Stocks bleed for 7th day

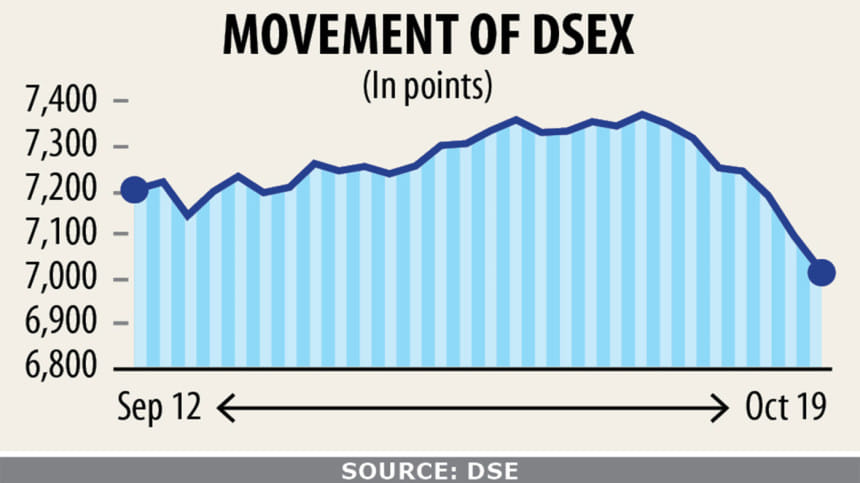

Stocks continued to bleed yesterday, the seventh consecutive trading day that the benchmark index of the Dhaka bourse witnessed a drop.

The DSEX, the benchmark index of Dhaka Stock Exchange (DSE), slid 77 points, or 1.08 per cent, to 7,020. The fall amounted to 347 points or 4.71 per cent over the seven-day period.

Stock investors are disappointed with the continuous fall while the premier bourse lost around Tk 17,566 crore in its market capitalisation.

The index can fall for profit-availing tendencies but the continuous fall is raising tensions, said stock investor Abdul Mannan.

What was depleted in just seven days had taken over a month to be gained, he said.

He questioned why investors, especially institutional investors, were not getting busy making purchases while some were selling shares to rake in profits.

Moreover, institutional investors are selling shares, so big paid-up capital-based companies are undergoing erosion the most, he added.

The DSEX's drop can be attributed to the falls of LafargeHolcim Bangladesh Limited, British American Tobacco Bangladesh, Beximco Pharmaceuticals Limited, the Investment Corporation of Bangladesh and NRB Commercial Bank Limited, said amarstock.com.

Right off the start of the day, the index fluctuated on a massive scale. It soared 89 points but ended up bleeding 77 points.

Turnover, however, rose around 21 per cent to Tk 1,682 crore, up from Tk 1,393 crore the day before.

At the DSE, 87 stocks advanced, 254 fell and 35 remained unchanged.

General investors suffered a panic attack witnessing the continuous fall while institutional investors stayed on the sidelines, so the index is in a free fall, said a stock broker.

"I think the BSEC (Bangladesh Securities and Exchange Commission) should not push the stock market so that it bounces back," he said.

"Moreover, once the index makes a comeback on its own accord, the market will be efficient. But the BSEC is already trying to stop the correction," he said.

Delta Life Insurance Company Limited topped the gainers' list, rising 9.33 per cent, followed by Sonargaon Textiles Limited, FAS Finance & Investment Limited, Fareast Islami Life Insurance Company Limited, and Padma lslami Life Insurance Limited.

Bangladesh Lamps Limited shed the most, losing 11 per cent, followed by NRB Commercial Bank Limited, HeidelbergCement Bangladesh Ltd, Rangpur Dairy & Food Products Ltd and Beach Hatchery Ltd.

Stocks of NRB Commercial Bank Limited were traded the most, worth Tk 104 crore, followed by Delta Life Insurance Company Limited, IFIC Bank Limited, Orion Pharma Limited and Fortune Shoes Limited.

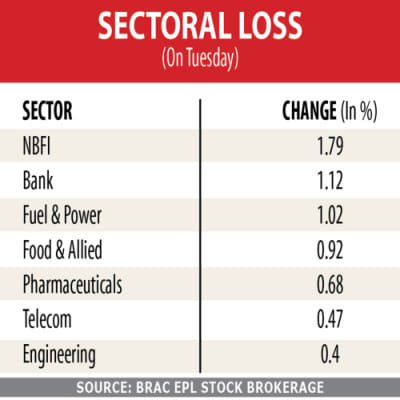

All the large-cap sectors posted a negative performance yesterday.

Non-bank financial institutions (NBFI) experienced the highest loss of 1.79 per cent followed by banks, fuel and power, food and allied, pharmaceuticals, telecommunication and engineering, according to Brac EPL Stock Brokerage Limited.

The Dhaka stocks observed another steep fall as panic-driven investors continued their sell offs, said International Leasing Securities Limited in its daily market review.

The risk-averse investors preferred the sidelines due to consecutive price corrections apprehending that the indices may decline further.

Though the market started off on a flying note after the last few sessions' price fall, heavy sales pressure of shaky investors in the second half forced the benchmark index to lose 77 points, it said.

However, some optimistic investors took up general insurance and life insurance sectors, it added.

Chittagong Stock Exchange (CSE) also dropped yesterday.

The CASPI, the general index of the port city bourse, edged down 186 points, or 0.90 per cent, to 20,521.

Among the 298 stocks to undergo trade, 79 rose, 199 fell and 20 remained unchanged.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments