How Bangladesh can cash in on record low oil prices

Energy is a major requirement for the development of a country and directly or indirectly plays an important role in revenue generation.

Crude oil is a key source of energy which is constantly driving the world economy.

At this critical moment of coronavirus pandemic, I want to highlight the impact of the oil price plunge in the international market as Bangladesh has to spend a huge amount of foreign currency every year on importing crude oil which affects the economy of the country in many ways.

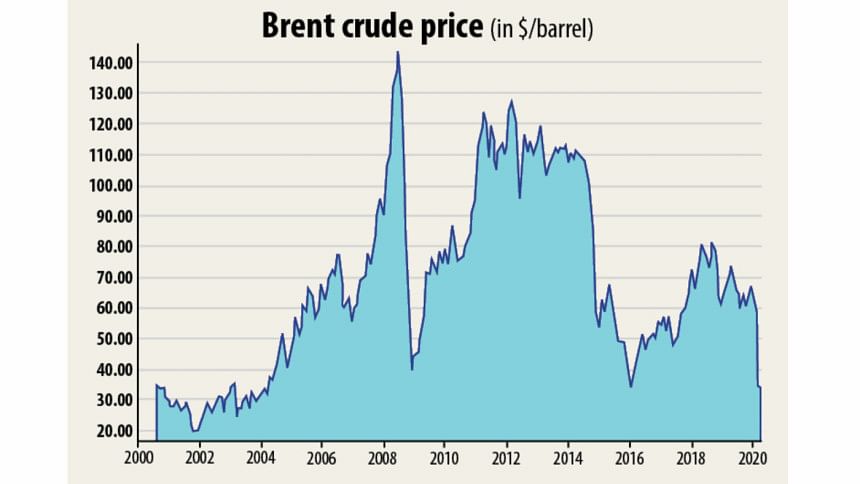

Oil price had been in the range of $45-60 a barrel for the last 3-4 years but the sudden outbreak of coronavirus is now putting a strain on the international oil market.

The lethal pathogen that is spreading like wildfire is bringing the economies of many countries to their knees and leaving an overwhelming impact on oil prices.

As most of the countries affected by coronavirus are resorting to tough measures like lockdown, their economies are grinding to a halt.

There is no doubt that imposing lockdown is a tough decision for any economy but it is the most effective way to contain the spread of the deadly virus as life is more important than economy.

Partial and full lockdown in many countries has brought down fuel consumption by almost 30-40 per cent all over the world creating a supply glut in the international market.

Most of the oil importing countries have cut back on their oil purchase orders because of a shortage of oil storage capacity, while international oil companies did not bring down oil production to that extent.

Ultimately, the situation led to a surplus supply of oil in the international market, which is why prices crashed to $20 a barrel.

If the lockdown continues until the end of April, oil price may plunge further to about $10 a barrel as oil purchase orders from the importing countries might hit rock-bottom due to a huge amount of unused fuel at home.

Against this backdrop, international oil companies might think of cutting oil production to keep the market stable.

Bangladesh is one of the oil-importing countries but it does have adequate or surplus storage capacity, refinery as well as standard distribution and marketing policies.

Hence, the government can consider the following proposals that can also help formulate cost-saving and long-term business policies.

1) The Sangu platform was built for offshore drilling and gas supply from offshore facilities to the national grid in Chattogram.

The platform is connecting 10-12 wells of Sangu gas field and the depth of each well is around 3,500 metres.

The gas field is abandoned and all the wells are sealed off.

The Sangu platform is connected with a production pipeline to the Chattogram port that can be 20-22 kilometres long.

These 10-12 wells of the Sangu field and 20-22km pipeline could be used as storage tanks for the imported crude oil.

Additionally, the government may need to build a structure at the Sangu platform for oil tankers to make the platform suitable for unloading crude oil from ships and carrying the oil to the empty wells/pipeline for storage.

This oil can later be transported to Chattogram oil refineries for processing. It may reduce carrying cost by saving time and facilitate quick unloading without additional port arrangements.

Before that, Bangladesh Petroleum Corporation and Bapex can jointly conduct a feasibility study on this platform and the wells to check if those are viable for storing oil.

The feasibility study may assess the present status of the platform and the pipeline, and consider other aspects like hole cleaning, pressure test of the wells for finding leaks, and pressure test of the pipeline to Chattogram from the Sangu platform.

It can also calculate the capacity of the 10-12 wells and 20-22km pipeline.

2) The government can install a floating refinery close to the Sangu platform.

The refined oil can then be distributed through riverways to different river ports inside the country.

It may reduce domestic carrying costs and will ensure quality of products as well.

3) All the abandoned gas wells can also be used as reservoirs of diesel or unrefined crude oil following the above procedure.

Onshore gas fields are already safe and secure and they can make the marketing process quite easier.

Following the means mentioned above, Bangladesh can purchase and reserve a huge volume of refined or unrefined oil for further use and thus save foreign currencies at this critical moment.

The writer is a petroleum geologist and an international oil and gas exploration

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments