Lenders witness surge in internet banking amid pandemic

Nayeem Uddin, a college teacher by profession, faced immense difficulty to settle banking transactions between April and May, when strict restrictions on movement were imposed by the government to curb spread of coronavirus.

However, internet banking allowed Nayeem to resolve the crisis by helping him send money to his near and dear ones without having to visit a physical bank branch.

"I learned about the internet banking service at least two or three years ago but did not feel comfort to use it. So, I did all my banking in person by going to a branch," he said.

Initially, Nayeem faced some issues while trying to send money through internet banking but eventually, it made his life easier than ever.

"Although there are no restrictions on movement at the moment, I am now used to paying instalments for both my deposit pension scheme and loan by way of using the digital banking platform," he added.

With just a smartphone, one can settle almost all types of transactions as a significant number of banks have already introduced their own apps.

"I now even pay my house rent through the app. The pandemic has changed my lifestyle to a great extent but one of the best changes is being able to use technology to settle financial transactions," Nayeem said.

Nayeem is just one of many individuals that have recently embraced internet banking as a part of their efforts to keep the deadly coronavirus at bay.

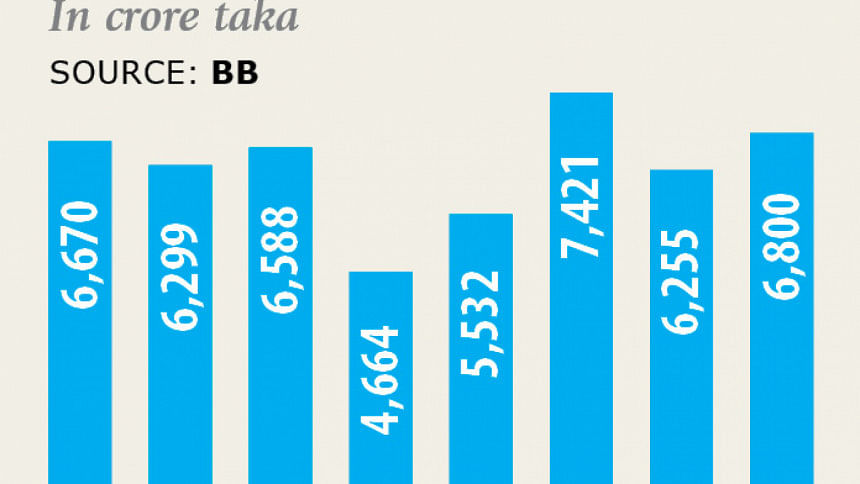

Both internet banking transaction and the number of the service users have risen at a faster pace in recent months.

The total value of transactions made through internet banking stood at Tk 6,800 crore in August, up 46.36 per cent year-on-year while users of the service increased nearly 30 per cent to 29.20 lakh, data from the central bank shows.

There is no doubt that the use of internet banking will get much more popular in the days ahead as many local banks are shying away from opening branches, a Bangladesh Bank official said.

For this reason, lenders have recently taken several initiatives to embrace the branchless banking model, which includes agent banking, mobile financial services and so on.

Mutual Trust Bank will open a maximum of 1-2 branches for a year as it has taken programmes to popularise digital banking, said Syed Mahbubur Rahman, the bank's managing director.

Branchless banking will help lenders significantly cut costs at a time when clients will receive faster and hazardless services.

"Internet banking is one of the most sophisticated tools for the expansion of digital financial services," he said, adding that Mutual Trust Bank witnessed a rapid increase in the number of internet banking users amid the pandemic.

Clients are now able to avail various financial services from the comfort of their homes by using the 'MTB Smart Banking' app.

The app helps clients collect their account statements, transfer funds from one bank to another, recharge their mobile balance and pay utility and credit card bills.

As much as 278,600 of Mutual Trust's clients now settle their transactions through the lender's internet banking platform.

Between July and August, Dhaka Bank carried out a special campaign to popularise internet banking so that people would be encouraged to engage in branchless banking, said Emranul Huq, managing director of Dhaka Bank.

During the campaign, the lender also introduced a new service that helps clients open banking accounts from home.

An account opening form is available on Dhaka Bank's website. Clients can get the required document by clicking on a link and after filling it out, the client can submit it online, Huq said.

Representatives of Dhaka Bank even provide the debit card and cheque book services required by respective clients so that they can avoid going to any branch, he said.

"The campaign helped attract 32,000 new customers to the bank. The clients are taking the facilities of internet banking service as well," Huq said.

Dhaka Bank Go -- a mobile app of the lender -- has already gained huge popularity among clients in recent times, he added.

Dutch-Bangla Bank's (DBBL) internet banking service, which was introduced back in 2004, managed to gain popularity amid the pandemic, according to the lender's Managing Director Abul Kashem Md Shirin.

"Two lakh clients now use the internet banking service to transfer their funds from DBBL to other banks," he said.

In addition, 29 lakh clients now use the lender's NexusPay app to settle intra bank transactions.

"The settlement of funds through internet banking gained momentum in recent months. Settling funds through digital means is now a regular habit for clients," Shirin said.

The number of Eastern Bank's clients that engage in internet banking increased by at least 25 per cent amid the ongoing pandemic, said Ziaul Karim, head of communications and external affairs at Eastern Bank.

At least 2 lakh clients now use EBL Skybanking -- the bank's mobile app -- to conduct their required financial transactions, he said.

Bangladesh Bank recently increased the limit on inter-bank fund transfers through internet banking with a view to meeting the customers' requirements.

Clients can now transact a maximum of Tk 5 lakh per day against the previous ceiling of Tk 2 lakh, according to a central bank notice issued on September 6.

Bangladesh Bank also specified the transaction ceiling on internet banking for business institutions for the first time.

Any business entity will be allowed to transfer Tk 10 lakh and conduct a maximum of 20 transactions per day under inter-bank internet banking, the central bank notice said.

The increased ceiling set by the central bank has pushed the internet banking transaction up further, the Bangladesh Bank official said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments