FDI falling—experts call for urgent policy overhaul

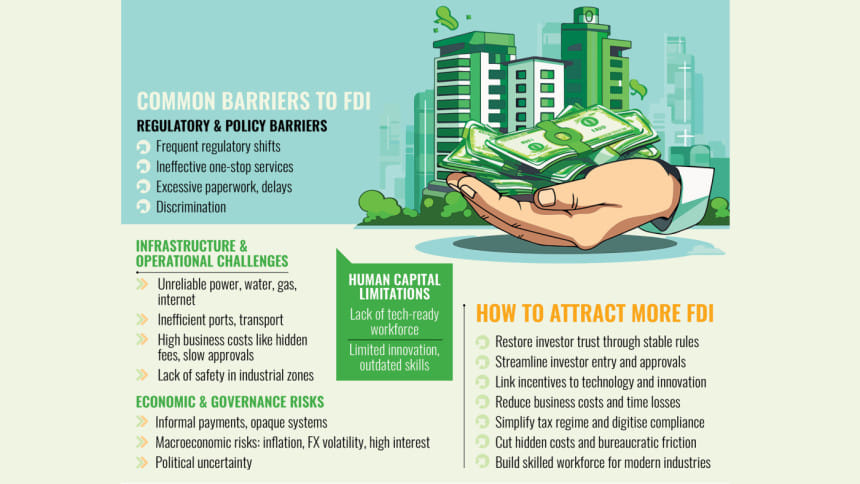

Bangladesh must urgently adopt a strategic, reform-driven foreign direct investment (FDI) policy by removing existing barriers to attract and retain investment to remain competitive in the region, experts suggest.

Despite recent high-level government initiatives, investor confidence continues to falter due to policy inconsistencies, weak infrastructure, and inadequate institutional capacity, they pointed out.

In a promising move, however, the government has formed a five-member high-level committee, led by Finance Adviser Salehuddin Ahmed, tasked with crafting incentive frameworks to attract quality investments, according to a May 29 gazette from the Chief Adviser's Office.

Net FDI in Bangladesh plunged to a five-year low in 2024, according to provisional figures released by Bangladesh Bank, raising concerns over investor confidence amid growing economic headwinds and policy uncertainties.

The country received $1,270.39 million in net FDI in 2024, a 13.25 percent drop from $1,464.13 million in 2023.

Bangladesh needs a more strategic and goal-oriented approach to attracting FDI, said Syed Akhtar Mahmood, former global lead for regulatory reforms at the World Bank Group.

"We must be clear on why we want FDI—whether to access export markets, join global value chains, or promote innovation and sustainability," he said.

He said not all investors would meet every objective, so aligning investor capabilities with national development priorities was key.

Instead of offering blanket tax holidays, Mahmood advocated performance-linked incentives tied to outcomes like technology transfer, local supplier development, and research and development (R&D).

"South Korea is a prime example of how incentives, when linked to clear expectations, can drive long-term gains," he said.

Mahmood emphasised that foreign investors could catalyse innovation in Bangladesh, encouraging local firms to adopt R&D practices and global standards.

He cited a World Bank study in Turkey showing that firms receiving R&D-linked incentives grew faster in patent and design filings.

However, he cautioned that performance-based schemes must be carefully designed to avoid deterring investment.

"Done right, they can attract quality FDI while delivering on national goals," he added.

Finally, Mahmood urged a thorough review of Bangladesh's existing incentive packages, asking, "What returns have we earned from the incentives already granted?"

He stressed the need for evidence-based policy reform to ensure incentives support productivity, innovation, and sustainable growth.

Zaved Akhtar, chairman and managing director of Unilever Bangladesh and president of the Foreign Investors' Chamber of Commerce and Industry (FICCI), stressed that Bangladesh must urgently address policy inconsistency and institutional inefficiency and ensure credibility to sustainably attract FDI.

"Investors return to countries that deliver—not just promise," Akhtar said, citing delays in profit repatriation, weak intellectual property (IP) protection, and a complex regulatory regime as key deterrents.

He emphasised the need for a forward-looking, simplified tax system, digitalised compliance processes, and a unified investment window empowered to coordinate across agencies such as the Bangladesh Investment Development Authority (Bida), the Bangladesh Economic Zones Authority, and the National Board of Revenue.

Akhtar also called for formal investor onboarding and aftercare services, stronger financial sector governance, and the removal of sectoral restrictions that deter foreign capital.

"There's enough global FDI—Bangladesh must learn how to fish by fixing its investor journey," he noted, urging the formation of a National Economic Reform Committee to fast-track reforms.

"Credibility, clarity, and capacity must be our investment brand," he said.

Asif Ibrahim, founder and former chairperson of Business Initiative Leading Development, said Bangladesh must adopt a multi-pronged strategy to boost FDI.

This includes streamlining regulations, ensuring policy consistency, and strengthening investor protections through bilateral treaties and efficient dispute resolution, he said.

He emphasised the need for infrastructure upgrades—modern ports, stable power, and strong digital connectivity—to lower operational costs.

Special economic zones offering tax holidays, duty-free imports, and simplified profit repatriation can serve as major incentives, he said.

Promoting sectors like garments, pharmaceuticals, ICT, and renewable energy via global roadshows is vital, he said.

With LDC graduation approaching, strategies to sustain export competitiveness and develop a skilled workforce through vocational training are also essential to attract long-term, export-oriented FDI, he added.

Fahmida Khatun, executive director of the Centre for Policy Dialogue, welcomed the government's move to form a high-powered committee to boost FDI but deemed it insufficient.

Despite global roadshows, actual FDI remains low due to political uncertainty and structural issues, she said.

Khatun noted that foreign investors remain cautious, citing deterrents such as policy unpredictability, poor infrastructure, weak consumer demand, bureaucratic delays, and corruption.

The One-Stop Service portal introduced by Bida for investors is still ineffective, plagued by procedural hurdles, she said.

Additional challenges include security concerns, macroeconomic instability—such as exchange rate volatility, high inflation, and interest rates—and a shortage of skilled labour, especially in technology sectors, she said.

Khatun urged the government to ensure policy stability, streamline tax and regulatory processes, and make the One-Stop Service portal fully functional.

She also stressed improving human capital through technical education and offering preferential treatment to both local and foreign investors.

Most critically, she emphasised the need for a credible, long-term roadmap for political stability. Without urgent reforms, Bangladesh risks falling behind regional competitors like Vietnam and Cambodia, she said.

"The potential is undeniable, but it will remain unrealised unless the investment climate improves," she warned.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments