Laurels for top taxpayers

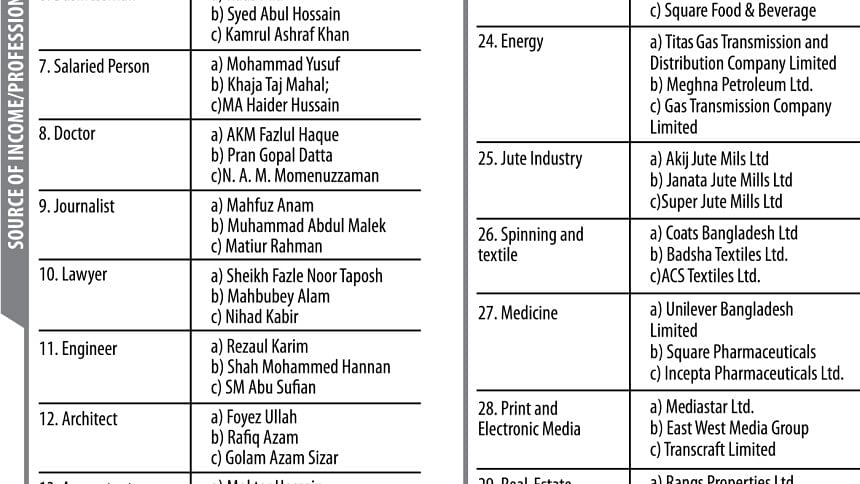

Golam Dastagir Gazi, textiles and jute minister, Grameenphone, Islami Bank Bangladesh, Infrastructure Development Company, Nestlé Bangladesh, Akij Jute Mills, Unilever Bangladesh, and Rangs Properties were among individuals and companies that won awards from the National Board of Revenue yesterday for being top taxpayers.

The tax administration handed out the accolades to 141 individuals and companies at a ceremony at the Radisson Blu Dhaka Water Garden for the current fiscal year. Of the awardees, 74 are individuals, 57 companies, and 10 organisations.

In the banking category, Islam Bank Bangladesh, Standard Chartered, National Bank, HSBC, Brac Bank, Pubali Bank, Southeast Bank and UCB were crowned as top taxpayers.

Infrastructure Development Company, the Investment Corporation of Bangladesh, IDLC Finance, and Bangladesh Infrastructure Finance Fund won the top award in the non-bank financial institution category.

Grameenphone was the lone top taxpayer in the telecommunication category.

Nestlé Bangladesh, Olympic Industries, and Square Food & Beverage were handed out the award in the food and allied industry category.

Unilever Bangladesh, Square Pharmaceuticals, Incepta Pharmaceuticals, and Renata won the accolade in the pharmaceuticals category.

Rangs Properties, Equity Property Management, and Bay Developments emerged as the top taxpayers in the real estate category.

Youngone Hi-Tech Sportswear Industries, Rifat Garments, GMS Composite Knitting Industries, Ha-Meem Denim, That’s It Sports Wear, Pacific Jeans and Four H Fashions were crowned among the garment companies.

In the tannery industry category, the honour went to Bata Shoe Company (Bangladesh), Apex Footwear and Atlas Footwear.

Sheikh Fazle Noor Tapos, a lawmaker; Mahbubey Alam, attorney general; Nihad Kabir, president of the Metropolitan Chamber of Commerce and Industry; Abu Mohammad Amin Uddin, a noted lawyer; and Rafique-Ul Huq, an eminent jurist, won the award in the lawyer category.

Bangladesh Machine Tools Factory, Khulna Shipyard and BSRM Steels won the award in the engineering category.

Speaking at the ceremony, Finance Minister AHM Mustafa Kamal called upon the top taxpayers to encourage others to pay tax.

He said tax rates would be reduced in a way that the total tax collection does not suffer.

“I must reduce tax rates. I will form a committee to examine how much the rates can be reduced without affecting the overall collection target.”

NBR Chairman Md Mosharraf Hossain Bhuiyan touched upon the question raised by the media why renowned businesses don’t top the list of the highest taxpayers.

He expected that tax collection would increase and facilitate development activities if competition creates in tax payment.

The NBR chief cited the example of Kaus Mia, who has been topping the list of top taxpayers in the businessperson category, since 2010.

“He is so eager to remain on the top that he does not hesitate to pay additional tax.”

“He is a jewel of our country. We expect all others to come forward and pay tax spontaneously,” the NBR chairman said, adding that Kaus Mia pays Tk 43-45 crore in income tax.

Bhuiyan said some personalities and firms regularly get recognition as top taxpayers and called others to pay higher amount of tax so that they can also become the top taxpayers next year.

In his reaction, Kaus Mia said he had emerged as the top taxpayer in 1967.

“I have been engaged in business since 1950. I am a grandchild of a landlord. I did not enter the world of business because of hunger.”

The 89-year-old said he had been paying taxes since 1958 and said he is engaged in 40-45 types of businesses.

The NBR introduced the awards in fiscal 2010-11 as an incentive to improve compliance and reduce tax evasion and avoidance in a country where just 1.33 percent of the population submitted income tax returns last fiscal year.

According to an NBR estimate, 4 crore people out of more than 16 crore have taxable incomes. But most of them have remained out of the net in the absence of adequate enforcement.

The NBR says the number of filings would be far below the number of people with taxable income.

The Centre for Policy Dialogue, a think-tank, last year in a survey found that 68 percent of the people with taxable income do not pay any tax -- a figure that explains in part why Bangladesh has one of the lowest tax-to-GDP ratio in the world despite its spectacular economic growth and increasing income.

Bangladesh’s tax-to-GDP ratio is 9.2 percent.

In recent years, the number of registered taxpayers increased on the back of various policy measures taken by the revenue authority.

Now, the number of taxpayer identification number holders is more than 44 lakh, up from nearly 19 lakh three years ago.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments