HBL focuses on boosting Bangladesh’s regional trade facilitation

In a rapidly evolving South Asian trade landscape, HBL Bangladesh (Habib Bank) is carving out a bold and purposeful role for itself – not as a competitor in traditional banking, but as a connector of economies and an enabler of regional trade.

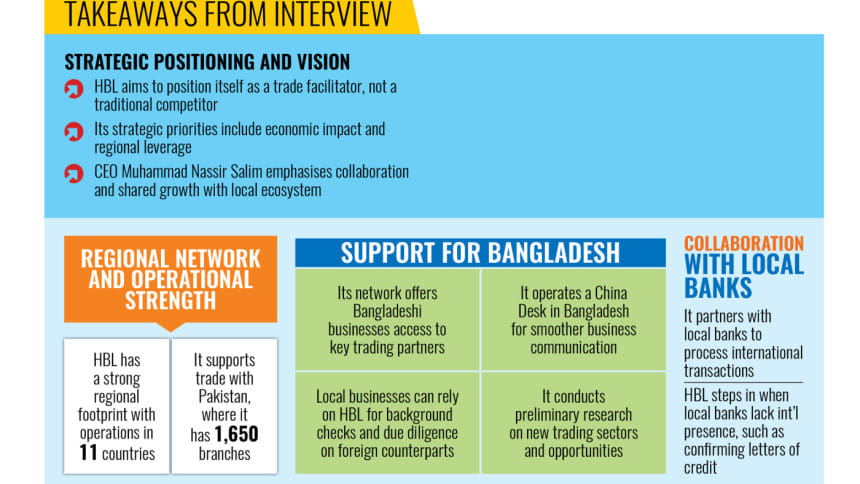

During a recent visit to Dhaka, HBL President and Chief Executive Officer Muhammad Nassir Salim outlined his strategy to move the bank forward in facilitating regional trade networks spanning Asia, the Middle East, and beyond.

HBL's vision for the next three to five years hinges on three strategic priorities: benefiting communities and the economy, leveraging regional presence, and adopting strong governance rooted in environmental, social, and governance (ESG) principles.

For Bangladesh, the bank's focus is on regional trade facilitation.

Based in Pakistan, HBL has operations in 10 other locations, including China, Singapore, Bangladesh, the Maldives, Sri Lanka, Dubai, and Bahrain. Its network also extends to the UK and Turkey, giving it a broad regional footprint.

A majority of HBL is owned by the Aga Khan Fund for Economic Development, a part of the Aga Khan Development Network, which promotes inclusive economic growth in the markets where it operates.

HBL offers something few banks can: a cohesive network that facilitates cross-border trade and financial flows. For Bangladeshi businesses, this means direct access to HBL's on-ground operations in key trading partner nations – especially China.

HBL's dual presence enables enhanced due diligence, greater confidence in counterpart credibility, and innovative trade structuring, Salim explained. "We're not looking to compete with high-street banks here," he said. "Instead, we offer what many local banks cannot – regional connectivity."

For instance, Bangladesh conducts significant trade with China, mostly in terms of imports. "HBL has a branch in China, and we have a branch here in Bangladesh. So, Bangladeshi entrepreneurs can connect with exporters through HBL," he added.

"This gives them confidence, as we can also provide background checks on these clients," said Salim, who has 36 years of banking experience across several countries.

HBL now has a China desk within Bangladesh and employs a dedicated Chinese national to support it. Chinese customers feel more comfortable dealing with someone who speaks their language and understands their business culture.

Regarding increased trade between Pakistan and Bangladesh, Salim noted that HBL has 1,650 branches in Pakistan and is a leading bank in the country across nearly every indicator – financing, investment banking, agri-finance, SME finance, card services, and retail banking.

"We can support Bangladeshi businesses in exploring opportunities," he said.

HBL also offers preliminary research on potential trading sectors. Its team in Bangladesh coordinates with their counterparts to conduct groundwork before local entrepreneurs make business visits.

"We're happy to facilitate – that's exactly the kind of regional relevance we bring," Salim added.

HBL's inclusive approach has also opened doors for collaboration with local financial institutions, rather than competition. The bank supports local banks in confirming trade documents and facilitating transactions when the local counterpart lacks an international presence.

"The goal is shared growth. We see ourselves as partners to local banks, extending their reach – not replacing them," Salim said.

"There's a genuine desire here to build, grow, and connect. And we're ready to be part of that journey."

Accordingly, HBL is collaborating with financial institutions to support trade and payments that local players may wish to process internationally.

"It will be helpful for local banks because we have the capability to facilitate," Salim said.

For example, if a local bank does not have a branch in Sri Lanka and a letter of credit confirmation is needed for a trade transaction, HBL can act as a facilitator.

"We've met with many banking sector representatives and are exploring how we can further collaborate. We already work with them, and they are interested," he added.

Salim acknowledged that there are already many banks in Bangladesh.

"Our core strength in this market will be facilitating trade. We're not trying to be a retail bank," he said.

"There are some very good banks that are in healthy competition in the country, so I don't think another foreign bank is needed to offer the same services," he added.

Against this backdrop, Salim said HBL is looking to position itself as a trade facilitator and support the local financial sector.

For instance, HBL could confirm trade documents, especially when documents issued by local banks are not accepted by overseas counterparts.

"They may want a confirmation. If the transaction is within our network, we can confirm it because we might be serving both the customer abroad and the customer here," he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments