Stocks up despite weak economic data

The stock markets rose yesterday on the back of a regulator's decision to allow investors to buy shares on the same day a cheque is deposited with brokerage houses and fresh bets from some big individual investors despite weaker remittance and export data.

On Tuesday, Bangladesh Bank data showed that remittance inflow declined 7.4 per cent year-on-year to $1.52 billion in October, the lowest in eight months.

And the Export Promotion Bureau yesterday said foreign sales declined 7.85 per cent to $4.35 billion last month.

Higher remittance and export earnings are crucial for Bangladesh in its attempt to fight off the impacts of the global crisis and the volatility in the foreign exchange market, which have pushed up the imports of the country, driving down foreign currency reserves and driving up inflation.

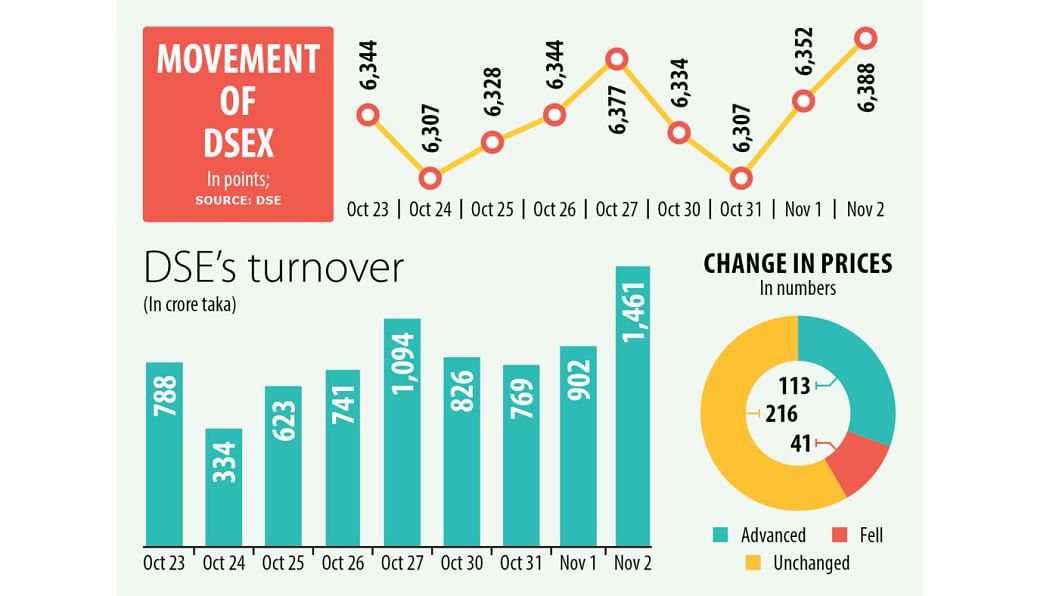

Despite the weak export and remittance data, the DSEX, the benchmark index of the Dhaka Stock Exchange (DSE), rose 35 points, or 0.56 per cent, to 6,388.

The DS30, the blue-chip index, was up 0.37 per cent to 2,244 while the DSES, the index that represents shariah-based companies, advanced 0.68 per cent to 1,399.

On the DSE, 113 securities advanced, 41 declined, and 216 did not see any movement. Turnover, one of the important indicators of the market, surged 61 per cent to Tk 1,461 crore.

The stocks on the DSE extended their gaining streak for the second consecutive session as investors put fresh bets on large-cap stocks amid the June-end declaration, said International Leasing Securities Ltd, a brokerage house, in its daily market review.

Buying pressures of the investors pulled the prime index at the beginning of the trading session riding on the regulator's decision on the cheque encashing issue.

On Tuesday, the Bangladesh Securities and Exchange Commission revoked an order that stipulated that investors could buy shares only against funds already present in beneficiary owners' accounts.

Now, stock brokers and merchant bankers can transact securities against account payee cheques, payment orders, and demand drafts. However, merchant bankers and stock brokers would have to deposit cheques either on the day investors provide them or on the following working day.

If the cheques are dishonoured, brokers will have to transfer the fund from their bank accounts.

A stockbroker said some big individual investors also injected fresh funds into the market.

Desh General Insurance topped the gainers' list, advancing 10 per cent. Bangladesh Welding Electrodes, Lub-rref Bangladesh, Navana Pharmaceuticals, and Genex Infosys also rocketed more than 9 per cent.

JMI Syringes suffered the sharpest fall, giving up 5 per cent. Aramit Ltd, Hakkani Pulp & Paper Mills, Intraco Refueling Station, and Apex Foods were also among the major losers.

The Caspi, the all-share price index of the Chittagong Stock Exchange, gained 71 points, or 0.38 per cent, to close at 18,804.

Of the issues that traded on the bourse in the port city, 91 advanced, 29 declined, and 157 did not show any price movement.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments