School banking getting traction

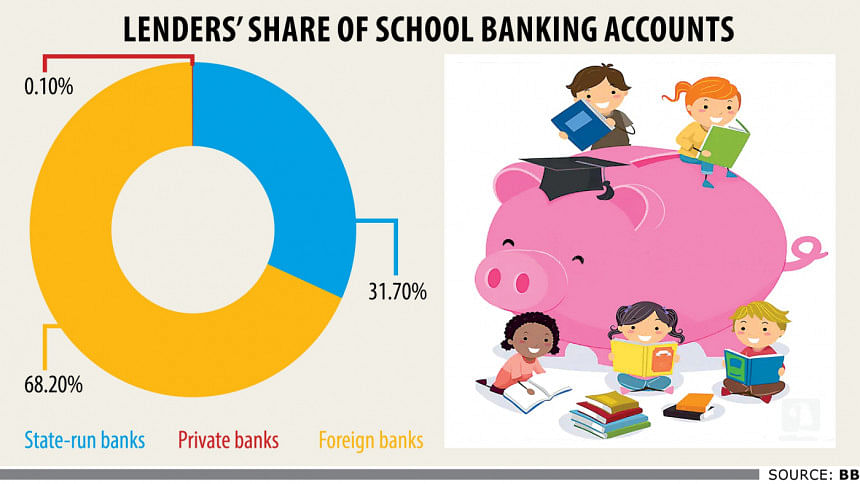

School banking is increasingly getting popular among students as the deposits in their accounts crossed Tk 1,600 crore in 2019.

As of December last year, students deposited Tk 1,626 crore in the accounts, up 8 per cent from a year ago, according to data from the central bank.

The number of accounts under school banking rose 10 per cent to 19.92 lakh last year.

A number of banks earlier took a set of measures to widen the banking operation among students as per instruction of the central bank, giving a boost to financial inclusion, bankers say.

The number of accounts and the outstanding balance under school banking would rise many folds if lenders initiate measures in keeping with the time, a central banker said.

The central bank introduced the school banking in 2010 as part of its efforts to widen financial inclusion and make students financially literate. The scheme aims to instill the habit of savings into students and make them more efficient in money management.

So far, 55 banks have rolled out school banking operations, allowing students aged 11 to 17 to open accounts.

The accounts come with a number of advantages, such as waiver on fees and charges, free internet banking, lower minimum balance requirement and debit card availability at lower costs.

Accounts can be opened with a minimum deposit of Tk 100.

Dhaka Bank, one of the top five banks in terms of mobilising deposits under school banking, arranges programmes at schools on a regular basis in order to raise awareness on building savings habit, said its Managing Director Emranul Huq.

The lender rolled out two savings products – Students' Ledger and Edu Savings Plan – to attract students. Guardians initially operate the accounts and the students are allowed to run them once they turn 18.

Edu Savings Plan is a long-term deposit scheme where students park a certain amount every month and the deposit is insured by MetLife Bangladesh.

Students with such accounts will receive insurance coverage for health treatments along with benefits that come with an insurance product.

Dhaka Bank mobilised deposits to the amount of Tk 89 crore from students in 2019.

Islamic Bank Bangladesh Ltd also achieved success in popularising school banking products.

The bank ranked third in terms of opening accounts and pooling deposits, said IBBL Deputy Managing Director Abu Reza Mohd Yeahia.

"Islami Bank arranges workshops for its staff on how to encourage students for savings. This has helped us pull off success in school banking," he said.

The bank runs awareness campaigns among the proprietors of its agent banking outlets so that they can open accounts for students in an efficient manner.

The number of accounts and deposits at IBBL stood at 1.93 lakh and Tk 92 crore respectively at the end of last year.

State-run Agrani Bank, which came second among all banks in terms of opening accounts, plans to mobilise deposits from students, said its Managing Director Mohammad Shams-Ul Islam.

The bank has opened 2.30 lakh student accounts but is yet to mobilise deposits as expected due to a lack of digitalisation, he said.

"We are not sitting idle. We have taken a number of measures to digitalise the banking operation," he said.

He went on to hope that deposit collection would accelerate once the lender completes digitalisation.

The central bank organises annual school banking conference in every district to draw students to school banking as it ultimately helps build savings habit, said Md Anwarul Islam, general manager of the financial inclusion department at the central bank.

The central bank has submitted a proposal to the National Curriculum and Textbook Board to include a chapter in textbooks so that primary and secondary-level students can gather knowledge on financial literacy, he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments