Rise in remittance, dip in imports: Some breathing space for now

The country's economy has got a welcome respite from the ongoing volatility, thanks to a rise in remittance inflow and decrease in imports last month.

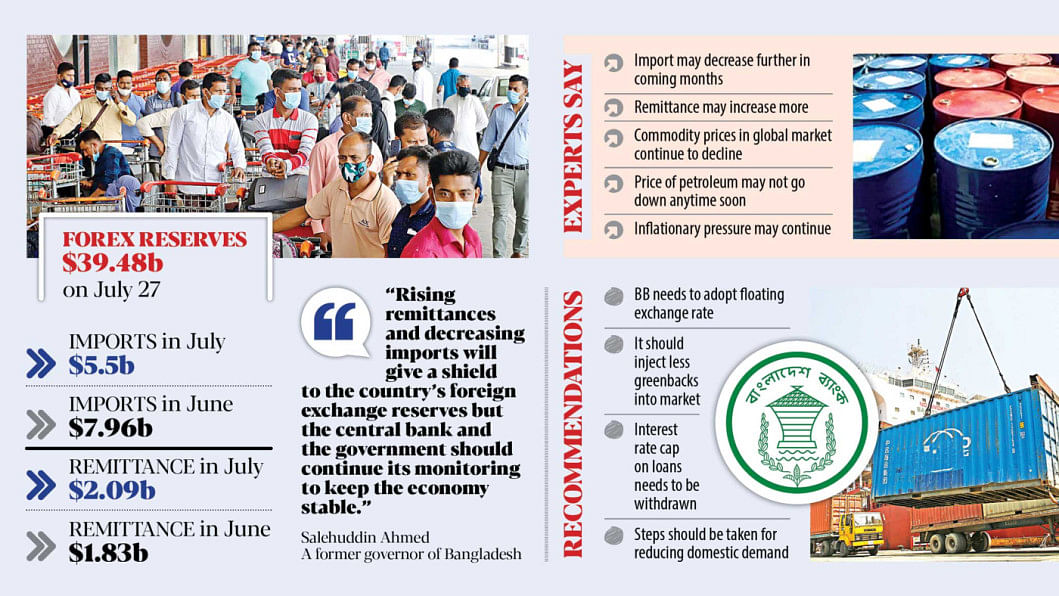

Imports in July fell by 31 percent to $5.50 billion from $7.96 billion a month ago while remittance went up by 14 percent to $2.09 billion from $1.83 billion, shows Bangladesh Bank data.

Economists say the volatility in the financial sector may ease within the next few months as import payments are likely to decline further with the prices of some commodities falling in the global market.

There is, however, no room for complacency as the global economy is yet to get into a better shape. The government and the central bank should continue to monitor the foreign currency market, they said.

Talking to The Daily Star, Md Serajul Islam, spokesperson for the BB, said rising remittance and falling imports will help shore up the foreign exchange reserves.

The central bankrecently took a set of measures to reduce import payments, and the move is paying off, he said.

Banks were asked to take up to 100 percent advance payments from businesses for opening letters of credit (LCs) to import luxury and non-essential items.

Moreover, the BB also instructed banks to provide it with information on LCs worth above $3 million, a measure that helped squeeze import payments.

The directives came as the country's import payments kept rising for several months since the end of last year.

The import payments stood at $82.49 billion in FY22, up 36 percent in FY 21, while remittance fell 15 percent to $21.03 billion in FY22.

Salehuddin Ahmed, a former BB governor, said that rising remittance and decreasing imports would help protect the foreign exchange reserves, but the BB should keep monitoring the forex market.

The country's forex reserves stood at $39.48 billion on July 28 this year, compared to $46.15 billion on December 30 last year.

"We do not know what will happen in the global economy in the days to come. We should consider the latest development as a short-term phenomenon," Salehuddin said.

The BB should take more steps to reduce money supply to the market to tackle both inflation and imports, he noted.

He also hoped that export earnings might increase in the coming days.

Export earnings stood at $49.26 billion in FY22, up 33.45 percent year-on-year.

Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh, said that falling prices of some commodities in the international market would help Bangladesh manage its volatility in the financial sector.

For instance, wheat price in the global market was $459 per tonne in June compared to $522 in May, while Soybean oil price dropped to $1,752 from $1,963 a tonne, according to World Bank data.

He, however, said import payments are unlikely to fall substantially as the current price of petroleum may remain high.

Though Europe and North America may face recession due to the ongoing Russia-Ukraine war, the Chinese economy is rebounding from the slowdown triggered by the Covid pandemic, he pointed out.

Against this backdrop, the demand for oil may rise in the Asian market, he said.

Ahsan suggested that the central bank reduce its supply of dollars to banks to protect its reserves from further depletion.

The BB had supplied a record $7.62 billion to banks last fiscal year.

Ahsan thinks inflation will not come down soon due to the depreciation of the taka against the dollar.

The inter-bank exchange rate of the dollar was Tk 94.70 yesterday, up11.67 percent year-on-year.

Depreciation of the taka means consumers have to pay more to buy goods. Inflation in the country hit a nine-year high of 7.56 percent in June.

"Withdrawal of the interest cap of 9 percent on loans will help tackle the situation," he said, adding that such a step will help contain inflation by reducing the supply of money to the market.

Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, said, "There is no scope for becoming complacent following the latest development in the global market."

If necessary, import restrictions will have to be widened to ease pressure on the economy, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments