Govt to revive stock market with multiple schemes

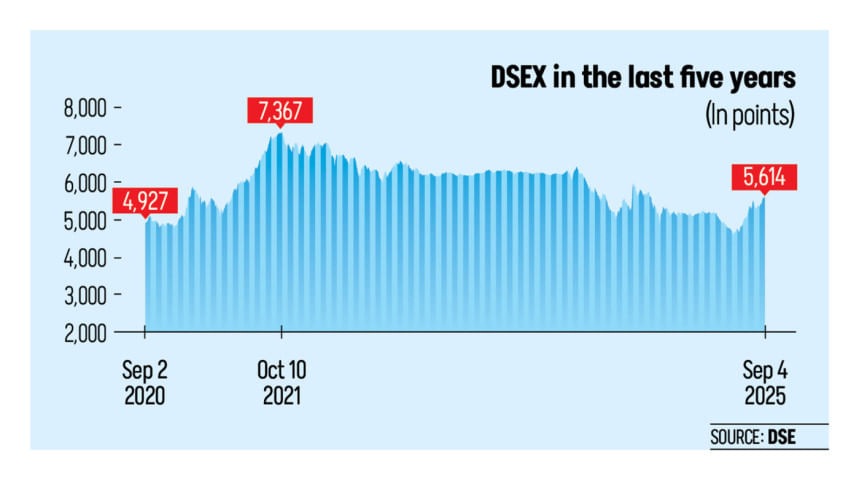

The interim government has taken a series of steps to restore confidence among investors and reinvigorate the stock market, which has been hovering between 4,000 points and 5,500 points for the last several years.

Fresh capital is being channelled into the state-run Investment Corporation of Bangladesh (ICB) to help stabilise the market and protect small investors.

The government has also extended a Tk 900 crore special fund for the market by five years till 2032. It was formed after the 2010 market crash to support retail investors.

Alongside this, the finance ministry is going to provide Tk 2,000 crore to ICB, which got a sovereign guarantee against Tk 3,000 crore in loans last year.

To increase the supply of quality shares to the market, the government agencies have shortlisted ten firms, including six multinationals, namely Unilever, Nestlé, Novartis, Syngenta, Synovia (formerly Sanofi Bangladesh) and Karnaphuli Fertilizer Company.

Since the government holds roughly 40 percent stakes in most of the multinationals, officials say they are looking to offload at least five percent of their shares to the public.

Four state-run firms -- Pashchimanchal Gas Company, North-West Power Generation, Sylhet Gas Fields and Karnaphuli Gas Distribution -- have been shortlisted, according to a list sent by ICB Capital Management, a state-owned merchant bank, to the finance ministry.

General and institutional investors, who have long been demanding an increase in the supply of good scrips in the stock market, are now feeling optimistic.

Dhaka Stock Exchange (DSE), the main bourse, has 360 listed companies. Three years ago, the number of listed companies was 350.

Over the past 13 years, 127 companies have been listed on the stock exchanges through the issuance of initial public offerings. And over half of those are categorised as poor performing companies giving no or low dividends, according to the DSE.

DSEX, the benchmark index at the DSE, closed at 5614.27 yesterday, shedding 17.33 points or 0.30 percent from the previous day.

The DSE launched DSEX in 2013. The value of the index was 4,055 points, three years after the bursting of the previous bubble. It never rebounded to the previous highs of 8,900 points, with stakeholders blaming the absence of adequate quality stocks.

Only two multinational firms and one state-run company got listed in the last one and a half decades.

Mazeda Khatun, chief executive of ICB Capital Management, said discussions with the regulator and boards of the multinationals and state-run companies are underway.

Although the government intends to offload its own holdings, current shareholders must be offered first refusal. So far, the multinationals have been reluctant to join the market.

"The companies will get a good price, an example of which is existing multinational companies that are trading almost at the highest price among all the listed companies," Mazeda said.

Preferring anonymity, a senior ICB official said the institution sought Tk 13,000 crore in support but was likely to receive only Tk 2,000 crore. "It will be helpful to support the market, though it is still very low compared to its necessity," he said.

He added that the extension of the Tk 900 crore special fund would also aid investors.

Between 2013 and 2015, this fund was distributed in three tranches among 35,000 small investors through stockbrokers and merchant banks. Once repaid, the fund was recycled, and since 2019, it has been lent out on a revolving basis to intermediaries investing in the market.

In May 2025, Chief Adviser Muhammad Yunus instructed that the government offload its stakes in state-owned multinationals and bring them into the capital market.

Investors believe such listings could be a game-changer.

"When the listing of multinational companies is complete, it will have a massive impact on the stock market as investors will get the opportunity to invest in these high-performing companies," said Abdullah Huzaifah, a retail investor.

He pointed to Grameenphone's entry into the market, which attracted thousands of investors, and said a similar effect could follow if six more multinational firms offload shares.

"Although it is a long-time demand of investors, no government has taken firm steps to bring them into the market. This time, the chief executive of the country talked about the listing, which is giving me hope," added Huzaifah.

However, he was critical of delays in listing state-owned enterprises. "Why are the state-run companies taking such a long time to offload shares?"

Huzaifah appreciated other market reforms, such as cuts in trading tax and BO account fees, but urged quicker progress on legal changes.

The Bangladesh Securities and Exchange Commission (BSEC) is drafting amendments to rules on margins, mutual funds and public issues to ensure a more transparent and fair trading environment.

In a press statement on Wednesday, Dhaka Stock Exchange Brokers' Association of Bangladesh (DBA) President Saiful Islam welcomed initiatives by the regulator regarding listing of domestic and foreign companies.

He said no good companies had entered the capital market for a long time. "Due to the lack of good companies, there had not been any significant participation of domestic and foreign investors in our market, and as a result, the market had not become stable and sustainable."

He said for the greater good of the capital market, there is a need to list good domestic and foreign companies.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments