Banks should make performance data available to clients: analysts

Banks and non-bank financial institutions (NBFIs) should make their data available for clients such that they can verify the performance of every lender, analysts said today.

Weak lenders are showing reluctance to provide their financial data to clients, which is not a good practice at all, they said.

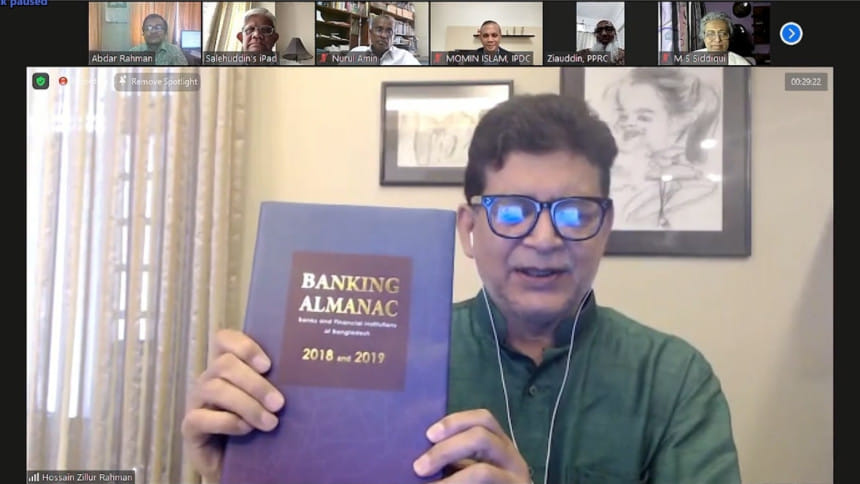

They came up with the remarks at a webinar to mark the launch the third edition of "Banking Almanac: Banks and Financial Institutions of Bangladesh 2018 and 2019".

The banking almanac on Bangladesh banks and financial institutions has been compiled and published since 2016.

The almanac is a research project of the weekly Shikkha Bichitra.

Transparency was highly important for the banking sector as it usually plays a vital role in keeping the economic wheels of the country turning, said Hossain Zillur Rahman, a former adviser to a caretaker government.

There are many dimensions of the corporate governance and one of them is to ensure available financial data for the commoners, he said.

Many lenders typically show less interest in providing their data to the common people, Rahman said.

But, the almanac will help the individuals, both local and foreign investors and researchers know the actual picture of respective lenders in the country.

In addition, the book will also create pressure on banks and NBFIs to release their data accurately, he said.

Salehuddin Ahmed, a former Bangladesh Bank governor, chaired the event.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments