Textile millers demand duty, VAT cut for man-made fibre

Textile millers yesterday demanded the withdrawal of tax on the import of man-made fibre and reduction of VAT on the sales of the item in the local markets as the consumption of the artificial raw material is rising globally.

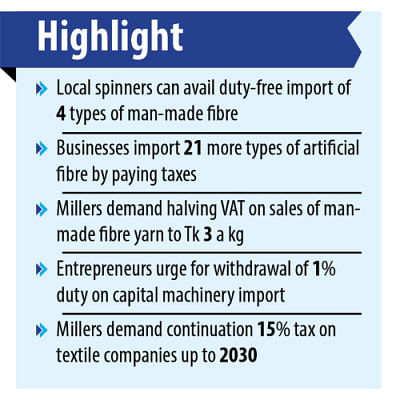

Currently, local spinners can avail the duty-free import of only four types of man-made fibre upon receiving certification from the Bangladesh Textile Mills Association (BTMA). But businesses import 21 more varieties of artificial fibre paying taxes.

The textile millers also called for halving the value-added tax on the sale of a kilogramme of manmade fibre yarn to Tk 3 from Tk 6 now as they also pay Tk 3 on the sale of cotton-made yarn, according to a proposal of the BTMA.

The association submitted the proposals to the National Board of Revenue (NBR) for incorporation in the budget for the upcoming fiscal year of 2022-23.

Mohammad Ali Khokon, president of the BTMA, presented the proposals during a meeting with Abu Hena Md Rahmatul Muneem, chairman of the NBR, at the latter's office in Dhaka.

The textile millers also proposed the government withdraw the 1 per cent duty on the import of capital machinery.

"The government should also continue the 15 per cent income tax on textile production-related companies up to 2030 as the current tenure is coming to an end June 30," the association said.

Moreover, the government should withdraw the 2 per cent tax levied on the purchase of cotton from the local markets as many spinners buy the textile raw material from the local market during any shortage.

The BTMA suggested scrapping the 15 per cent VAT on the sales of pet chip textile as the use of artificial fibre and yarn is increasing in Bangladesh.

Speaking at the same meeting, the leaders of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), demanded the withdrawal of VAT on all kinds of goods related to export-oriented garment industries.

While presenting the proposals, Mohammad Hatem, executive president of the association, called for continuing a logical source tax on export receipts and fixing the corporate tax for green garment factories at 10 per cent and for non-green factories at 12 per cent, all for five years.

He said the 10 per cent tax on cash incentives should be withdrawn, while the duty on the imported products needed to set up central effluent treatment plants should be zero, according to a press release of the BKMEA.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments