External deficit falls to three-year low

Bangladesh's overall external deficit nearly halved in fiscal year (FY) 2023-24, hitting the lowest mark in three years, a positive development which is expected to ease the pressure on forex reserves and reduce exchange rate volatility.

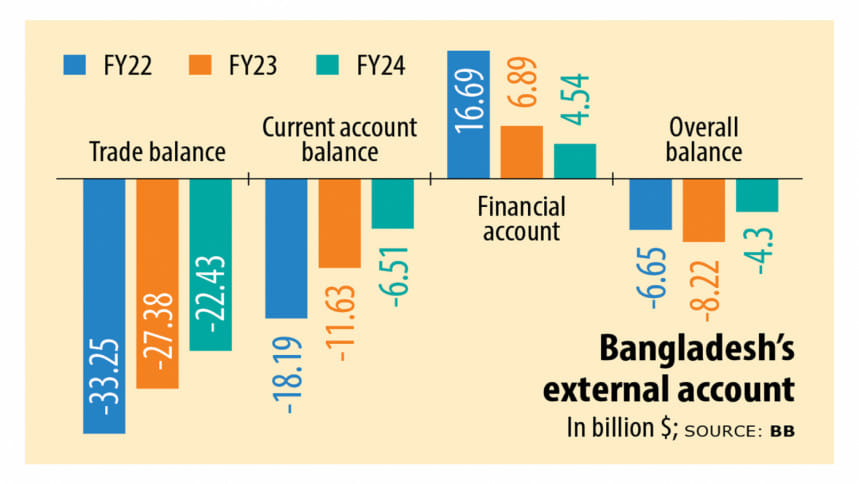

At the end of FY24, the overall external deficit stood at $4.3 billion, down 48 percent year-on-year from $8.2 billion a year ago, according to Bangladesh Bank data on the Balance of Payments, which records a country's transactions with the rest of the world.

The current account balance, which includes inflows and outflows to and from a country through exports, imports, interest payments and remittances, also improved in FY24, which ended on June 30.

The BB said the current account deficit narrowed to $6.5 billion in FY24 from $11.6 billion a year ago, reflecting a 44 percent year-on-year fall.

Trade imbalance declined 18 percent year-on-year to $22.4 billion in FY24 despite a fall in export earnings. This was because import contractions helped to cut the deficit.

"Overall, this is a positive development," said Monzur Hossain, research director of the Bangladesh Institute of Development Studies (BIDS).

He said the reduction in the overall deficit may foster stability in the exchange rates, adding that the pressure on foreign exchange reserves will also reduce.

"At the same time, the concerning aspect is that stability is coming at the cost of imports," Hossain said, adding that this would have implications on industries and consumption.

Amid consistent shortfalls of foreign exchange and declining forex reserves, the central bank, on various occasions since 2022, has discouraged imports of non-essential or luxury items.

"It would be good to relax imports once the exchange rate stabilises," said Hossain.

Md Deen Islam, an associate professor of economics at the University of Dhaka, said the fact that the deficit was narrowing in the overall balance of payments in the FY24 marked a significant improvement.

Another positive is that foreign direct investment has also seen a slight uptick.

"These positive developments are largely attributed to the perception of increased stability following the January 2024 elections," Islam said.

"However, whether this trend will continue depends on the interim government's performance and the confidence of the public, particularly the business community, in its ability to govern effectively."

Despite these improvements, he said, some concerning trends have emerged.

"Both exports and imports have been declining over the past few fiscal years," he cautioned.

Furthermore, in FY24, the surplus in the financial account decreased by more than $2 billion.

"However, with changes to the administration and a focus on greater transparency and accountability, it is anticipated that more foreign assistance will follow, along with an increase in remittances, potentially improving the overall balance further in FY25 and beyond," Islam concluded.

Ashikur Rahman, a senior economist at the Policy Research Institute of Bangladesh, said a reduction in the external account's overall deficit was expected.

This is because the central bank has allowed a market-based interest rate and sharp depreciation of the local currency, the taka, following the introduction of the crawling peg in the first half of this calendar year.

"As a result of lifting the curbs, interest rates were allowed to become market based. The impact of that is being seen in the financial account. Funds are flowing in," he said

"There were fears related to the exchange rate. Now, it is likely to be stable in the coming months. But we need some additional external financing for full currency stabilisation."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments