Price upheaval wreaks havoc on investors

Prices of newly listed companies continue to rise abnormally on the Dhaka Stock Exchange without any apparent reason, which experts said may eat up general investors' money.

Even the regulator's restriction for 30 days on margin loan for buying new shares has failed to rein in the unusual rise in new share prices.

Analysts said a group of large scale investors, mostly institutional, such as merchant banks, asset management companies, mutual funds, stock dealers, banks, financial institutions, and insurance companies play up with these shares spreading rumors till they sell off their shares.

And, they have a reason: institutional investors cannot offload their entire holdings on the first day of the trading of a stock.

These investors are allowed to sell 50 percent of their shares of a stock on the first trading day. Then they have to wait six months to sell another 25 percent and then another three months to sell the rest.

"This is one kind of manipulation and it is maintained until eligible shareholders find the selling price attractive enough to get rid of their shares," said Abu Ahmed, a former chairman of the economics department of Dhaka University.

According to the professor, sponsors might be involved behind this manipulation.

"Sponsors of a company may be linked with this manipulation to sell their (eligible investors) shares at a higher price," he said.

DSE data showed most of the companies that made debut in 2017 and so far this year saw their shares rise abnormally.

These shares remained overvalued in the first few months following the debut before a major correction took place, dealing a blow to general investors because eligible investors get rid of their holdings when the prices are high.

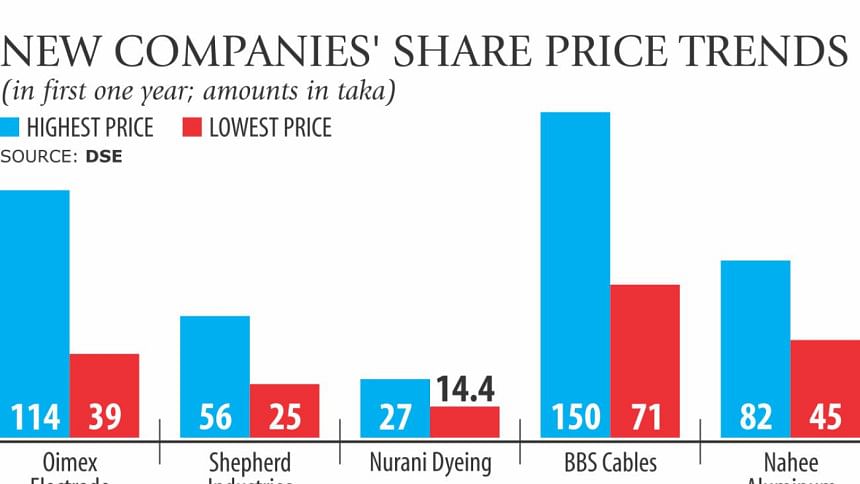

For instance, Oimex Electrode was listed on the bourse on November 6 and its shares soared to Tk 114 in the first month. Later, it shed 65 percent within six months to Tk 39.

Similarly, Shepherd Industries' shares soared to Tk 55.40 in the first few days following its debut. It lost 55 percent and came down to Tk 25 within a year. Nurani Dyeing rose to Tk 27 within one month and a half but nosedived to Tk 14.40, a 48 percent fall.

BBS Cables also advanced to Tk 150 before shedding 52.66 percent to Tk 71, while Nahee Aluminum rose to Tk 81.60 before losing 45.12 percent to Tk 45.

The shares of the companies that went public this year were also found to be overvalued. For example, Queen South Textile Mills was listed at a face value of Tk 10 on March 13. Within three months, it soared more than five times to Tk 56.90, DSE data showed.

Advent Pharma's shares advanced to Tk 45 within a quarter following its debut on April 12 with the face value of Tk 10.

Listed on May 17, Intraco Refueling Station's shares reached Tk 55.80 within a month. Shakil Rizvi, a former president of the DSE, blamed the limited IPOs and the low number shares they offer to the public for the unusual hike in prices of newly listed companies.

"As general investors rush to the new stocks, big players get chance to play with these shares," he said. Khairul Bashar Abu Taher Mohammed, secretary general of the Bangladesh Merchant Bankers Association, agreed that some big investors may have been involved in the manipulation. "It's true that some players do the manipulation."

As the general investors lack knowledge and look for quick profits, they pour money in the new shares without understanding the market, Mohammed said.

Every foreign investor invests in a newly listed stock after watching it for at least a year, in order to realise its true picture of earnings, he said. "I don't understand why the general investors don't want to observe. Why do they buy stocks soon after their debuts?" he asked. A managing director of a merchant bank said:

"When a company itself does not believe that it can get more price than the face value, why are people buying these stocks at such a higher price?"

He said general investors should be careful about their investment because the shares of these companies do not reflect their true earnings.

According to the DSE, the price earnings (PE) ratio of newly listed companies was 47.59 in May against 14.43 of "A" category companies.

When PE ratio exceeds 18 it is considered a risky share unless the company has a major opportunity to increase its earnings in future, market analysts said.

Ahmed said the BSEC should look into the matter and find out the people or institutions responsible for the manipulation. "Otherwise, it will continue."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments