FDI still below par

The inflow of foreign direct investment, which is critical to a country's infrastructure development, has not been increasing despite good incentives being offered by Bangladesh to investors from abroad.

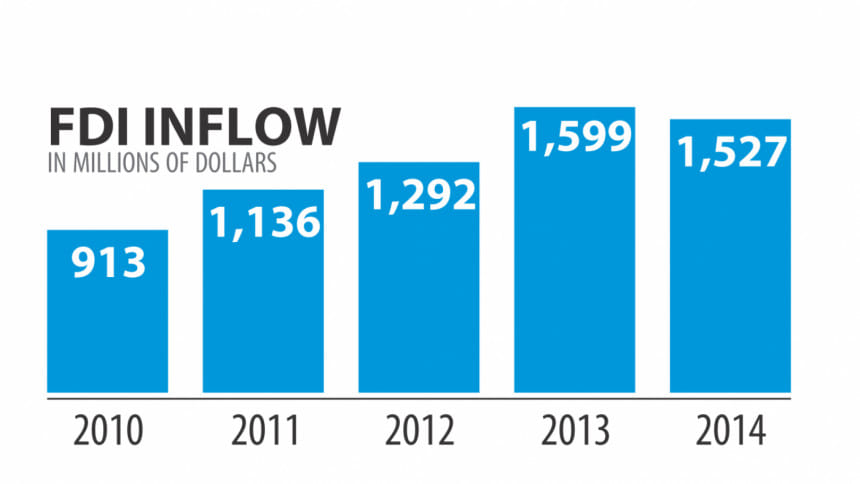

The country received FDI worth $1.6 billion or slightly more than 1 percent of its gross domestic product in 2013, according to Bangladesh Bank data.

In 2014, FDI went down to $1.52 billion, which was less than 1 percent of the GDP worth $170 billion.

On the other hand, FDI inflow to Vietnam, China and India was 6 percent, 5 percent and 3.5 percent of their GDP respectively in 2013. Even land locked Bhutan received FDI equivalent to 1.12 percent of its GDP in 2013, according to the World Bank.

The average worldwide FDI as a percentage of GDP was 4.72 percent in 2013. The highest value was in Hong Kong with 27.97 percent of its GDP. Typically, FDI worth 2-3 percent of GDP comes into a developing country and if a country routinely receives FDI that exceeds 5-6 percent of its GDP each year, then it is a significant success.

“Setting up special economic zones (SEZs) has become very important for Bangladesh to meet the foreign investors' demand for land. The government should allocate funds in the budget to develop these zones as soon as possible,” said Prof Mustafizur Rahman, executive director of the Centre for Policy Dialogue.

Rahman said China, India and Vietnam have developed hundreds of SEZs, also known as industrial parks, to accommodate both foreign and local investors. The move has brought a huge amount of FDI into these countries.

“Unfortunately, Bangladesh has failed to formulate rules to operate the SEZs even after four years of the enactment of a law in 2012,” said Ahsan H Mansur, executive director of Policy Research Institute.

Mansur, also a former senior official of the International Monetary Fund, criticised the government for its lacklustre attitude towards removing the land-related complexity with Korean Export Processing Zone.

This has kept some potential foreign investors, including Samsung, at bay.

“We have to change our mindset,” he said. “You cannot want back the land you give to a foreign investor. This doesn't give a good signal to other foreign investors.”

Analysts have identified a number of reasons behind a poor inflow of FDI to Bangladesh. These include a scarcity of land, infrastructure, gas and electricity; a delay in giving services; uncertainty in policy continuation; unclear dispute settlement, and unexpected delay in formulating rules and regulation of the SEZ law.

They said if Bangladesh cannot address these constraints, it will not get the expected FDI even by offering tax benefits.

Bangladesh offers competitive fiscal and non-fiscal incentives to foreign investors. The investors enjoy remittance of royalty, technical know-how and technical assistance fees, repatriation facility of dividend and capital at exit, tax holiday, depreciation allowances, duty-free import of machinery and spares, bonded warehousing, and cash incentives against exports.

Permanent residency is given on investing a mere $75,000 and citizenship on $500,000. Moreover, Bangladesh has opened almost all its sectors -- be it manufacturing, farm or services -- for foreign investment.

Foreign investors face an unexpected delay in knowing a government decision, said MA Hamid Sharif, an importer of Japanese reconditioned cars. Around 6,000 Japanese companies want to relocate their factories in Bangladesh due to a rise in production cost there, he added.

“Officials of many of these factories visited Bangladesh and have been in talks with the government since 2012, seeking an SEZ of 60-150 acres. But they are yet to get the land,” said Sharif, who had lived in Japan for more than three decades.

Mansur of the PRI pointed out another vital issue -- foreign investment in the garment and textile sectors. Though Bangladesh has allowed FDI in the sectors, foreign investors face strict opposition from the domestic apparel makers.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments