Taskforce to push large firms toward stock listing

A joint taskforce is going to be formed to introduce legal changes that would make it mandatory for large companies to go public if their loans or turnover cross a certain threshold, said the stock market regulator yesterday.

"We are forming a committee comprising representatives from Bangladesh Bank, BSEC, and the Financial Institutions Division (FID)," said Khondoker Rashed Maqsood, chairman of the Bangladesh Securities and Exchange Commission (BSEC).

The taskforce will also work on developing a vibrant bond market, he said, adding that the BSEC has already held discussions with several large local companies and multinational corporations (MNCs) regarding potential stock market listings.

Maqsood was addressing a discussion on "The Current State of Bangladesh's Capital Market" as a special guest, organised by the DSE Brokers Association of Bangladesh (DBA) at the Dhaka Stock Exchange (DSE) in Nikunja.

DBA President Saiful Islam urged the authorities to include private sector representatives in the taskforce to ensure broader stakeholder participation and meaningful input.

Abu Ahmed, chairman of the Investment Corporation of Bangladesh (ICB), stressed the importance of listing large and multinational companies even if they do not require funding.

"They are making money in Bangladesh, so they have a responsibility to share ownership with the people," he said.

He argued that simply increasing the gap in taxes paid by listed and non-listed companies to 7.5 percentage points would not be effective.

He proposed offering greater tax benefits and, if necessary, pressuring large companies to get listed.

Regarding listing state-run companies, Ahmed said the ICB has been trying to engage with them but has received no response.

"The government should sit with them and issue strong instructions. If they still refuse, secretaries of the related ministries should be transferred," he said.

"Without a good number of quality listed companies, the capital market cannot improve," he added.

GOVERNMENT FOCUS ON MARKET REFORM

Anisuzzaman Chowdhury, special assistant to the chief adviser of the interim government, said the chief adviser recently had a talk with him regarding the capital market prior to a meeting.

This is an indication that the government is prioritising market development, unlike in the past, he claimed.

He noted that systemic reforms take time, but once completed, they are expected to attract more foreign investment.

Tapan Chowdhury, managing director of Square Pharmaceuticals, thanked investors and brokers for their early support. "The Tk 50 crore raised during our IPO (initial public offering) helped us become a pharmaceutical giant," he said.

FICCI URGES POLICY STABILITY

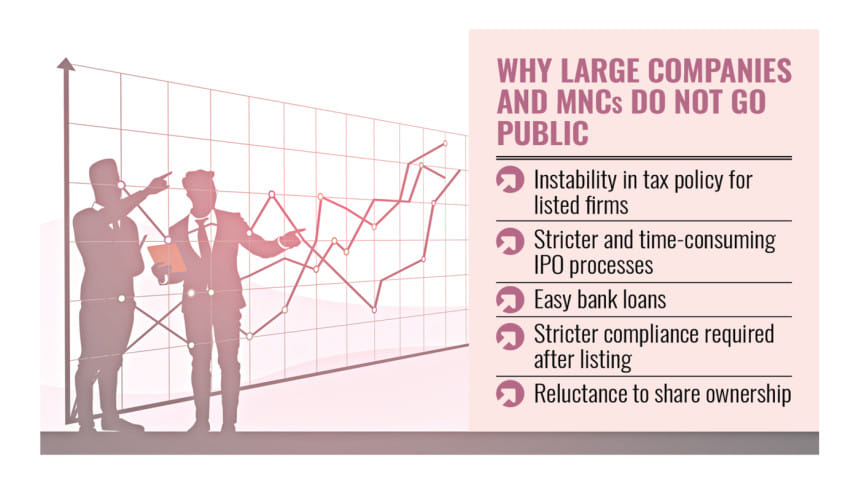

Zaved Akhtar, president of the Foreign Investors' Chamber of Commerce and Industry (FICCI), called for simplification of the IPO process and assurance of policy stability post-listing.

He cited recent changes by the National Board of Revenue (NBR), which disqualified some firms from tax benefits because they offloaded less than 10 percent of shares during IPOs. These changes, he warned, may discourage future listings.

He also urged the bourses to build institutional investment capacity to absorb large volumes of shares in case large firms want to divest significant stakes.

NEGATIVE EQUITY: A MAJOR CONCERN

The BSEC chairman identified negative equity as the "biggest cancer" for the capital market and called for government intervention to resolve the issue.

Md Shakil Rizvi, a former DSE president, blamed government and regulatory directives that barred forced sales by brokers and merchant banks, even when share prices plunged.

As a result, around Tk 10,000 crore worth of negative equity has piled up, burdening market intermediaries, he said.

Negative equity occurs when the market value of an asset falls below the outstanding loan taken against it.

Anisuzzaman said there was no textbook solution to negative equity, as legally it should not exist. However, the interim government is working on resolving the problem, he said.

REFORM PROGRESS

On capital market reform, the BSEC chairman said the regulator was working inclusively, which was why reforms were taking time.

He said most recommendations from the taskforce have been submitted and key regulations—including public issue rules, margin loan rules, and mutual fund rules—would soon be amended.

"Once that is done, major reforms will be complete," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments