Paddy prices run riot. Could this go on to pose threat to food security?

Paddy prices have shot up to very high margins for a decline in its availability in suburban haats and bazars owing to big farmers and seasonal stockists taking it slow while releasing the staple.

Crop losses for cyclone Amphan, recurrent floods and apprehensions over low yields of aman paddy for late plantation and food shortages for the coronavirus pandemic are fuelling rumours among growers, traders and millers that supply of the food grain will become tight in the coming months.

And these factors are encouraging paddy to be stocked up and released slowly, said millers and traders.

Prices vary from market to market and among regions.

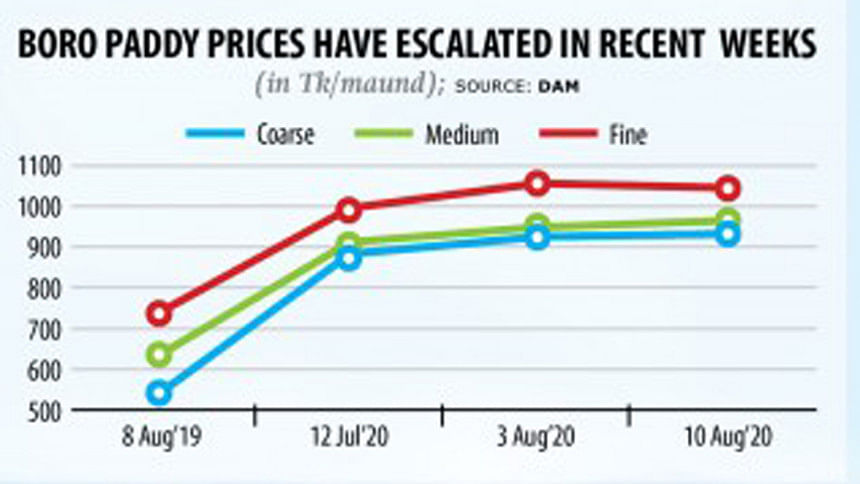

However, data collected by the Department of Agricultural Marketing (DAM) showed that national average prices of coarse paddy soared 62 per cent year-on-year to Tk 933 per maund at suburban bazars on 10 August from Tk 544.

Meanwhile, prices of medium quality grains increased 41 per cent year-on-year to Tk 961 per maund on 10 August.

On 10 August, the national average prices of fine quality paddy stood at Tk 1,044, in contrast to Tk 743 a year earlier, showed data from the DAM.

The market has become abnormal as the supply of paddy has reduced in the markets as prices are going up, said Ramesh Bhuiya, general manager of Blue Bell Auto Rice Mill in Dinajpur, one of the major rice-producing regions in the north.

The upward trend contradicts the findings of the Bangladesh Rice Research Institute (BRRI) that there would be more than 55 lakh tonnes of rice in surplus once domestic demand was met at the end of November.

The state rice breeding agency said farmers bagged more than 2 crore tonnes of rice from Boro harvested in the April-June period. It also said the country had 2 crore tonnes of grain at the end of June.

However, Nirod Boron Saha Chandan, president of the rice and paddy commission agents and wholesalers' association at Naogan in the north, disagreed with the BRRI estimate.

There might be something wrong with the calculation of acreage of Boro paddy, he said.

Availability of farmlands is falling because of their use for non-farming purposes while a section of farmers has also shifted to other crops and aquaculture.

"There is no reflection of the changes in acreage estimate."

Besides, the yield of aus paddy would be less than expected as excessive rainfall has affected the crop.

Prolonged floods are going to affect Aman cultivation too. The optimum period for plantation of seedlings is going to expire by this month's end.

And given the damages of seedlings for floods, it is likely that many farmers will have to do with planting their crops late. And being late in creating plantations means a reduction in yield, he said.

Until 13 August, farmers planted seedlings of paddy on 31.5 lakh hectares during the current Aman season. The area is 57 per cent of the total target for transplanted Aman crop, showed data from the Department of Agricultural Extension.

And this is the reason behind the unstable trend in the market, said Chandan, while suggesting the government to go for imports to increase the public stock of food grain to contain the prices of the staple.

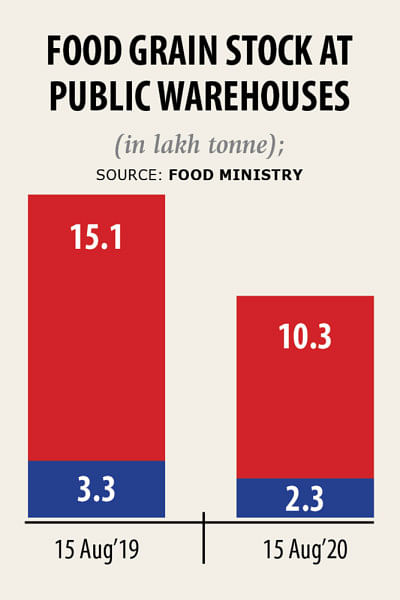

Foodgrain stocks at public storages dropped 31 per cent year-on-year to 12.62 lakh tonnes as millers and farmers are least interested in selling to the government in the face of rising prices, much to the worries of poor as well as the low-income group, whose hardships will increase because of shrinking incomes.

The coronavirus-related economic crisis increased impoverishment of a considerable number of people, pushing the poverty rate to 29.4 per cent of the population by the end of June from 20.5 per cent the previous year, according to an estimate by Planning Commission.

The number of poor is estimated to be higher by independent think-tanks and research organisations.

"The government should be cautious. There will be a shortage in case the aman crop is affected," he said.

Millers said forecasts of a food crisis for the pandemic by international agencies and erratic weather also attracted a higher number of seasonal stockists in the paddy market.

They have bought the grain early on to profit from selling in the lean season.

A lot of seasonal traders have bought paddy and stocked them, said Sabbir Khaleque, director of Desh Agro Industries, which has three rice mills at Kushita, another major rice processing hub.

Besides, farmers and traders in the value chain are more aware of the market trends and other events because of increased use of information communication technology and mobile phones, he added.

The government might face difficulties in keeping the prices steady if it does not increase the stock first, said Chitta Majumder, managing director of the Majumder Group of Industries that operates rice mills.

In that case, the government might end up facing a repetition of the price spike witnessed in 2017.

Subsequently, Majumder suggested a reduction of import duty on rice by about 60 per cent in a way such that consumers can afford it while farmers do not suffer losses.

The effects of increased prices of paddy were not visible yet as traders were holding back when placing orders to mills assuming that the government would go for imports, he added.

The food ministry got approval from the prime minister regarding the import of rice considering risks faced from damages to Aman crop in the event of natural calamities, said Food Secretary Mosammat Nazmanara Khanum.

The flood situation improved after 15 August and the food ministry was tracking the progress of plantation of paddy during Aman season, which was susceptible to natural calamities.

"We are watching and assessing trends as well as international forecasts regarding the risk of a natural disaster. We will import the amount we need."

A small quantity will be imported such that the government can provide food to the poor and so that people get the staple at reasonable prices.

The decision is likely to be taken within this month, she said, adding that public import would be given priority.

There would be no crisis in the market because of harvests running uninterrupted until the Boro season and for farmers having a good stock of food.

Large-scale imports by private entities will not be encouraged this year, she added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments