Bourses learnt a lesson: all-out digitalisation is a must

The Covid-19 outbreak has showed clearly how poorly Bangladesh's stock market was digitally prepared to fight a pandemic like this.

The Dhaka and Chattogram stock exchanges had to pay the price of not having a functioning digital platform to settle trades online during the pandemic and keep their doors closed for a record of 66 days.

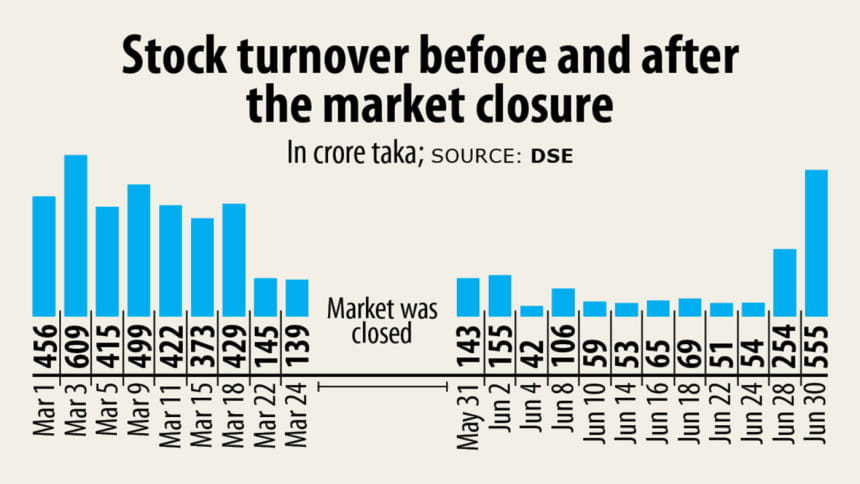

The shutdown ate up a major portion of revenue of the bourses at a time when they had been struggling hard to survive because of a continuous fall in turnovers.

The last time the country's stock market was shut down for such a long period was back in 1969, when the then East Pakistan was embroiled in a mass uprising ahead of the Liberation War. The market later reopened in 1976.

Even, Bangladesh's stock market was the only one in the world to remain closed for over two months due to the pandemic. Only Jordan and Sri Lanka stopped trading for a few days while others kept capital markets open as usual.

"It was not possible to settle a trade without the physical assistance of a trader. So both the bourses were bound to stop trading during the outbreak," said a director of the Dhaka Stock Exchange (DSE) preferring anonymity.

After remaining closed for a few days, banks were given go-ahead to open their doors during the two-month lockdown.

But, the government did not allow stock market officials and traders to go to their office, he said.

"It hurt the local investors, as majority of them were not accustomed to do online trading and were dependent on traders to execute any trade."

Their dependency is clearly evident from a data of the DSE and the Central Depository Bangladesh, which shows only 2 per cent of all beneficiary owner's accounts are registered for online trading.

After experiencing the bitter aftertaste of a closure, Bangladesh Securities and Exchange Commission (BSEC) ordered authorities concerned to go for digitisation of every market-related activity.

BSEC Chairman Professor Shibli Rubayat Ul Islam also announced that the trading platform for stocks will soon be completely automated to enable the bourses continue running their activities without the physical presence of any people.

The stock market watchdog has also allowed listed companies to submit their reports and hold annual general meetings online.

Now, the DSE is forming a company to ease the trade settlement process to comply with the regulatory instruction to automate its IT platform, said a top DSE official.

The new company, Central Counterparty Bangladesh Ltd, will be added to DSE's operations to handle digital share trading, the official said.

The BSEC has already approved Abdus Salam Sikder as the company's chairman along with appointing a few directors.

"For revenue, stock brokers mostly depend on brokerage charges. So they were earning almost nothing during the closure," said Rahmat Pasha, chief executive officer of UCB Capital.

Share trading is a two-pronged system: share transfer and money transfer, he said.

The Central Depository Bangladesh executes share transfers while money transfers are handled by a department of the DSE, he said.

The money transfer process is mostly manual, so brokers fell in hot water when trading stopped, Pasha said.

The prolonged closure also had a negative impact on the global image of the domestic stock market, he added.

The DSE already has a platform that facilitates real-time trading of shares from mobile devices or a computer from anywhere in the world.

However, the country's premier bourse is yet to be integrated into a unified system with the platform, which is why it has to depend on manual labour to complete trade settlements and other similar tasks, he added.

"We are working on the issue and the BSEC will appoint a strategic person to complete the entire digitalisation process, said Asif Ibrahim, chairman of Chattogram Stock Exchange.

The digitisation process will become easier as soon as the Central Counterparty Bangladesh starts operations in full swing, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments