SA Group MD held over loan scams

Shahabuddin Alam, managing director of Chattogram-based SA Group and a director of Mercantile Bank, was arrested yesterday on at least five counts of loan irregularities.

The irregularities include illegal transfer of mortgaged assets, forgery of import documents and signatures of bank officials, cheque dishonour and willful non-payment of bank loans.

He was picked up from the capital's Gulshan area in the afternoon in a case filed by Bank Asia, Molla Nazrul Islam, special superintendent of police of the Criminal Investigation Department, told The Daily Star.

Shahabuddin was later produced before a court which sent him to Keraniganj jail.

Police didn't seek his remand, saying they had already collected a lot of information from him.

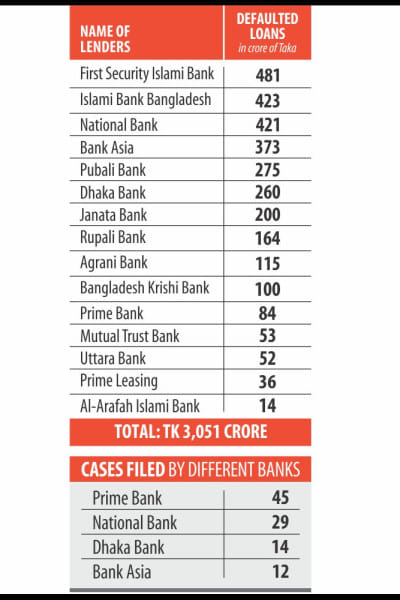

SA Group is one of the biggest loan defaulters in the country with more than Tk 3,500-crore loans from over a dozen banks and financial institutions. These institutions have so far filed more than 100 cases against Shahabuddin.

Two private enterprises also filed two cases against him over a claim of Tk 28 crore.

Mohammad Eqramul Islam, a counsel for Bank Asia, told this newspaper that Shahabuddin was arrested in a fraud case filed by the private bank for siphoning off around Tk 28 crore from it.

The bank lodged the case with the EPZ Police Station in Chattogram city last year, alleging that he had forged import documents and forwarded those to the shipping agent concerned in 2014 for having released imported crude palm oil from the port.

He then sold the goods on the open market but didn't give back the money to the bank, said Eqramul.

Bank Asia has filed a total of 12 cases against him to recover its defaulted loans amounting to Tk 373 crore.

Talking to this correspondent, a counsel for another private lender, National Bank, said the bank has so far filed 29 cases with different courts to recover Tk 421 crore non-performing loans given to Shahabuddin.

The SA Group MD also faces 45 cases filed by Prime Bank over various charges, including non-payment of loans and illegal transfer of mortgaged assets, an official of the private bank said seeking anonymity.

Besides, SA Oil Refinery and Samannaz Super Oil -- both owned by Shahabuddin -- owe Tk 84 crore to the bank.

Another private lender -- Pubali Bank -- also filed a case against him and his wife over dishonour of a cheque. He owes Tk 275 crore to the bank.

According to the documents of several cases, he transferred his assets illegally -- mostly those mortgaged to different lenders -- to his son, daughter and relatives.

He is also trying to flee the country, mentioned one of the case documents.

Talking to this newspaper, Pubali Bank Managing Director MA Halim Chowdhury said, “We recently applied to Bangladesh Bank for cancelling Shahabuddin's directorship at Mercantile Bank.”

As per the law, a loan defaulter cannot be a director of a bank, but Shahabuddin still remains in the Mercantile Bank board due to a court's stay order.

He got restructured Tk 1,153-crore loans from seven banks under a special policy offered by the BB in 2015.

As of March this year, the figure stood at Tk 1,441 crore as he paid only Tk 27 crore to the lenders.

Shahabuddin, who started his business career in 1988, has a number of oil refineries, dairy farms, drinking water processing units, and vegetable oil mills.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments