Nagad to make MFS sector lopsided

The disproportionately higher transaction limits of Bangladesh Post Office's digital financial service platform Nagad have raised the eyebrows of private sector players, who voiced concerns of uneven competition and possibilities of money laundering and terrorist financing.

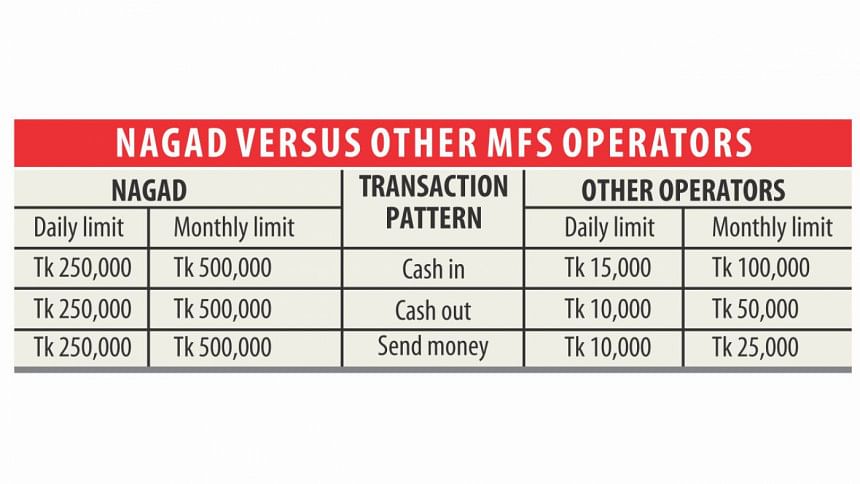

Through Nagad, a customer will be able to make 10 transactions a day amounting to Tk 250,000 and send Tk 50,000 in one transaction and the numbers will remain the same in case of money withdrawal also.

In contrast, by way of two transactions the cash-in limit is Tk 15,000 and for withdrawal it is Tk 10,000 a day for the existing mobile financial service providers -- bKash, Rocket and UCash.

Through Nagad, a person can send Tk 250,000 a day while it stands at Tk 10,000 for the existing MFS providers.

And the reason Nagad is getting away with the higher transaction limit is that it does not fall under the purview of the central bank thanks to the postal act, which has empowered the postal department to independently provide financial services.

For the last eight years with the help of the Bangladesh Bank and different government agencies, the existing MFS players have developed the market and ensured discipline and order in the industry, said Shamsuddin Haider Dalim, head of corporate communications at bKash. “Now the market requires a level playing field for healthy competition and regulatory consistency to protect investment.”

But the big difference in transaction limit between the existing players and Nagad will make the playing field lopsided, he said. Nagad will be run by Bangladesh Post Office and Third Wave Technologies, the platform's developer, under a revenue-sharing model.

Not only that, it has opened a window for money laundering, terrorist financing and other suspicious transactions, to curb which the BB slashed the transaction limits for MFS accounts only last year.

Sushanta Kumar Mandal, director general of Bangladesh Post Office, dismissed the concerns though.

“A negative campaign has already taken off against them. Nagad will be beneficial for citizens.”

Asked about the regulatory requirements that the other MFS providers have to maintain, Mandal said the postal department has been providing financial services for about a century now.

“It will not be an issue,” he added.

The central bank too has no issues with the postal department's new digital financial service as of now, said its spokesman Serajul Islam.

“They have come up with the platform under their act,” he said, adding that the BB will assess the situation once Nagad is fully operational.

Lila Rashid, general manager of the Bangladesh Bank's payment systems department, though raised concerns that the platform's higher transaction limit might widen the scope for unethical transactions.

Although launched officially in Dhaka yesterday on a test basis, Nagad has been running in other cities since last week. The platform has already logged in 87,000 customers.

Prime Minister Sheikh Hasina will officially inaugurate Nagad once it gets 10 lakh accounts, Mandal said.

As of August, there are 6.47 crore active MFS accounts in the country, which have transacted Tk 34,399 crore during the month, according to data from the BB.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments