Loan write-off declines

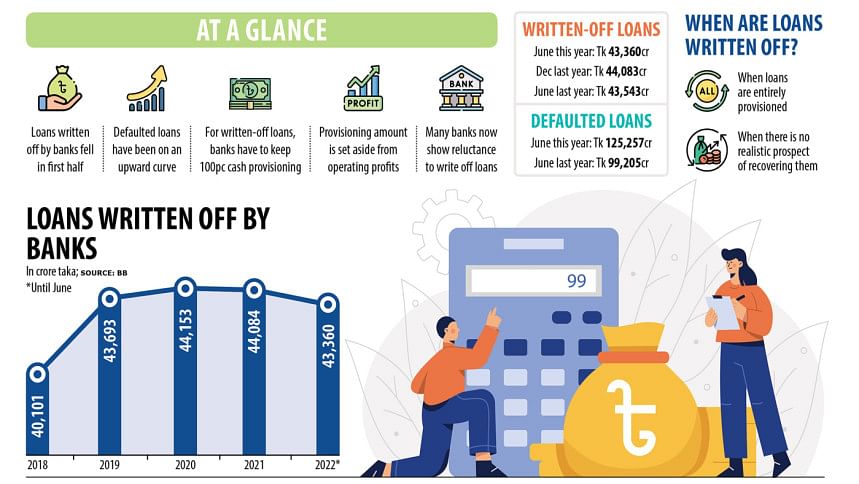

Loans written off by banks in Bangladesh declined in the first half of 2022 despite the upward trend of default loans.

As per the rules, banks have to keep 100 per cent provisioning against delinquent assets and the coverage has to come from operating profits.

So, many banks show reluctance in writing off loans, which goes on to explain why the volume of sour loans has not fallen substantially.

The outstanding amount of write-off loans stood at Tk 43,360 crore in June this year in contrast to Tk 44,083 crore six months ago, data from the Bangladesh Bank showed. It amounted to Tk 43,543 crore in June last year.

Usually, loans are written off when they are entirely covered by cash and there is no realistic prospect of recovering them. These assets are shifted to off-balance sheet records.

But banks are not cleaning up their balance sheets despite the escalation in non-performing loans (NPLs): defaulted loans hit an all-time high of Tk 125,257 crore in June, an increase of 26.3 per cent from Tk 99,205 crore a year prior.

NPLs accounted for 8.96 per cent of the total outstanding loans of Tk 13,98,592 crore as of June.

One of the reasons many banks ignore tidying up their balance sheets by writing off loans is to enjoy a higher net profit, a central bank official explains.

A majority of banks managed a hefty profit in the January to June half this year thanks to the recent rebound of businesses from the coronavirus pandemic and the fluctuation of the exchange rate of the taka against the US dollar. Still, many showed unwillingness to remove the bad loans from the balance sheets.

Lenders are allowed to show 50 per cent of the collateral as provisions against default loans. This means banks can avoid keeping the 100 per cent mandatory cash provision against NPLs.

As per BB regulations, banks have to maintain provisioning of 0.25 per cent to 5 per cent for unclassified loans. It is 20 per cent for the default loans of the substandard category, 50 per cent for the doubtful category, and 100 per cent for the bad or loss category.

Banks have to keep a full amount in cash in provision for the NPLs that are written off.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, says the banks that enjoy sound financial health usually write off NPLs.

"Although writing off bad debts helps them clean up their balance sheets, maintaining a 100 per cent cash provision is difficult for many banks."

Banks recovered Tk 565 crore through writing off loans between January and June compared to Tk 225 crore in the identical first half of 2021, bringing down the outstanding amount of write-off loans.

Since the facility was introduced in Bangladesh in 2003, a total of Tk 60,402 crore has been written off. Of the sum, Tk 43,360 crore has remained unrealised.

The amount of funds that was recovered through the process increased substantially in the first half of 2022, which Rahman described as a positive development for the banking sector.

The enhanced recovery has helped reduce the outstanding amount of the write-off loans as well.

Although the provision base has expanded to some extent, there is still a large provisioning shortfall in the banking sector of Bangladesh.

The provision deficit stood at Tk 13,219 crore in June in contrast to Tk 14,007 crore six months earlier.

Mohammad Ali, additional managing director of Pubali Bank, also said keeping 100 per cent provisioning is difficult for the weak banks. "The capacity of writing off loans is not the same for every bank."

Shah Md Ahsan Habib, a professor of the Bangladesh Institute of Bank Management, said writing off bad loans is not always bad.

"It also shows how much of soured loans a bank can absorb. It is a matter of decision as well."

"We need to check and analyse data before concluding on the association between increasing NPLs and decreasing loans write-off," he added.

Anis A Khan, a veteran banker, sees the fall of the write-off loans as a good sign.

"This means that banks' efforts to recover bad loans have paid off to some extent."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments