Investment slump deepens

As the interim government completes one year in office, signs of a worsening investment downturn are becoming hard to miss, according to business leaders and economists.

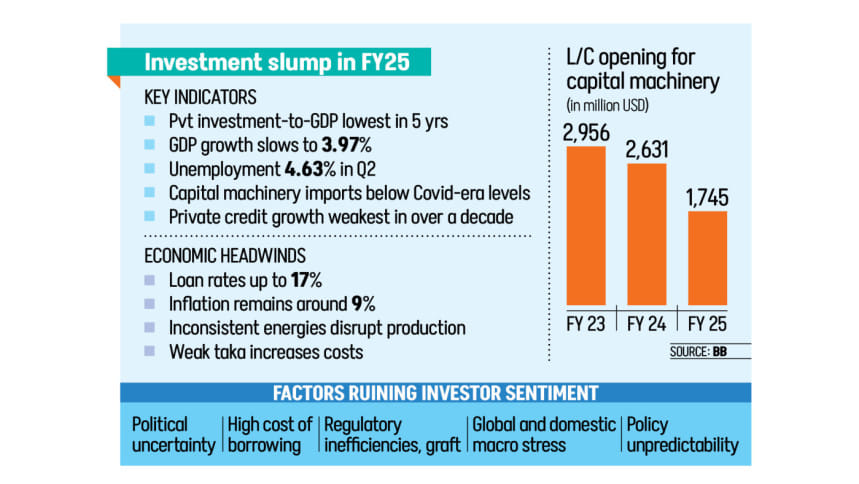

Private investment has slowed sharply. Imports of capital machinery have fallen to multi-year lows, dipping even below Covid-19 levels.

Private sector credit growth, a key indicator of economic activity and confidence, is now at its weakest in more than a decade.

According to the Bangladesh Bureau of Statistics, private investment accounted for 22.48 percent of GDP in fiscal year (FY) 2024–25, the lowest in five years and well short of the 28.2 percent target under the 8th Five-Year Plan.

Monetary tightening to battle double-digit inflation has complicated the situation.

The Bangladesh Bank (BB) has been maintaining a contractionary stance, making borrowing costlier for businesses. Loan interest rates now stand at 16 to 17 percent.

Energy disruptions and inconsistent gas supply to industries are further hurting factory output, while business leaders repeatedly expressed concern over regulatory inefficiencies and corruption as major hurdles.

With GDP growth slowing to 3.97 percent in FY25 and unemployment rising to 4.63 percent in the October-December quarter of 2024, the economic consequences are becoming more visible.

"Investment activity has practically stalled," said AK Azad, chairman of Ha-Meem Group, one of the largest garment exporters in the country. "No one wants to take risks until there is clarity on political stability and policy continuity."

Azad said many believe investment will not return until a new government is in place, adding that political developments now largely dictate the economy's direction.

Domestic instability, he noted, has eroded market confidence, slowing both job creation and investment.

"Investors are concerned about interest rates, law and order, and political risks. Unless political stability and investment security are ensured, few are willing to take the risk of new ventures."

The apparel exporter also cited worsening energy supplies as a serious obstacle for businesses.

Meanwhile, Anwar-Ul-Alam Chowdhury, president of the Bangladesh Chamber of Industries, said, "This is not just a short-term slowdown."

"The indicators show a deeper erosion of confidence in the business environment," he said, adding that political uncertainty is undermining trust in state institutions and casting doubt on the government's ability to ensure economic stability.

Asif Ibrahim, former president of the Dhaka Chamber of Commerce & Industry (DCCI), urged the authorities to act fast.

Private investment, he said, is vital for sustaining growth and creating jobs, particularly as nearly 20 lakh young people enter the workforce each year.

"Recent trends, such as the deceleration of private sector credit growth and a decline in the investment-to-GDP ratio, suggest that investor sentiment may be weakening. If unaddressed, this could pose challenges for long-term economic stability."

DCCI president Taskeen Ahmed said the drop reflects growing investor hesitation amid economic uncertainty, stubborn inflation, currency depreciation and sluggish credit demand.

He pointed to ongoing geopolitical tensions, the country's violent political changeover, high interest rates and prolonged energy shortages as further drags on confidence.

Ahmed argued that the environment is not conducive to fresh investment.

"To restore investor trust, we urgently call for reforms in financial governance, guaranteed energy availability, political stability, and improvements in the ease of doing business. Otherwise, it would not be possible for private investment to recover," added the business leader.

M Masrur Reaz, chairman and CEO of local think tank Policy Exchange Bangladesh, said private investment has been stuck at about 23 percent of GDP, far below the level needed for sustained growth.

He listed inflation, forex pressure, weak demand, gas shortages, poor infrastructure, red tape, political instability and unclear policy direction as the main barriers.

Without urgent reforms, according to the economist, sluggish investment will damage job creation, growth and long-term development.

Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD), said uncertainty over future policies, rising energy costs, high interest rates, import restrictions, corruption and bureaucratic inefficiencies are discouraging investors.

"These combined challenges are stalling investment," she said, adding that without fresh capital, industrial growth, job creation and incomes will stagnate.

"This is a critical juncture," she said.

Selim Raihan, executive director of the South Asian Network on Economic Modeling (Sanem), said the lack of consensus on reforms has heightened risks. "Such unpredictability makes long-term planning difficult."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments