Sunlife Insurance holding on to dear life

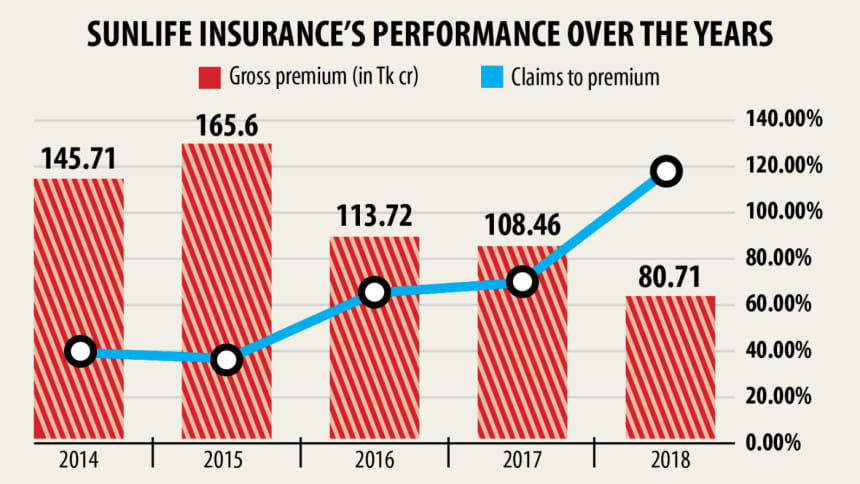

While others have been slowly but surely drawing in new clients, one insurer has been showcasing a dismal performance to such an extent that its gross premium in 2018 reached half of what it was five years back.

Sunlife Insurance stated in its annual report that its gross premium was Tk 80 crore in 2018. In 2015, it was Tk 165 crore.

Its life insurance fund amounted to Tk 231 crore in the first three quarters of 2019.

During this same period in 2018, it was Tk 301 crore, according to the company's latest data published on the website of Dhaka Stock Exchange (DSE).

Since being listed in 2013, it provided 18 per cent stock dividend in total but could come up with no cash dividend.

The gradual deterioration in performance left it incapable of providing any dividend to shareholders in 2018, causing it to be placed in the Z category.

At present, the company has no reserve or surplus.

Each stock of Sunlife Insurance, which has a paid-up capital of Tk 35.76 crore, traded at Tk 17 yesterday.

On Tuesday, it announced through the DSE that it was going to liquidate a fixed asset: selling a piece of land worth Tk 45 crore.

The company's main problem was that it failed to attract clients as required whereas an insurance company's lifeline is the addition of new clients, said a top official of the company requesting not to be named.

So, its gross premium declined and claim settlements became tough, he said.

The problems intensified when some claim settlements were delayed and it eroded the confidence of its clients, he added.

Contacted, Rubina Hamid, chairperson of Sunlife Insurance, said the insurer has been facing some problems because its costing was high.

"So, some problems arose in claim settlements."

Probed further on this, she said after a certain period following its launch a life insurance company needs to simultaneously settle several claims, leading to some problems.

Then the global coronavirus pandemic arrived and exacerbated matters. Sunlife's business was troubled like others because claim settlements and arrear withdrawals were handicapped.

"But I think we will be able to come out from the trouble very soon as the economy has started to roll. We have passed the crisis period so we will be able to bounce back."

On the announcement to liquidate the asset, she said: "We are selling the land to liquidate money that would be invested either in a fixed deposit into banks or the stock market."

"We think investment into banks, bonds or the stock market would give us a better return than through the land investment."

The company is also trying to reach new business segments, including the corporate sector. It initiated some new policies like group insurance and signed business deals with microfinance institutions.

"Once the deals start generating revenue, the situation would change. We hope to turn our business around," she said.

A top official of the Insurance Development and Regulatory Authority said they were yet to get any information from the company over plans for the sale.

"It may have been decided just recently. They will definitely inform us," he said.

Responding to a question, the IDRA official said the company had some problems regarding claim settlements and some of them were solved by the regulator.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments