Why insurance stocks surging in a dull market

Shares of most of the insurance companies rose almost every day in the last one month, becoming an outlier in a market that has been dull for several months due largely to persisting economic uncertainty at home and abroad.

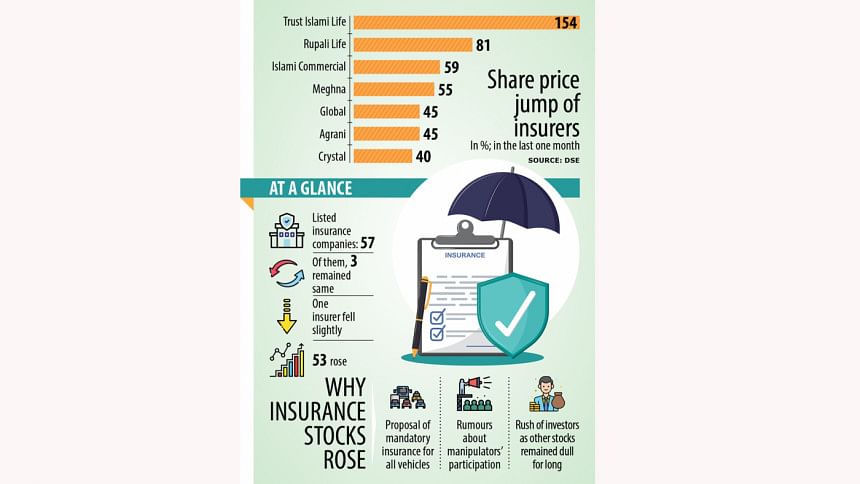

Of the 57 insurers listed on the Dhaka Stock Exchange (DSE), 53 have seen a spike, three have remained stuck at the floor price, and one has fallen slightly.

This upward trend of the sector comes after the regulator proposed making insurance mandatory for all types of vehicles, pulling investors to the stocks of general insurance companies since the move is expected to bring about positive impact for them, said a top official of a brokerage firm, preferring anonymity.

On March 1, Prime Minister Sheikh Hasina gave directives to ensure that no uninsured vehicles ply the streets. And the Insurance Development and Regulatory Authority (Idra) has sent a proposal to the finance ministry to take the initiative to amend the Road Transport Act 2018.

The Financial Institutions Division of the finance ministry has prepared a summary to this effect for the Prime Minister's Office for consideration.

According to the proposal of the insurance regulator, vehicle owners will face a fine of up to Tk 3,000 if not insured.

Insurance was once mandatory for all vehicles, including motorbikes, cars, buses, and trucks. The law was repealed in 2018, although road crashes are common and at least 7,713 people were killed in road accidents in 2022, according to the Road Safety Foundation.

The government's policy aimed at making insurance mandatory will lead to a higher income for general insurance companies.

But stocks of life insurance companies are rising mainly because of rumours, said the broker.

"Rumour has it that some big players are taking a stake in the insurance sector, so many investors are rushing towards these stocks."

Some investors are making investment decisions on the basis of speculation as most stocks have seen little movement in recent months owing largely to the floor price.

In July last year, the Bangladesh Securities and Exchange Commission (BSEC) set the floor price of every stock to halt the free fall of the market indices amid global economic uncertainties. The floor was lifted for some companies in December before bringing it back for every firm in March.

Owing to the floor price, most stocks have become illiquid and investors fear that the shares could slide once the regulatory move is lifted completely since the economic uncertainty shows no sign of disappearing as the war rages.

"Most of our stocks rise without any logic and we always look for stocks that are backed by big players," said an investor.

"When big players invest heavily and try to manipulate a stock, many general investors believe that the share will rise as large investors will not let it fall primarily before dumping it."

Seeking anonymity, a top official of an investment bank says the news related to making insurance obligatory for vehicles has given a much-needed fillip to investors and the manipulators are using this sentiment to their advantage.

"As the overall market has remained unattractive for many days, many investors are rushing to this group of stocks seeing some movement in the hope of making some short-term gains."

Of the 53 insurers that have witnessed an increase in the last one month, 16 rose more than 30 per cent, DSE data showed. Thirty-one firms advanced between 10 per cent and 29 per cent. Only six companies gained less than 10 per cent.

Among the individual firms, newly listed Trust Islami Life Insurance surged 154 per cent, Rupali Life Insurance climbed 81 per cent, and Islami Commercial Insurance Company, another newly listed insurer, climbed 59 per cent.

Stocks of Meghna Insurance, Global Insurance, Agrani Insurance, and Crystal Insurance jumped more than 40 per cent.

The fact that the rise of most of the insurance stocks has been driven by speculation was evidenced by the sharp increase of the newly listed insurers and low paid-up capital-based stocks. On the other hand, most of the well-performing insurance companies rose slightly, said a merchant banker.

For example, Delta Life Insurance, one of the leading life insurers in Bangladesh, rose less than 10 per cent. Reliance Insurance grew 11 per cent and Bangladesh General Insurance Company advanced 20 per cent.

In fact, most of the well-reputed companies have not moved much. For example, Grameenphone and Square Pharmaceuticals, two blue-chip companies, did not see any price movement in the last one month.

The upward movement of the overall insurance sector in the stock market comes although the business has been affected by the global economic crisis fueled by the Russia-Ukraine war.

On the DSE, 43 non-life insurance companies and 14 life insurance companies are listed. The non-life insurers have started to publish their financial reports for the year that ended on December 31.

Twelve non-life insurance companies have disclosed their earnings so far. Of them, eight saw lower profits and the rest registered a slight increase in earnings.

The listed insurance companies have not published their financial reports for 2022. But their asset growth could give a strong indication about their business scenario.

The asset growth of life insurance companies slowed in 2022, growing at 1.61 per cent year-on-year to Tk 45,715 crore. In 2021, the asset growth was up 2.54 per cent to Tk 44,992 crore, according to the Idra.

The DSEX, the benchmark index of the DSE, added 62 points, or 0.98 per cent, to 6,325 in the last one month. And it ranged between 6,100 points and 6,200 points in the last one year, way lower than more than 7,100 points seen before the outbreak of the war.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments