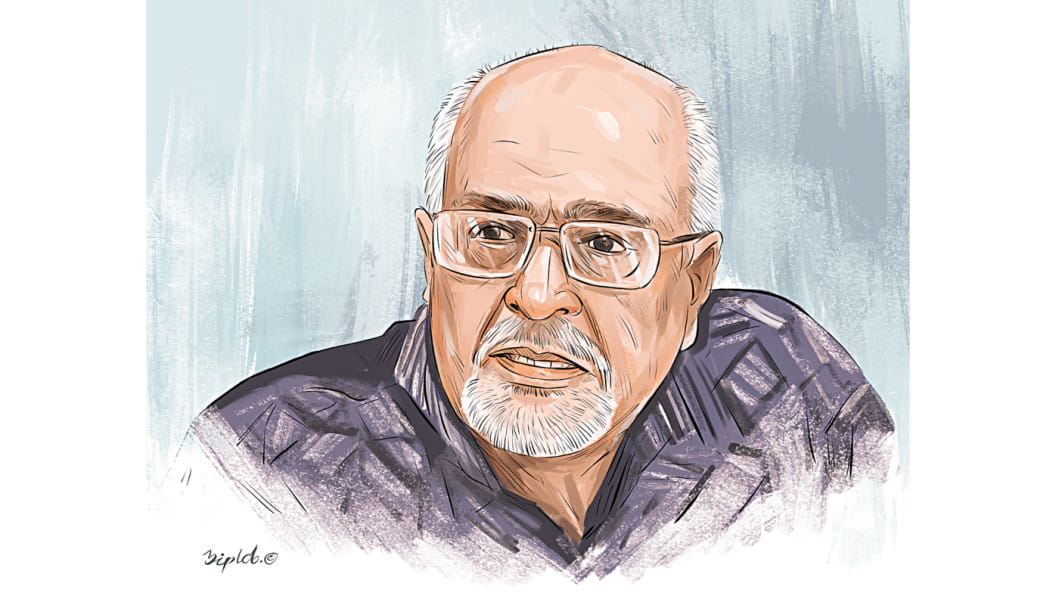

Investors have been grappling with uncertainty over the absence of meaningful discussion between political players and the interim government about the country's future fiscal direction, said Debapriya Bhattacharya, a distinguished fellow at the Centre for Policy Dialogue (CPD).

"Without political consensus and policy continuity, private investors will remain hesitant," he said while addressing a pre-budget debate for the 2025-26 fiscal year, organised by Debate for Democracy at the Film Development Corporation in the capital yesterday.

Expressing regret over the lack of dialogues between the interim government and political parties regarding the national budget, Debapriya said, "Such discussions could have assured investors of a long-term policy continuity."

According to him, the government should pursue fiscal discipline, restore stability in the banking sector, and engage in cross-party dialogue to assure investors of a predictable policy environment.

"Only then can the budget become a tool for recovery, not mere survival."

Debapriya's comments come at a time when the interim government is preparing to announce the national budget for the next fiscal year on Monday amid economic uncertainty and political transition.

He criticised the interim government's reliance on borrowing from local banks and noted that high interest rates and a weak banking system are undermining private investment.

"Investment and employment are interconnected," he said, adding that macroeconomic stability will falter if confidence in long-term policy continuity is not ensured.

Expressing concern over the present state of revenue mobilisation, Debapriya said Bangladesh's tax-to-GDP ratio has dropped below eight percent, which is among the lowest globally.

He highlighted the case of the neighbouring nation Nepal, which collects more tax than Bangladesh despite having a lower per capita income.

Debapriya cautioned against over-reliance on indirect taxes, saying it fosters inequality and disproportionately affects the poor.

To build a fairer system, he called for a shift toward direct taxation, particularly targeting luxury spending and wealth.

"Two-thirds of our taxes come from indirect sources. This must change," he said, suggesting new tax measures on second cars, high-value services, and digital transactions.

Debapriya also urged reforms in tax administration, including digitisation and the integration of tax identification numbers with national IDs, bank accounts, and social benefit cards to curb evasion.

"Tax compliance is not just the government's job. Citizens must also demand receipts, avoid cash deals, and stop enabling the culture of evasion."

He criticised the Implementation Monitoring and Evaluation Division (IMED)'s narrow focus on financial expenditure rather than performance-based outcomes, stating, "Budget accountability must shift from inputs to impacts. Otherwise, taxpayers lose faith."

Regarding budget financing, Debapriya proposed seizing and monetising illicit assets to fund next year's budget.

"This could be a breakthrough -- using laundered, untaxed, and defaulted funds as a source of budgetary finance."

Despite some achievements, like repaying $5 billion in foreign debt and maintaining exchange rate stability, he warned that the upcoming budget risks being a "repackaged version of the past" without structural change.

While moderating the pre-budget debate, Hasan Ahmed Chowdhury Kiran, chairman of Debate for Democracy, said, "Corruption, inequality, and weak tax management will hinder budget implementation."

Kiran warned that political instability could deter investment and disrupt trade.

He urged the interim government to expose and prosecute corrupt officials and loan defaulters.

Without tax reform and increased allocations for health, education, agriculture, and social security, he said, the upcoming 2025–26 budget will be just "old wine in a new bottle".

A politically neutral tax structure is essential to restoring fiscal balance, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments