Term loans shrink as industries weaken

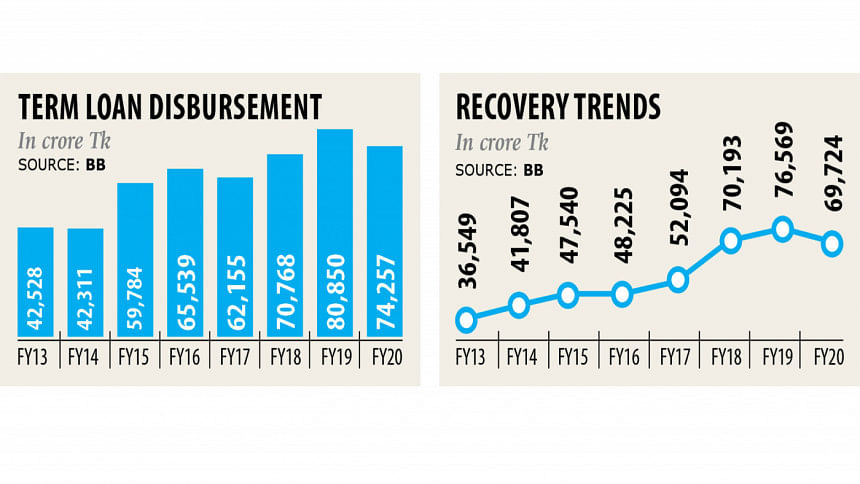

Disbursement of industrial term loans contracted 8.15 per cent year-on-year to Tk 74,257 crore in the last fiscal year due to the economic meltdown brought on by the coronavirus pandemic.

The dismal figure exposed the stagnation the country's industrial sector has been confronting, prompting experts to call on the central bank to take immediate measures to boost the industrial sector by providing term loans to businesses.

A term loan is a credit from a bank for a specific amount that has a specified repayment schedule. The minimum repayment period is more than a year and it carries either a fixed or floating interest rate.

Businesses often take the loan to set up new industrial plants or expand the existing ones, thus contributing to the economy.

The term loan disbursement has started to face a major blow when the country embraced the lockdown in the last week of March to contain the coronavirus pandemic.

Term loans given out by banks stood at Tk 12,132 crore in the last quarter of FY20, down 45.43 per cent from a year ago, according to data from the central bank.

The recovery of term loans also registered negative growth for the first time in recent years because of the eroding capacity of businesses to repay.

Lenders recovered term loans worth Tk 69,724 crore in FY20, in contrast to Tk 76,569 crore a year ago.

However, defaulted term loans did not face any escalation thanks to the central bank's initiative that allowed loan moratorium facility to borrowers from January to September this year.

Thanks to the payment holiday, borrowers' credit rating will not be downgraded even if they fail to pay instalments.

Defaulted term loans stood at Tk 32,380 crore as of June this year, down from 19.14 per cent year-on-year.

"The overall disbursement situation of the term loan is not unexpected given the ongoing financial meltdown," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

The central bank should immediately take a set of policies to revive the term loan disbursement, he said.

The central bank may extend the ongoing loan moratorium facility for another three months to December.

"But this will not give any solution to expediting the term loan disbursement. The facility for the affected businesses may be extended by a year," said Mansur, also a former high official of the International Monetary Fund.

Businesses should be allowed to pay only their interest amount for the next year. Then, they will start paying back the principal, he said.

According to the economist, this is not the time to expand business; rather manufacturers and traders should give their all-out efforts to protect existing enterprises from the financial meltdown.

"But we can't be sitting idle. A long-term roadmap should be formulated in the quickest possible time as job creation is largely dependent on the proper implementation of loans," he said.

The downward trend of term loans will not stop this year. However, the disbursement would get a turnaround from the beginning of 2021 if a second wave of the coronavirus infection could be avoided.

Bankers should prepare to restructure their existing term loans so the businesses hit hard by the recession get breathing space, Mansur said.

"The country's GDP growth is still in a contracted situation. So, time-befitting policies will help get back the growth momentum when the pandemic is brought under control," he said.

The central bank has helped businesses by giving out working capital in the form of soft loans, playing a great role in speeding up the recovery, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

Bangladesh's investment has been in a stagnant situation, so there is no scope to fast-track the term loan disbursement overnight, he said.

The entrepreneurs in the medical and pharmaceutical sectors, however, applied for term loans as their businesses have not faced debacle because of the pandemic.

Both the central bank and lenders should cater to businesses so that the recovery of the economy takes place smoothly, Rahman added.

Md Arfan Ali, managing director of Bank Asia, said lenders should extend cooperation to restructure existing term loans.

The readymade garment sector, which received a large portion of term loans, has already made a comeback on the back of the central bank's stimulus package, he said.

"If the recovery persists, the term loan disbursement will get its tempo in the months ahead," Ali said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments