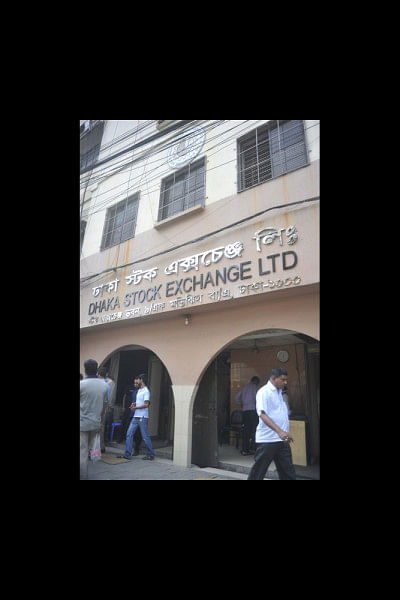

Technical breakdown disrupts stock trade

A technical breakdown halted trade on Dhaka Stock Exchange for an hour and a half yesterday, while the regulator served notice on the premier bourse, seeking an explanation.

The bourse will have to submit a report today, according to Arif Khan, a commissioner of Bangladesh Securities and Exchange Commission. "The commission will take a

decision on Tuesday after reviewing the report."

Trade began at noon, an hour and a half behind schedule, and continued until 4pm. Trade usually takes place between 10:30am and 2:30pm.

The problems came to the surface after the TREC (trading right entitlement certificate) holders failed to log into the bourse's main trading server within the stipulated time.

The TREC holders, commonly known as stockbrokers, usually log in between 9:30am and 10:25am.

Officials said they were yet to identify the cause of the problem.

"Work is in progress to identify, isolate, and rectify the issue," the DSE said in a statement.

The incident once again exposed flaws in the automated trading system, which was introduced in December last year to ensure smooth trade.

The DSE introduced the systems in two segments at a total cost of around Tk 35 crore. NASDAQ OMX, a leading provider of trading and exchange technology, supplied the matching engine, while FlexTrade Systems, a global leader in broker-neutral trading platforms, provided the order management system at the brokers' end.

The post of chief technical officer at the Dhaka bourse has also remained vacant a year and a half; the bourse authorities are running the IT department with junior executives.

In May, trade was disrupted for two days. A technical breakdown also halted trade on the DSE for less than two hours on August 12.

After yesterday's incident, many stockbrokers reiterated their dissatisfaction and said the DSE management does not have enough capacity to maintain the trading machines.

"Either the systems are not compatible for us, or the bourse management does not have the capacity to run these," said a stockbroker seeking anonymity.

A DSE official also said they did not get enough time to absorb the system. "Before official introduction, we needed trial operations for atleast six months, but we did not get it."

Stocks closed higher with the DSEX, the benchmark general index of the DSE, increasing 65.18 points or 1.43 percent, finishing the first day of the week at 4,596.81 points.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments