Listed MNCs see 17% drop in profit as inflation bites

Most listed multinational companies (MNCs) in Bangladesh reported a sharp drop in earnings for the April-June quarter as persistent inflation weighed on consumer spending and raised operating costs, squeezing profit margins across sectors ranging from tobacco and footwear to electronics.

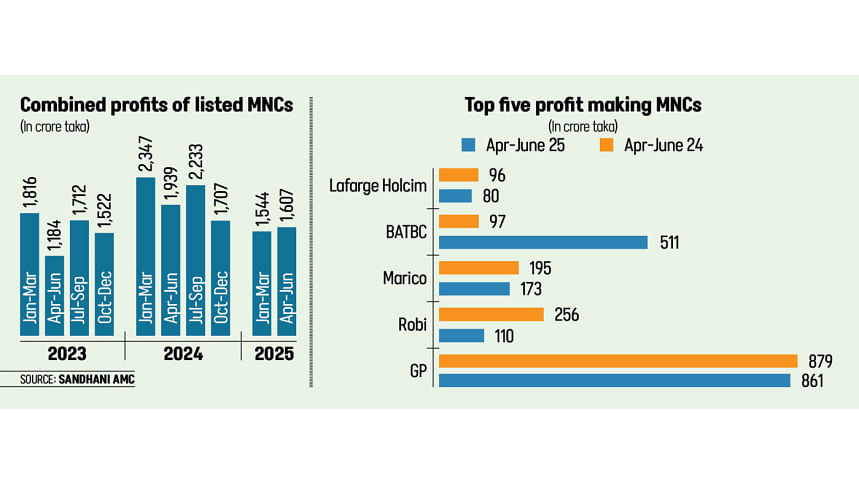

Combined net profits of 14 listed MNCs fell 17 percent year-on-year to Tk 1,607 crore during the second quarter, despite logging a 6 percent growth over the last quarter, according to stock exchange filings.

Analysts attributed the downturn to slowing demand, rising finance costs and continued pressure on input prices.

"Not only multinationals, but corporate earnings overall were also dry, except in banking, due to a slowdown in the economy," said Shahidul Islam, chief executive officer of VIPB Asset Management.

"The central bank is following a contractionary monetary policy to contain demand so that inflationary pressure drops. It's working, but aggregate demand has fallen as a result, impacting the topline or sales of corporates," said Islam.

The Bangladesh Bank has maintained a contractionary monetary policy to rein in inflation. Annual average inflation rose to 10.03 percent in June from 9.73 percent a year ago.

The Bangladesh Bank has maintained a contractionary monetary policy to rein in inflation. Annual average inflation rose to 10.03 percent in June from 9.73 percent a year ago

"When companies' sales drop, it ultimately squeezes their profits. Moreover, costs of doing business rose through higher finance costs as interest rates in the banking sector rose, which coupled with the bottom line of the companies," said Islam.

Major listed players, including Bata Shoe and Singer Bangladesh, incurred losses in the quarter, while they were in profit during the same period of the previous year. RAK Ceramics remained in loss.

Bata reported a loss of approximately Tk 10 crore for the April-June quarter, as sales declined sharply following the widespread disruption and damage to several of its retail outlets, the company said in its half-yearly financial reports published on July 30.

The listed multinational shoe producer's sales plummeted by 39 percent to Tk 158 crore in the quarter. The company had logged profits of Tk 19 crore in the same quarter last year.

"Several retail locations were affected by acts of vandalism, which disrupted operations and had a material impact on financial performance," said the company regarding the quarterly loss.

Singer Bangladesh posted a Tk 31 crore loss, compared with a Tk 25 crore profit in the same quarter last year.

The home appliance and electronics retailer said rising costs for advertising, warranty claims, bank charges and demurrage costs for shipping detention hurt margins.

Its net finance costs almost tripled due to higher short-term borrowing costs and a 4.2 percent depreciation of taka against the euro since May added to its finance burden.

Singer said while its sales volumes improved, it was unable to raise selling prices enough to offset higher product costs.

Unrealised exchange losses on intercompany loans from its Turkish parent Arçelik, also weighed on the bottom line.

The loans were used to finance a new manufacturing plant in the Bangladesh Special Economic Zone, due to become operational by year-end.

The company, however, expects the investment to improve its profitability starting from the end of 2025.

The British American Tobacco Bangladesh Co Ltd also reported an 81 percent year-on-year profit decline to Tk 97 crore in the second quarter, citing lower sales volumes, inflation-adjusted cost increases, and impairment charges related to the closure of its Dhaka factory site.

RAK Ceramics in its price-sensitive statement for the quarter said that its revenue rose by 15 percent to Tk 163 crore, however, it incurred a loss of Tk 18.50 crore, 18 times higher than the loss recorded in the same quarter of the previous year.

The company said sales decreased by 3 percent due to declining market demand.

Among the listed multinationals, only a handful of firms, most notably Marico Bangladesh and Robi Axiata, managed to secure profits during the second quarter, buoyed by improved cost controls and selective demand.

Marico Bangladesh, which sells personal care and hair oil products, saw both revenues and profits rise, helped by stable demand and cost optimisation.

Robi Axiata Ltd, the country's second-largest telecom operator, reported a doubling of quarterly profits, despite softer revenues. The company attributed the gain to lower operating costs.

The company's profit soared 140 percent year-on-year to Tk 257 crore in the three months, according to its half-yearly financial reports.

At the same time, its revenue dropped around 2 percent year-on-year to about Tk 2,600 crore.

A 31 percent decline in sales and distribution costs during the period made the highest contribution to the jump in profits, the financial report showed.

Meanwhile, the outlook for the rest of the year remains cautious.

"As interest rates in the banking sector are high, companies with high debt portfolios will continue to suffer as their costs of finance will continue to chip away at their profits," said Ali Imam, CEO of EDGE Asset Management.

"The telecom sector is a mature sector, so they may not see any big growth in the coming days," he said, adding that the outlook for the construction sector is not exciting.

Construction-linked sectors, such as cement, steel, and paints, are unlikely to see major growth amid a broader liquidity crunch and slower private investment.

"As owners of black money holders are in a tight situation, so the construction sector may not see high growth," said Imam.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments