Airfreight in a downspin due to lower trade

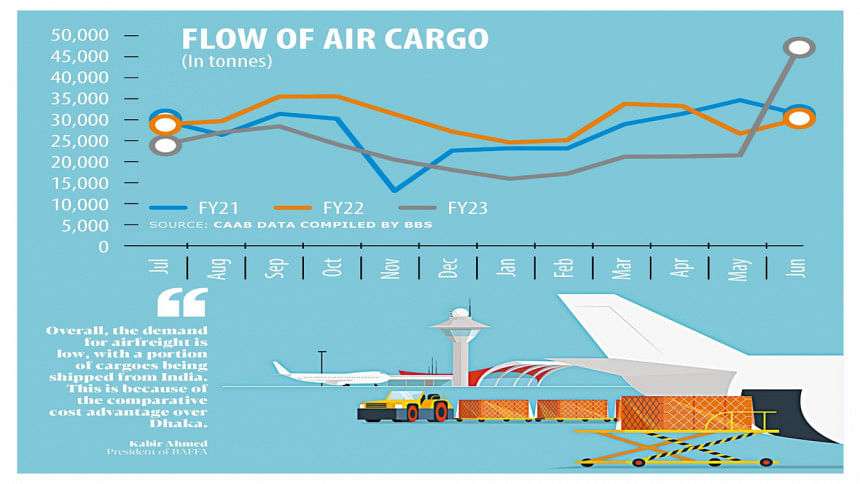

Freight movement through airports in Bangladesh fell to a four-year low last fiscal year (FY) as airlines slashed their capacity for carrying import-export cargo amid reduced demand, according to official data.

About 2.85 lakh tonnes of cargo were shipped by air in FY23, down by some 21 percent year-on-year, as per the latest data of the Civil Aviation Authority of Bangladesh.

However, it is expected that demand for airfreight will pick up from April next year, said Sheikh Idrish Ali, managing director of Soul Aviation, a local general sales agent of the US-based National Airlines.

More than 30 airlines operate cargo flights to and from the country, with about 96 percent of the overall airfreight in FY23 having been handled by the Hazrat Shahjalal International Airport in Dhaka.

Officials of the local aviation industry said the reduced airfreight is a result of lower imports.

On a yearly basis, exports grew 6.67 percent while imports fell 16 percent in FY23 due to reduced demand in the EU and US resulting from inflationary pressure.

Besides, the ongoing US dollar crisis is causing difficulties in opening letters of credit for importing raw materials, leading to a slump in export growth.

The slump in imports has continued this year too, with inbound shipments to the country having slumped 24 percent year-on-year to $14.74 billion in the first quarter of the current fiscal.

On the other hand, export rose 3.5 percent year-on-year to $17.47 billion in the July-October period.

The downturn in airfreight was also exacerbated by the diversion of a portion of export cargoes to the airport in India's Delhi, said Bangladesh Freight Forwarders Association (BAFFA) President Kabir Ahmed.

"Overall, the demand for airfreight is low, with a portion of cargoes being shipped from India. This is because of the comparative cost advantage over Dhaka," he added.

On average, firms can save 20-25 cents per kilogramme when shipping goods from Delhi airport thanks to lower ground handling and transport costs, which are higher in Dhaka.

"So, the civil aviation authority needs to work on this," Ahmed said.

A senior official of Biman Bangladesh Airlines said some foreign airlines had increased their cargo carrying capacity in order to narrow the losses stemming from a dip in passenger movement during the Covid-19 pandemic.

"But as the passenger flow is recovering with increased air traffic, they have cut their cargo capacity," he added.

A top official of a foreign carrier that handles a good amount of the country's import-export cargo, said airfreight is viable unless the flow of import and export are sound.

"Only having sufficient export is not viable," he added.

The official also said that air transport has not been robust this year as businesses are being badly affected by the ongoing political crisis and recent unrest in the garment sector.

"We had good business in the August-September period though," he added.

Mohammed Monsur, general secretary of the Bangladesh Fruits Vegetables & Allied Products Exporters' Association, said air shipment is the only option for fresh fruits and vegetables.

The sector's shipment volume had fallen to 52,000 tonnes in FY23, down 24 percent year-on-year.

However, exports in the July-October period of FY24 stood at 42,000 tonnes.

"We were able to export a higher quantity of mango," said Monsur.

"Exports would grow if the related process is eased and we get support from customs, Bangladesh Bank and the plant quarantine wing of the Department of Agricultural Extension," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments