Asset managers crying out for funds

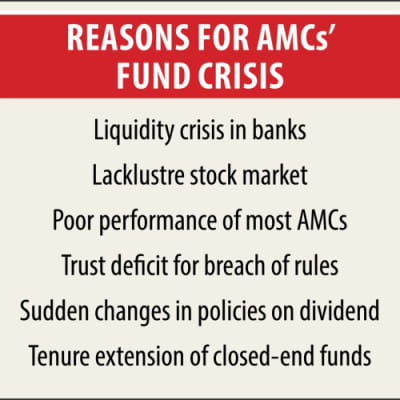

As many as 39 percent of the asset management companies (AMCs) are failing to attract funds from investors thanks to thinning confidence on fund managers and the stock market.

The AMCs form mutual funds by attracting money from individuals and corporate investors to put them in stocks, bonds and other assets.

Individuals are drawn to the AMCs because, worldwide, they are the experts at making well-timed investment decisions on behalf of their clients and at providing healthy dividends.

But investors’ experience is not that sweet in Bangladesh as most of the AMCs here have displayed below-par performance, which analysts say took a toll on investor confidence.

There are 44 AMCs in Bangladesh, of which 17 could not form or sustain mutual funds. Some of them have been showcasing this lacklustre performance since their inception five to nine years back.

One of the reasons being the AMCs’ sub-par performance when compared with their peers around the world, said Abu Ahmed, former chairman of the economics department at the University of Dhaka.

The bad performance of some asset managers made it hard for newcomers to get funds.

Another reason why investors do not want to pour their money is because some of the AMCs gave returns on units (stock dividend) and deprived unitholders of cash dividend.

As most of the mutual fund units are trading at prices well below their face value, the returns on each unit was low, which ultimately brought down profits for unitholders, Ahmed added.

Only four listed mutual funds out of a total of 37 are trading at prices exceeding their face value, according to data from the Dhaka Stock Exchange.

Investors’ experience was not that good as some of the AMCs invested people’s money in places not permitted by the law, said Mizanur Rahman, professor at the University of Dhaka’s department of accounting & information systems.

In March 2015, a regulatory probe of the Bangladesh Securities and Exchange Commission (BSEC) unearthed a number of gross violations of securities rules and misappropriation of cash by six mutual funds managed by LR Global Bangladesh.

“This is how a deficit of trust has been created,” Rahman said.

Despite such a situation plaguing the AMCs, the regulator gave out 11 more licences since 2018.

Of the 17 AMCs that failed to get funds, Invest Asia Capital Asset Management and Alif Asset Management Company got their licences in 2009.

The former failed to form any mutual fund in the past 10 years, while the latter did manage to form one but later saw unitholders withdraw their investments citing substandard performance.

Some of the AMCs were not finding funds due to liquidity problems in the banking sector, said Sk Shibly Sadik, coordinator of the Association of Asset Management Companies and Mutual Funds.

A top official of Alif Asset Management Company upon condition of anonymity acknowledged their failure with mutual funds.

“The event precipitated a change in management.”

The current management is trying to attract investment and planning to launch an open-ended fund very soon.

On not getting funds, the official blamed a lack of knowledge among investors about mutual funds and low confidence on the stock market.

No web address was found of Invest Asia Capital Asset Management. The telephone number it provided to the BSEC was found switched off for long.

Ahmed suggested three steps for the regulator to win back investor confidence.

The first is repealing the tenure extension of closed-end mutual funds. The second is stopping returns on unit and allowing cash dividends only.

The third is allowing asset managers to get commissions based on their performance and not on the fund amount.

Currently, the managers can get a maximum of 2.5 percent of the fund as their yearly commission fee, irrespective of their performance.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments