LIFE INSURANCE business LIFELESS for long

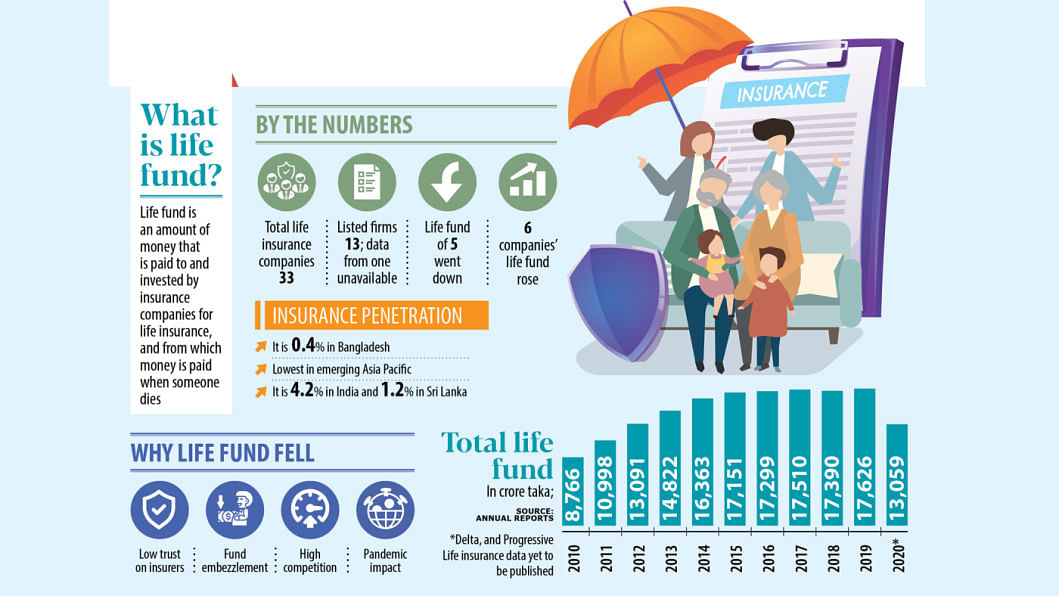

Bangladesh's listed insurers' life funds, or portfolios into which policyholder's life assurance premiums are paid and claims are paid out of, have remained nearly the same in amount since 2015.

The reason – low trust on whether claims would be met and increased competition from new companies amidst the pandemic.

Of 33 life insurance companies running with approval, 13 are listed. Of the 13, life funds of five decreased and six slightly increased. Data of one was unavailable.

Though their business was bearish, share prices were on a bull run the past two years.

Some new companies opened midway of the past decade, raising competition but were capable of little market penetration, said Sheikh Kabir Hossain, president of Bangladesh Insurance Association.

The pandemic hit right when the market was showing prospects, he said, adding that digitalisation was yet to be all-encompassing while selling policies was still a door-to-door affair.

The Insurance Development & Regulatory Authority (IDRA) brought many positive policy changes to restore people's faith, he added.

"We are hopeful that business will be better," said Hossain, also chairman of Sonar Bangla Insurance Company.

Ten companies opened in 2014, according to the IDRA.

They are namely Alpha Islami Life Insurance, Astha Life Insurance Company, Diamond Life Insurance Company, Guardian Life Insurance, Jamuna Life Insurance Company, LIC Bangladesh, NRB Global Life Insurance Company, Swadesh Life Insurance Company, NRB Islamic Life Insurance and Akij Takaful Life Insurance.

Delays in the payment of some matured policies' proceeds and claims eroded the trust, said SM Shakil Akhter, executive director and spokesperson of the IDRA.

Life funds of 12 companies rose just 2 per cent to Tk 17,570 crore between 2015 and 2019.

In contrast, it soared 95 per cent to Tk 17,123 crore between 2010 and 2015, revealed their annual reports.

This analysis was limited till 2019 as Delta Life Insurance and Progressive Life Insurance are yet to publish their data for 2020.

Some 8-10 companies refused claims and embezzled funds, making survival tough for all while raising management costs, said Akhter.

"When peoples' trust break down, it normally affects business," he said.

Business of some of the compliant insurers is soaring, albeit not at full potential.

The lack of trust is reducing the market penetration rate, Akhter said.

Insurance penetration in Bangladesh was 0.40 per cent in 2020 whereas 0.49 per cent a year ago, the lowest among emerging Asia Pacific countries, according to the Sigma report by Swiss Re Institute.

For neighbouring India, it was 4.20 per cent in 2020.

A massive drive is necessary to reinstate trust and the IDRA is trying to run one, he added.

A top official of a non-listed life insurance company, preferring anonymity, said news of some insurers' malpractices surfaced around 2015 to 2017, impacting the market's potential.

New clients took a U-turn and many policyholders applied to cease availing policies, he said, adding that Bangladesh's low penetration level promises great growth potential but the mistrust has already hurt the market.

"The problem is that the new customer creation process is almost stagnant. The non-listed companies' situation is not better. In turn, they are worse off," he said.

"By any means, the IDRA should work on regaining the trust, otherwise the sector will not grow," he added.

Sunlife Insurance Company's life fund was downed from Tk 344 crore to Tk 182 crore between 2015 and 2020.

"We have paid a huge number of claims…while clients' inclusion was little," reasoned Chairperson Prof Rubina Hamid.

Many companies emerged in the last four to five years but new clients and policies of good rates did not, so competition soared, she said.

So premium income fell and then became stable, she said, adding that life fund depletion was lower in 2020 compared to the previous year.

She hoped to see better times ahead.

Meanwhile, Popular Life Insurance Company's life fund decreased 38 per cent to Tk 1,758 crore.

It has been over 20 years since the company opened, so time has come to pay some claims, for which the life fund has been decreasing, said Company Secretary Mostafa Helal Kabir.

"Actually, the market situation is not good," he said. While they were trying to regain business, the pandemic hit. "We are really trying," he added.

Simultaneously, Fareast Islami Life Insurance Company's life fund plunged 21 per cent to Tk 2,474 crore.

CEO Mohammed Alamgir Kabir did not receive phone calls or reply to text messages.

Meanwhile, Padma Islami Life Insurance's life fund plummeted 96 per cent to Tk 13 crore.

Company Secretary Shakhawat Hossain also did not receive phone calls and reply to text messages.

During this time, Sandhani Life Insurance Company's life fund dropped around 12 per cent to Tk 797 crore.

Claim settlements have been higher than premium income, reasoned CEO Nemai Kumar Saha, adding, "So, our liability is falling."

He lamented that business growth had not been that good while some insurers had not abided by rules, affecting the overall business. "Our business is now growing," he added.

Its share price rose 80 per cent to Tk 36 in the last two years.

Stocks of Padma Life Insurance climbed 193 per cent to Tk 51, Sunlife 95 per cent to Tk 39, Fareast Islami Life Insurance 56 per cent and Popular Life slightly up at Tk 85.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments