Is stock market overvalued?

There is an ongoing debate in the share market whether securities on the Dhaka Stock Exchange (DSE) are overvalued as the benchmark index shows no signs of slowing down after hitting the historic high last month.

The DSEX even surged past 7,000 points for the first time on Sunday.

Many analysts say the market is not overvalued as the average price-to-earnings (PE) ratio is hovering around 20. They, however, say that some stocks have become overpriced.

PE ratios are used by investors and analysts to determine the relative value of a company's shares.

When a company's PE ratio is lower than 15, it is considered investible. If it ranges between 16 and 25, the investment decision is called moderately risky.

When it goes past 25, it is usually considered a risky bet.

Among 309 companies listed on the DSE, 27 companies have a PE ratio of more than 100. It ranges between 25 and 99 for 94 companies. There are 121 companies whose PE is lower than 25, data from DSE showed. Sixty-seven firms are in the red, so their PE ratio is not positive at all.

"In general, our stock market is not overvalued," said Faruq Ahmad Siddiqi, a former chairman of the Bangladesh Securities and Exchange Commission (BSEC).

"Many stocks are still reasonable, and most of them are good companies."

However, the market is distorted because there is price manipulation involving many stocks, particularly small companies, which are highly overvalued.

The PE ratio is not the last word in evaluating a stock. Many other criteria determine whether an issue is overvalued. However, an extremely high PE ratio indicates higher risk.

The valuation of a stock using the PE ratio might not be right all the time because it does not depict the real scenario, according to analysts.

For example, if a company incurs losses suddenly but has the potential to make profits, then the PE ratio does not work.

On the other hand, if a company makes a lot of profit from the stock market, the PE ratio would be lower. However, the stock might be risky, they said. The BSEC does not permit borrowing for a stock if its PE ratio crosses 40.

"If the policy is taken into consideration, the market is not overvalued yet as its PE ratio stands at around 20," said Prof Mohammed Helal Uddin, a professor of the economics department at the University of Dhaka.

If adjusted for inflation, the DSEX rising to 8,000 points would still be okay if it is compared with the 2007 level, the period before the 2008-09 bull-run and subsequent crash. "So, the time has not come to say the present index is overvalued," Uddin said.

"But some sectors and low paid-up capital-based stocks are overvalued. So, investors should invest after analysing them properly."

The stock market was very low when the coronavirus pandemic hit the country, so the rise of the prime index to the previous higher level should also be considered normal, he said.

"Considering the index before the pandemic, it has not surged much."

A top official of a merchant bank said the bad the company is, the higher its stock price is. "This is not a good sign."

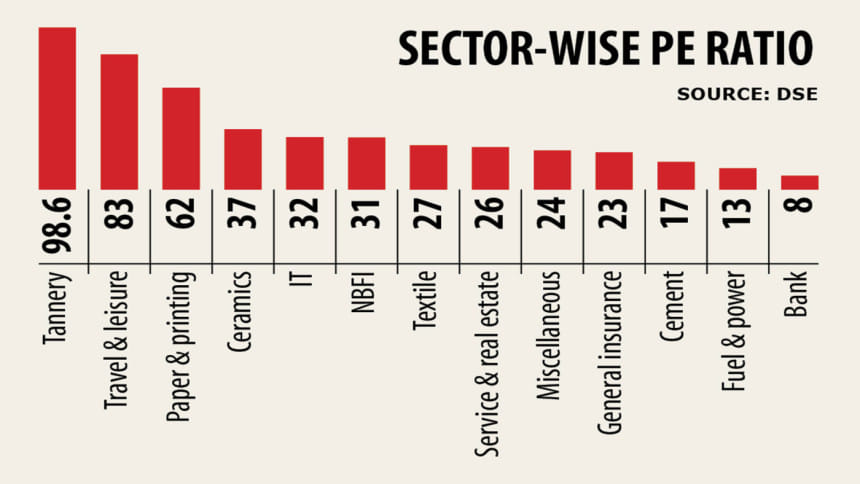

Among the sectors, the tannery sector has the highest PE ratio of 98, followed by travel and leisure at 83 and paper and printing at 62, according to UCB Stock Brokerage.

The PE ratio of banking stocks is 8, while it is 13 for the fuel and power sector and 17 for the cement sector.

"Because of the massive manipulation, the price of the low-profile stocks has gone up," the merchant banker said.

"People should be careful in choosing stocks. Otherwise, they will be the loser."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments