FDI flow to Bangladesh is low, why?

Despite developing economic zones and adopting one-stop services to attract foreign direct investment (FDI), Bangladesh has failed to get as much as it targeted.

Not only global economic giants like India, even small economies in the South Asian region such as the Maldives and Sri Lanka are ahead of Bangladesh in terms of FDI attraction.

According to UNCTAD's World Investment Report 2023, Bangladesh ranks fourth among South Asian nations in terms of FDI inflow as a percentage of gross domestic product (GDP) despite being the second-largest economy in the region.

From 2017 to 2022, Bangladesh received an annual average of $2.92 billion in FDI.

In 2022, Maldives received $722 million in FDI, which equated to around 11.70 percent of its GDP. Meanwhile, Sri Lanka, which endured a severe economic crisis in 2022, fetched $898 million from foreign investors, equating to 1.20 percent of its GDP.

While Bangladesh received more FDI than either nation in terms of US dollars, both countries outpaced Bangladesh when considering FDI as a percentage of GDP.

Bangladesh's FDI inflow amounted to only 0.75 percent of its GDP, according to the UNCTAD report.

But even in US dollar amounts, the FDI would amount to less than half of the requirement.

As per 'Vision 2041', the government's plan to turn the nation into an advanced economy by 2041, Bangladesh needs to get FDI equivalent to 1.66 percent of its GDP annually.

This reveals that the nation, which has registered around 6 percent annual economic growth over the past two decades, is failing to create enthusiasm among foreign investors despite taking several steps.

Numerous economic zones were established and the authorities framed a law to provide fast services through one-stop services over the past decade and a half. But the level of FDI did not grow as expected.

This ultimately begs the question: What's wrong? Why does a $450 billion economy fail to get the desired amount of foreign investment?

One of the major problems is that facilities at the port for handling cargoes and containers, alongside transport and logistic facilities, are not up to the mark, lagging behind facilities developed by Bangladesh's competitors in South Asia.

Foreign investors assess the facilities before making any investment decision.

Another issue is regarding policy design.

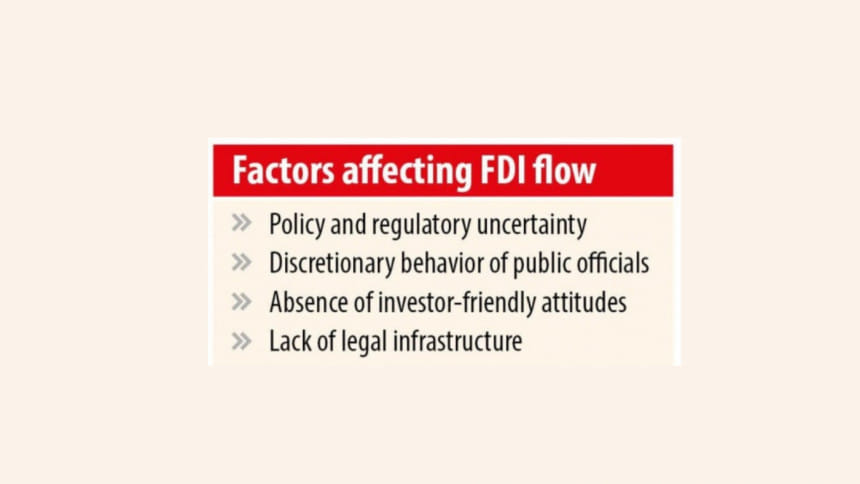

"Policy and regulatory uncertainties are a big factor discouraging foreign investors. The policies may be good, although I would say there are still gaps in different places," said Syed Akhtar Mahmood, former lead private sector specialist at the World Bank Group.

"We still have a lot of discretionary behaviour when it comes to treating foreign investors, which creates different kinds of uncertainties for the investors," added Mahmood, who has three decades of experience in advising the government on investment climate reforms including FDI attraction.

"It is not enough to have good policies only on paper," he said.

According to him, the real test is how they are implemented. Implementation deficiencies, such as too many ad-hoc or discretionary decisions, create uncertainty and discourage foreign investors.

"We must remember that foreign investors have many choices. If they don't find us attractive, they can easily go elsewhere," Mahmood added.

M Masrur Reaz, chief executive officer of Policy Exchange Bangladesh, said frequently changing policies jeopardises predictability, affecting investors' decisions.

There are also unnecessary delays in regulatory decisions, often using tired excuses, to take undue benefit.

"Bangladesh has the intention to attract FDI but the proper environment is yet to be created for that. Port and transport facilities are still lacking, regulatory problems and bureaucratic hurdles remain," he said.

Besides, the Maldives and Sri Lanka have prepared their policy focusing on specific areas and formulating effective laws for safeguarding FDI and repatriation of profit.

They have done everything. For example, Maldives focused on the tourism sector while Sri Lanka focused on tourism, agriculture, and information technology.

"But Bangladesh faces infrastructure constraints, including inadequate transportation, energy, and telecommunication facilities. These deficiencies can deter potential investors," Reaz added.

A top official of a multinational company in Bangladesh, seeking anonymity, said treatment and attitudes toward foreign investors by public officials is important.

"There is a lack of investor-friendly attitude," he said, adding that there is no central depository so that a prospective foreign investor can get all the required information and support without hassle.

Investors also face problems repatriating their profits, he said.

For a long time, foreign investors operating in Bangladesh have been demanding consistent and predictable tax rules and measures against the backdrop of regular changes in the tax rules.

They have also urged for the framing of investment-friendly tax policies.

In a publication, titled "Catalyzing Greater FDI for Vision 2041", the Foreign Investors Chamber of Commerce and Industry (FICCI) in November last year said trade logistics and infrastructure, investment policy and business regulations, including investor aftercare, productivity, and lack of depth in the financial market and tax environment had been hindering FDI in Bangladesh.

"Tax policies play a significant role in FDI decisions. The investment climate in Bangladesh faces several tax-related challenges. Bangladesh's tax system has major gaps when compared to international tax principles," it said.

"Empirical analysis confirms both tax revenue and FDI would likely increase if the tax environment is made more conducive," the FICCI added.

Rupali Chowdhury, a former president of FICCI, said there is a dearth of legal infrastructure, which is a major obstacle to attracting foreign investors.

Referring to a study by FICCI, Chowdhury said there is potential to attract FDI in agriculture, information technology, and the food processing sector. But the government needs to be prepared with the necessary legal and policy framework to realise the FDI.

She said there is no need to spend huge amounts of public money to create so many economic zones, adding they should be handed over to the private sector.

Private economic zones have already received FDI. But it is slow in public zones due to a lack of necessary utility services and required policies, she noted.

Mohammed Amirul Haque, managing director of Premier Cement Mills PLC, cited bureaucratic complexity and lack of stable policies for discouraging FDI.

Besides, inefficient port handling and complicated customs procedures lead to slower clearance of raw materials, which are hassles investors do not face in Maldives and Sri Lanka.

Haque emphasised following ethics and good governance with effective policies, keeping in mind the country's image. Then, FDI will increase overnight like in Vietnam, he said.

Mahmood suggested four points to reach the expected level of FDI.

Firstly, the government should ensure it is not carrying out policy or regulatory actions in a way that creates uncertainty.

Secondly, plans must be strategic. For example, if the plan is to diversify exports and attract investment into sophisticated sectors, sectors that may be attractive to foreign investors should be identified and investors who may be willing to invest in these areas should be targeted.

Thirdly, the progress made by investors who have shown some interest in investing in Bangladesh must be tracked. And finally, investors who are already here must be taken better care of.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments