External debt doubles in seven years

Bangladesh's external debt soared to $103 billion by the end of December 2024, doubling from $51 billion in fiscal year (FY) 2016–17, as the sharp increase in borrowing coincided with a rapid expansion of the economy.

During the period, the country's gross domestic product (GDP) grew from $223 billion in FY17 to $450 billion in FY24, show the latest figures of the Bangladesh Bureau of Statistics (BBS).

Despite the rise in debt, the debt-to-GDP ratio remained almost unchanged, edging down slightly from 22.9 percent in FY17 to 22.8 percent in FY24.

Economists say this stability suggests that strong economic growth has effectively absorbed the additional debt, keeping the overall burden in check.

According to them, the debt doubling reflects a period of aggressive borrowing, largely to fund infrastructure and energy projects.

"While such investments can support long-term growth, the pace of debt accumulation, against a backdrop of global interest rate hikes and weakening foreign exchange reserves, raises questions about sustainability," said Professor Selim Raihan, an economics professor at Dhaka University and also the executive director of the South Asian Network on Economic Modeling (Sanem).

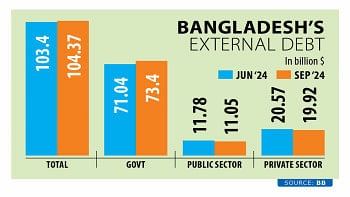

The central bank's latest report also shows a shift in borrowing patterns. While the government continues to account for the majority of external debt, which is around $84 billion, the private sector's share has grown to $19 billion.

Public sector borrowing rose 6.3 percent year-on-year by December 2024, continuing a trend that began in 2020. Private sector debt also climbed 5.3 percent over the same period.

During the 2020-2024 period, both the public and private sectors had sustained demand for external financing.

Ashikur Rahman, principal economist at the Policy Research Institute of Bangladesh (PRI), said that external debt stood at just $20 billion in FY2009–10.

"Bangladesh borrowed heavily when global interest rates were low, using the funds mainly for infrastructure," he said.

"Private firms also benefited from low-cost loans. But now, with interest rates rising and concessional options disappearing, we should tread more carefully, even if debt risk remains moderate," added Rahman.

The economist said the country is still within a safe zone, with external debt repayments amounting to 5.5 percent of combined export and remittance receipts.

"But if borrowing continues at this pace, the margin for safety will shrink," he commented.

Selim Raihan also echoed similar views.

He said, "Much of the new debt has yet to yield visible economic returns, and Bangladesh's narrow export base, dominated by garments, limits its ability to generate the foreign exchange needed for debt servicing."

He said that the key challenge now is to ensure that future borrowing is more strategic, with clear economic returns and improved governance.

While the country's debt-to-GDP ratio remains within comfort levels, the debt-service-to-exports ratio has climbed to 13.9 percent, underscoring growing repayment pressures.

Bangladesh is also shifting away from concessional loans, exposing it to increased volatility in global financial markets, especially if interest rates rise further or the local currency Taka weakens.

Interest payments on foreign loans are projected to rise 65 percent by 2027, driven by higher global rates and an expanding loan portfolio.

A finance ministry report estimates these payments will hit $2.21 billion (around Tk 26,000 crore) by then. The taka has already lost 35 percent of its value against the US dollar in the past two years.

Private firms, especially in textiles, telecoms, and pharmaceuticals, have tapped into foreign credit under relaxed borrowing rules. But with rising global uncertainty and currency risks, economists caution against overexposure.

Raihan said that strengthening debt transparency, enhancing domestic revenue mobilisation, and diversifying exports will be critical to avoid a potential debt trap and maintain macroeconomic stability.

"As the country graduates from LDC status, concessional financing will decline, making external borrowing more expensive and potentially riskier," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments