6 reasons stocks may rise in 2019

In 2018 stock market investors lost a good sum due to liquidity crisis, rising nonperforming loans in the banking sector and political tension centring on the national election.

On December 17, DSEX, the benchmark index of the Dhaka Stock Exchange, sank to 5,218 points from 6,280 points at the beginning of last year in spite of the peaceful political situation in the country.

Consequently, investors lost Tk 45,813 crore.

That was not abnormal considering the factors that can move the stock market.

The factors include: domestic and geopolitical events, economic data, and market sentiment. Supply and demand of stocks also cause the market to move either direction.

The fear of political instability is now over and analysts and investors are hoping the market will bounce back strongly in 2019. However, they urged the government to take steps to bring in new quality stocks to meet the expected demand this year.

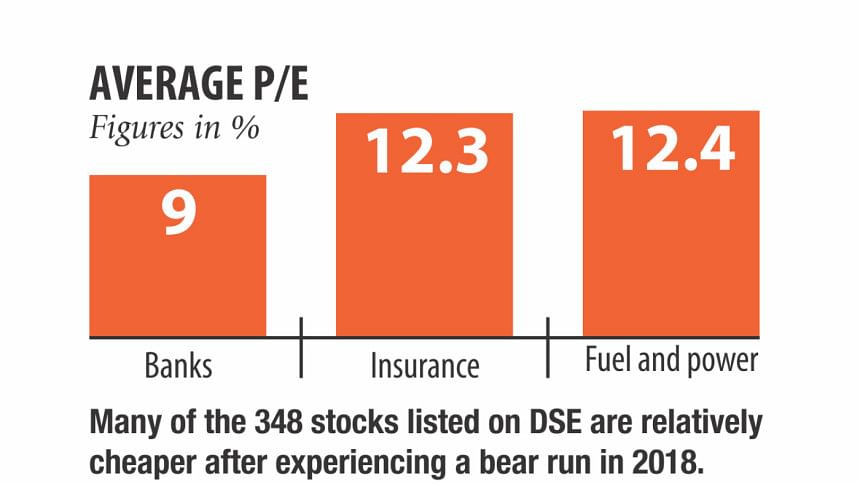

Many stocks, including banks and pharmaceuticals, are underpriced now, said AB Mirza Azizul Islam, former chairman of the Bangladesh Securities and Exchange Commission.

AB Mirza Azizul Islam

former chairman of BSEC

The stock market is under-priced now. The index may cross 6,500 points without any concern. But there must be quality stocks.

Faruq Ahmed Siddiqi

former chairman of BSEC

Foreign and institutional investors' participation declined last year. Now good stocks have become lucrative. There is hardly any chance that the index may go down this year.

Prof Mohammad Musa

dean of the school of business and economics of United International University

The market will climb up in 2019 if the economy remains stable. Banking and pharma-ceuticals have a space to grow.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments