Three local banks’ names come out in suspicious cross-border transactions

Three Bangladeshi banks were allegedly involved in suspicious cross-border transactions between 2014 and 2016, according to a report released by the International Consortium of Investigative Journalists (ICIJ).

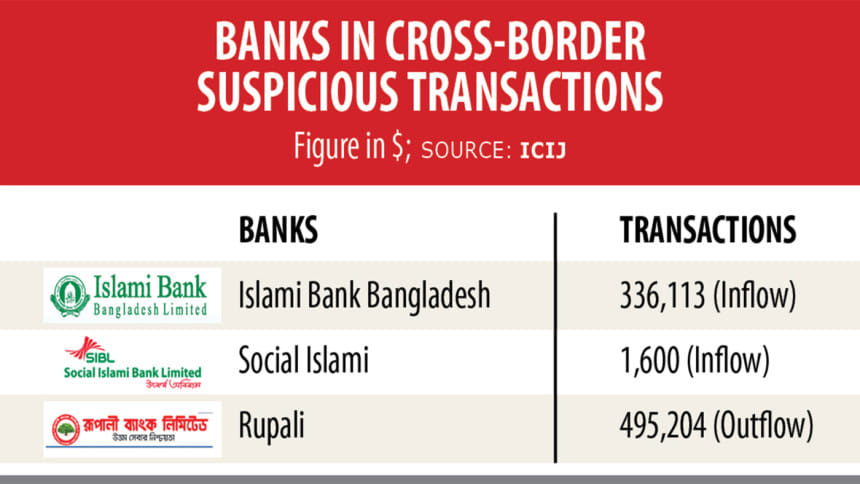

The lenders – Islami Bank Bangladesh Ltd (IBBL), Social Islami Bank Ltd and Rupali Bank – transacted $832,917 through three foreign banks as they sent $495,204 and received $337,733 in eight transactions.

The leaked documents, known as the FinCEN Files, include more than 2,100 suspicious activity reports filed by banks and other financial firms with the US Department of Treasury's Financial Crimes Enforcement Network.

The FinCEN is an intelligence unit at the heart of the global system to fight money laundering.

American news website BuzzFeed News obtained the records and shared them with the ICIJ. The consortium organised a team of more than 400 journalists from 110 news organisations in 88 countries to investigate the world of banks and money laundering.

Australia and New Zealand Banking Group (ANZ) sent $336,113 to IBBL between August 23 and September 1, 2016 in three transactions, according to the ICIJ website.

State-run Rupali Bank sent $495,204 to Deutsche Bank AG of Germany through four separate transactions in September 2016.

Regionala Investiciju Banka in Latvia sent $1,600 to Social Islami Bank on April 14, 2014.

These transactions were processed via two US-based banks, which filed suspicious activity reports with the FinCEN.

The Bank of New York Mellon Corp received $336,133 in three transactions, while Standard Chartered Plc sent $495,204 and received $1,600 in a total of five transactions. The central bank will look into the matter, said an official of the Bangladesh Financial Intelligence Unit.

"We will take punitive measures if any illegal transactions are found," he said.

In all, an ICIJ analysis found, the documents identify more than $2 trillion in transactions between 1999 and 2017 that were flagged by financial institutions' internal compliance officers as possible money laundering or other criminal activity.

Suspicious activity reports reflect the concerns of watchdogs within banks and are not necessarily evidence of criminal conduct or other wrongdoings, the ICIJ said.

The records show that five global banks — JPMorgan, HSBC, Standard Chartered Bank, Deutsche Bank and Bank of New York Mellon — kept profiting from powerful and dangerous players even after US authorities fined these financial institutions for earlier failures to stem flows of dirty money.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments