Stock brokers seek review of demutualisation act

The DSE Brokers Association of Bangladesh yesterday urged the government to review the demutualisation act, claiming that it has ultimately turned the prime bourse into "an ineffective institution".

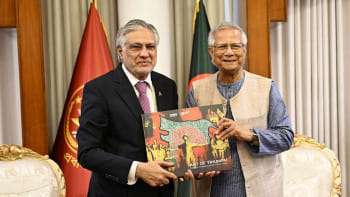

In this regard, the association sent a letter to the finance adviser of the interim government and the Bangladesh Securities and Exchange Commission (BSEC).

Following the 2010 and 2011 stock market collapses, separate inquiries recommended stock demutualisation. Some multilateral donor agencies also prescribed it.

Subsequently, the government in 2013 passed the Exchanges Demutualization Act to develop and better regulate the capital market.

The act reduced the number of representatives from the exchange and increased independent directors. It also reduced the influence of the brokerage house owners in the stock exchange.

As per the act, the DSE includes seven independent directors and its chairman is also chosen from among them. Only four directors came from 250 shareholders or stockbrokers through voting.

In the letter to the finance adviser, the DSE Brokers Association of Bangladesh said independent directors enjoy a majority in taking decisions whereas shareholder directors face disparity.

"As a result, the DSE has become an ineffective institution," said the letter.

The DSE Brokers Association of Bangladesh demanded six directors from shareholders and the chairman to be a shareholder director.

To bring back investor confidence in the market, it said the government should also look into the market activities of the past 15 years.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments