Six banks cut salary costs to safeguard profits

Six listed banks in Bangladesh cut their expenditures for the salaries and allowances of employees amidst the pandemic in 2020 in an apparent attempt to keep their profits unscathed.

Interestingly, the top bosses of 17 banks, including three of the six listed lenders, enjoyed raises, showed an analysis of the annual reports of all of the 32 lenders listed on the Dhaka Stock Exchange.

Exim Bank and Uttara Bank did end up logging higher profits.

Exim Bank spent Tk 325 crore for salaries, 5 per cent less than that in the previous year. Its profits rose 18 per cent to Tk 281 crore.

Uttara Bank's yearly salary and allowance expenditure dropped 1 per cent to Tk 448 crore. Profits went up 14 per cent to Tk 214 crore.

But profits decreased for One Bank, Southeast Bank and IFIC Bank. ICB Islamic Bank remained in the red. They slashed salaries and allowance costs by 6 per cent, 5 per cent, 0.78 per cent, and 0.38 per cent respectively.

Out of the six, the salaries increased for the managing directors of Uttara Bank, IFIC Bank and ICB Islamic Bank. For Uttara Bank's MD, the annual salary was up 8 per cent at Tk 1.65 crore.

IFIC Bank reduced salary and allowance costs by 0.78 per cent to Tk 253 crore. But its expenditure behind top officials' yearly salaries surged 33 per cent to Tk 2.09 crore.

Thanks to job security, handsome salaries, and increments, many brilliant students enter the banking profession, said a mid-level official of a private commercial lender preferring anonymity.

"But the pandemic revealed that even people in this profession could not remain unscathed," he said.

Banks have been logging profits year after year, so job or salary cuts after just a single tough period was not a logical option, he added.

"Moreover, employees should have been given better increments that year to boost their morale. Most of the banks' directors are blindly chasing profits."

Banks are securing profits almost every year and providing dividends too, so they should not think about profits at least for one pandemic-hit year, said Salehuddin Ahmed, a former governor of the Bangladesh Bank.

"Moreover, some of them tried to cut salary costs, something that affects a majority of employees."

According to the former governor, the directors of banks always try to find ways to increase profits.

"The top management of most lenders have always ended up becoming the beneficiaries as they abide by the decisions of the directors at the expense of the rest of the employees."

Ahmed urged the management and the board to work separately and in an effective way so that all the employees get benefits equitably.

The Bangladesh Bank was adamant on preventing job cuts in banks during the pandemic.

Necessary steps have to be taken to reappoint all bankers, either dismissed or forced to resign, from April 1 last year to September 15 this year despite having no specific and proven allegations, said the central bank in a circular in September.

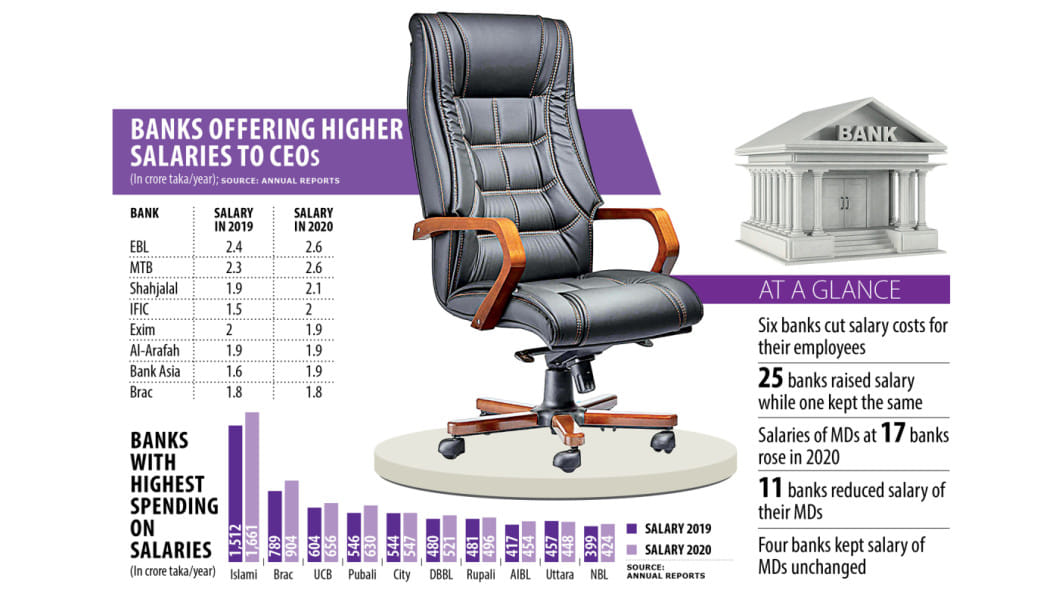

Among all the listed banks, the managing director of Eastern Bank received the highest salary and allowance in 2020, worth Tk 2.63 crore.

The top official of Mutual Trust Bank got Tk 2.62 crore. The CEOs of Shahjalal Islami Bank and IFIC Bank also got yearly salaries and allowances of over Tk 2 crore that year.

Islami Bank Bangladesh Ltd spent the most for the salaries and allowances of the workforce, Tk 1,661 crore, followed by Brac Bank, which spent Tk 904 crore.

However, 11 banks stood out for reducing the costs behind salaries of MDs and CEOs. They are City Bank, Dhaka Bank, Exim Bank, Jamuna Bank, Mercantile Bank, NCC Bank, NRB Commercial Bank, One Bank, SBAC Bank, Southeast Bank, and Trust Bank.

Four banks decided not to change their top official's salary that year.

IFIC Bank MD and CEO Shah A Sarwar said: "The salary of no specific individual has been reduced rather it was the need for efficiency that resulted in the reduction of the total cost of employment."

"This is achieved through enhancement of productivity - establishing multitasking, reviewing of processes, people empowerment and enhancing people engagement."

In all deserving cases, the salaries of individuals increased in 2020 under the pay and compensation policy of the bank, he said.

After remaining in the same salary contract for four years, the current CEO undertook a new contract on December 2019 where the salary has been increased, Sarwar added.

"We did not reduce the salary of our individual employees in that year despite the coronavirus pandemic," said Kamal Hossain, managing director of Southeast Bank.

"But some senior executives in the position of additional managing director and deputy managing director left the bank, and we have not recruited anyone in those positions, so the salary cost fell," he said.

"We will revise our salary soon."

Mohammed Rabiul Hossain, managing director of Uttara Bank, and Mohammed Haider Ali Miah, managing director of Exim Bank, did not receive phone calls and reply to text messages.

Md Monzur Mofiz, acting managing director of One Bank, declined to comment.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments