BB aid for stocks ends up salvaging Beximco sukuk

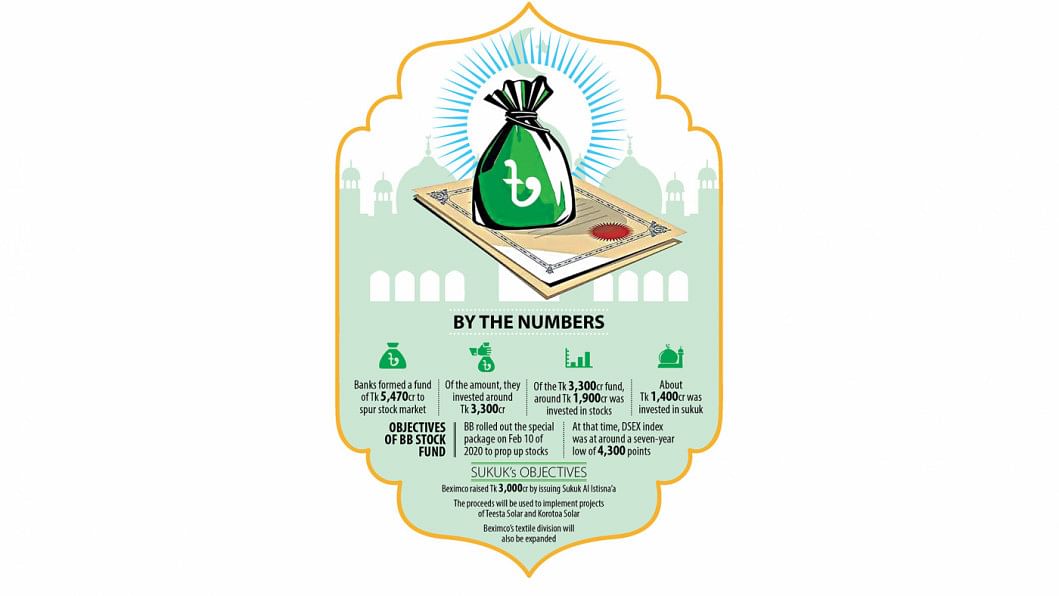

The central bank announced a special package in February 2020 to prop up the stock market as the benchmark index of the Dhaka Stock Exchange (DSE) was hovering around a seven-year low of 4,385 points.

As part of the package, scheduled banks had decided to form a fund of Tk 5,470 crore by borrowing from the central bank.

They have so far invested around Tk 3,300 crore, BB data showed. Of the sum, Tk 1,900 crore was invested in shares, and around Tk 1,400 crore was used in subscribing to the Islamic bond of Beximco Ltd.

As a result, Beximco turned out to be the ultimate beneficiary of the scheme as most banks subscribed to its Green Sukuk Al Istisna'a, thanks to the liberty extended by the Bangladesh Bank to the lenders.

As banks invested a huge amount of the fund in the sukuk instead of stocks, the main goal of the BB package was not achieved, said a top official of an asset management company, preferring anonymity.

On the other hand, banks have emerged as the key source of the fund for the sukuk though the bond was supposed to mobilise funds from the public, he said.

So, it is nothing but banks' lending through a different instrument, according to him.

The package allows banks to set up a Tk 200 crore fund each by taking it from the BB through a repurchase agreement against the Treasury bills and bonds they own.

Banks will have to pay 5 per cent interest for the fund and the credit tenure is up to February 2025.

Because of the stock market volatility, many banks were reluctant in setting up the fund and investing in equities.

Meanwhile, Beximco Ltd was trying to raise a fund worth Tk 3,000 crore through Sukuk Al Istisna'a since July last year to bankroll solar projects and expand its textile factory. Banks were not showing enthusiasm to invest in it either.

As per plan, half of the fund of the Islamic bond was supposed to be raised through private placement, Tk 750 crore from the existing shareholders of Beximco and Tk 750 crore through an initial public offering (IPO).

It managed to raise about Tk 450 crore from the existing shareholders and the IPO.

But the Bangladesh Securities Exchange Commission (BSEC) had earlier allowed the company to interchange the sukuk subscription amount between the IPO and the private placement if any of them remains undersubscribed.

The stock market regulator extended the subscription period several times.

In September, the BB allowed banks to buy private sector-issued green sukuk by using the special funds. This led banks to use the fund to subscribe to the sukuk.

Finally, Beximco raised most of the amount from banks and other institutional investors through private placement.

A top official of a listed bank says his bank subscribed to the sukuk as this is comparatively a low risk bearing instrument than shares.

"As the Bangladesh Bank has allowed us to utilise the fund to buy sukuk, we have made the investment."

Ershad Hossain, CEO of City Bank Capital, the issue manager of the sukuk, said it was the central bank's policy decision that allowed banks to invest in the bond using the special fund.

Actually, many banks had not used the fund before the sukuk was rolled out. So, banks' investment in the bond has not affected the objective of the special fund at all, he said.

As the investment in the sukuk was not included while calculating the market exposure, banks utilised the opportunity, he added.

"We offered banks that they can use the fund to invest in stocks and green sukuk. So, it is up to them where they will put their money," said Md Serajul Islam, a spokesperson of the central bank.

"The lenders have the freedom and they invest considering their safeguard."

Banks will get a minimum 9 per cent on their investment in the sukuk.

Beximco's green sukuk was traded at Tk 90.50 yesterday on the DSE. Its face value is Tk 100.

Meanwhile, the market has rocketed to record levels since the package was unveiled thanks to a rush of investors after the pandemic struck the country in March 2020 for a lack of investment opportunities amid deepening economic uncertainty and falling deposit rates at banks.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments